🔎 Exam 2 Formulas

Press Ctrl-D to bookmark this page. Feel free to download it, but please do not reupload. A downloadable Microsoft Word version of this formula sheet can be found at robmunger.com/1452share. The formulas for exam 1 can be found here.

Questions or comments? Please email robecon1452@gmail.com . Remember, your first reference is always the lectures and the homework.

L6 - Bonds

(Spreadsheets don't have a function for calculating yield of consols.)

Fc is annual payment.

= Bond Price

= coupon Rate

= Face Value

= Discount rate

= taxable yield

= number of years to maturity

= Tax rate

= Present Discounted Value

| ⇔ | ⇔ | “Discount Bond” | ||

| ⇔ | ⇔ | “Par Bond” | ||

| ⇔ | ⇔ | “Premium Bond” |

- Callable bonds - Issuer may buy the bond from the holder at a stipulated price

- Convertible bonds - Bondholder may convert each bond into a stipulated number of shares of stock

- Puttable Bonds - Give the holder an option to retire and/or extend the bond

- Floating-rate bonds - Adjustable coupon rate

- Eurobond - a bond denominated in a currency different from the country where the bond is issued. For example, a bond issued in Singapore but denominated in Japanese yen is a “Euroyen” bond.

- Foreign Bond - a bond issued in a foreign country, denominated in the currency of that country (Examples: Yankee bond, Samurai bond, Bulldog bond)

References: 6 Jul 17.pptx and L6-Bonds 1

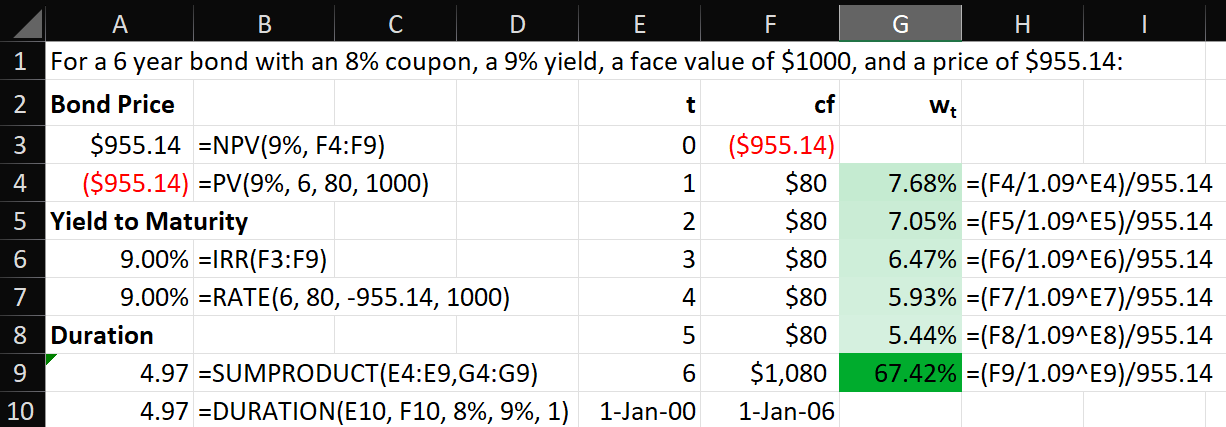

Bond Spreadsheet Formulas

These functions work both in Excel and Free Google Sheets. PV, NPV, Rate, and IRR are typically also available on financial calculators. Questions? Email me.

=NPV(i,Range of cells with cash flows, starting with first coupon payment)

=IRR(Range of cells with cash flows including initial price)

=YIELD (settlement date, maturity date, coupon, PB, Face, paymts per yr.)

In general, use Rate() or IRR() in this class rather than Yield().

Duration of a 30 year bond with a 3% coupon, a face value of $1000, and a yield of 4%. Settlement=1/1/2000, Maturity=1/1/2030, Coupon=3%, Yield=4%, Frequency=1

References: 6 Jul 17.pptx and L6-Bonds 1

L7 - Bonds 2 (Duration and Interest Rate Risk)

Duration (DUR) - 4 Steps:- Calculate PDV all payments

- Divide each PDV by current Bond Price

- Multiple PDV/PB ratio by the correlating period

- Sum individual durations

where

| 6 Principles of Interest Rate Sensitivity | 5 Rules of Duration |

|---|---|

|

|

| High Maturity (T) | Increases Duration and Increases Interest Rate Risk |

| High YTM | Decreases Duration and Decreases Interest Rate Risk |

| High Coupon Rate (c) | Decreases Duration and Decreases Interest Rate RiskE |

| A bond is Callable | Decreases “effective duration” and price volatility |

| Dur of Zero Cpn | Duration of Consol |

References: 7 Jul 22.pptx and L7-Duration and Yield Curve

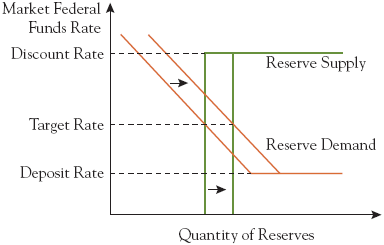

L8 - Monetary Policy

Old: 3 tools of Conventional Monetary Policy:

- Discount Rate

- Set reserve requirement percent: R

- Open Market Operations (OMOs were primary tools used to keep Fed Fund rate in the target range

Old: If Fed sells bonds, the money supply falls and interest rates rise.

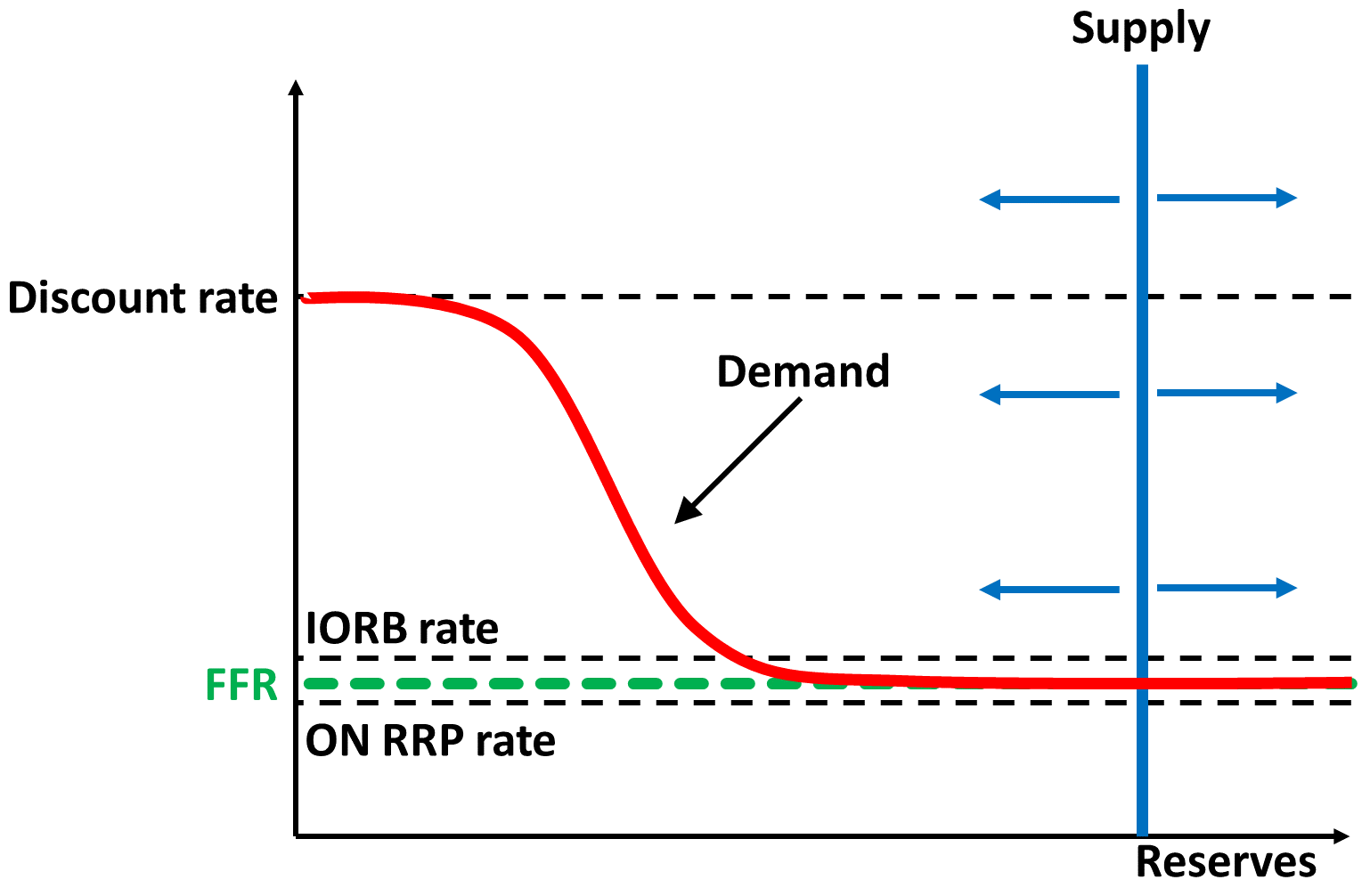

New: The Fed instead uses "Administered Rates"

As of July 26, to keep the Fed Funds rate in the $5.25%-5.5% target range:

- Discount rate = 5.5%

- IORB = Interest on Reserve Balances = 5.4%

- ON RRP = Overnight Reserve RePurchase = 5.3%

New: Because there are already so many bank reserves, the only way to control the FFR is by changing the administered rates (ON RRP, IORB, and Discount Rate.

Open Market Operations (OMOs)

Open Market Operation (OMO) Formulas:

ΔTotal Deposits = Initial Δ in Reserves × (1/(R+E))

ΔMS = ΔTotalDeposits + ΔCashHeldByPublic

R = Required Reserve Ratio.

E = Excess Reserve Ratio.

OMO Example: Suppose the Fed sells a $100,000 T-Bond to a bond dealer. Bond dealer pays $100,000 from checking account.

ΔTotal Deposits = Initial Δ in Reserves × (1/(R+E))

= -$100,000×1/(10%+0%) = -$1M

ΔMS = ΔTotalDep + ΔCashHeldByPublic

= -$1M + $0 = -$1M

Therefore, the money supply decreases, and interest rates rise, as shown in the diagram above. (Contractionary)

Repo

Repo (Repurchase Agreement)

Day 1: Fed buys a US govt. security from a NBFI

Day 2: NBFI buys the security back from the Fed at a slightly higher price

Repo means that the NBFI is borrowing money, using the govt security as collateral. (Correspondingly, the Fed is lending.)

Reverse Repo(Reverse Repurchase Agreement)

Day 1: Fed sells a US govt. security to a NBFI

Day 2: Fed buys the security back from the NBFI at a slightly higher price

Reverse Repo means that the NBFI is lending money. (Correspondingly, the Fed is borrowing.)

Reverse repo is like paying IORB, except that NBFI can use it. With both IORB and ON RRP, reserves that would have been lent to the private sector are instead lent to the Fed, slowing economic activity. This is the only way to fight inflation.

References: 8 Jul 24.pptx and L8 - Monetary Policy

L10 - International Investing

1452Continued example: A US investor's return on Eurozone deposits is predicted to be: For a US investor, the difference between dollar vs. euro deposits is therefore: (compare this to the previous equation and to Slide 23) Investors tend to put their money where they expect the highest return.

Interest rate parity: Investor's tendency to put money where they expect the highest return will cause the returns on domestic and foreign deposits to equalize.

In our example:

Appreciation = Stronger currency = E↓ - an increase in the value of a currency relative to another currency.

Depreciation = Weaker currency = E↑ - a decrease in the value of a currency relative to another currency.

Exchange Rate Regimes:

- Flexible (Floating) Exchange Rate

- Fixed Exchange Rate

- Currency Board converts between local currency and a reference currency

- Dollarization means simply using the reference currency as your own currency

References: 10 Jul 31.pptx and L10-International Investing

Feedback? Email robecon1452@gmail.com 📧. Be sure to mention the page you are responding to.