👨🏫 Notes

Overview

The Fed and Financial Markets

- Overview of Bank Accounting

- Structure of the Federal Reserve

- Functions of the Fed

- Chairman of the Fed

- Change in monetary policy tools

Bank Balance Sheet

| Assets | Liabilities |

|---|---|

Reserves | Deposits |

Bank Capital |

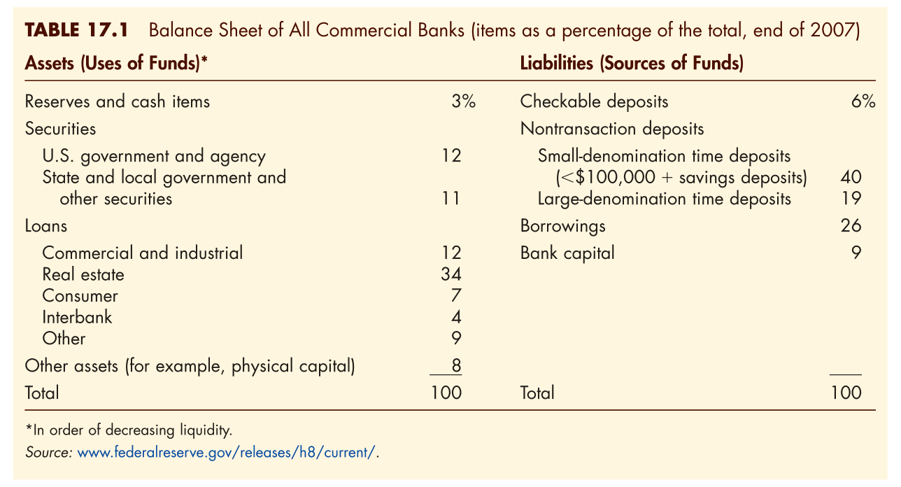

Aggregate Bank Balance Sheets, 2007

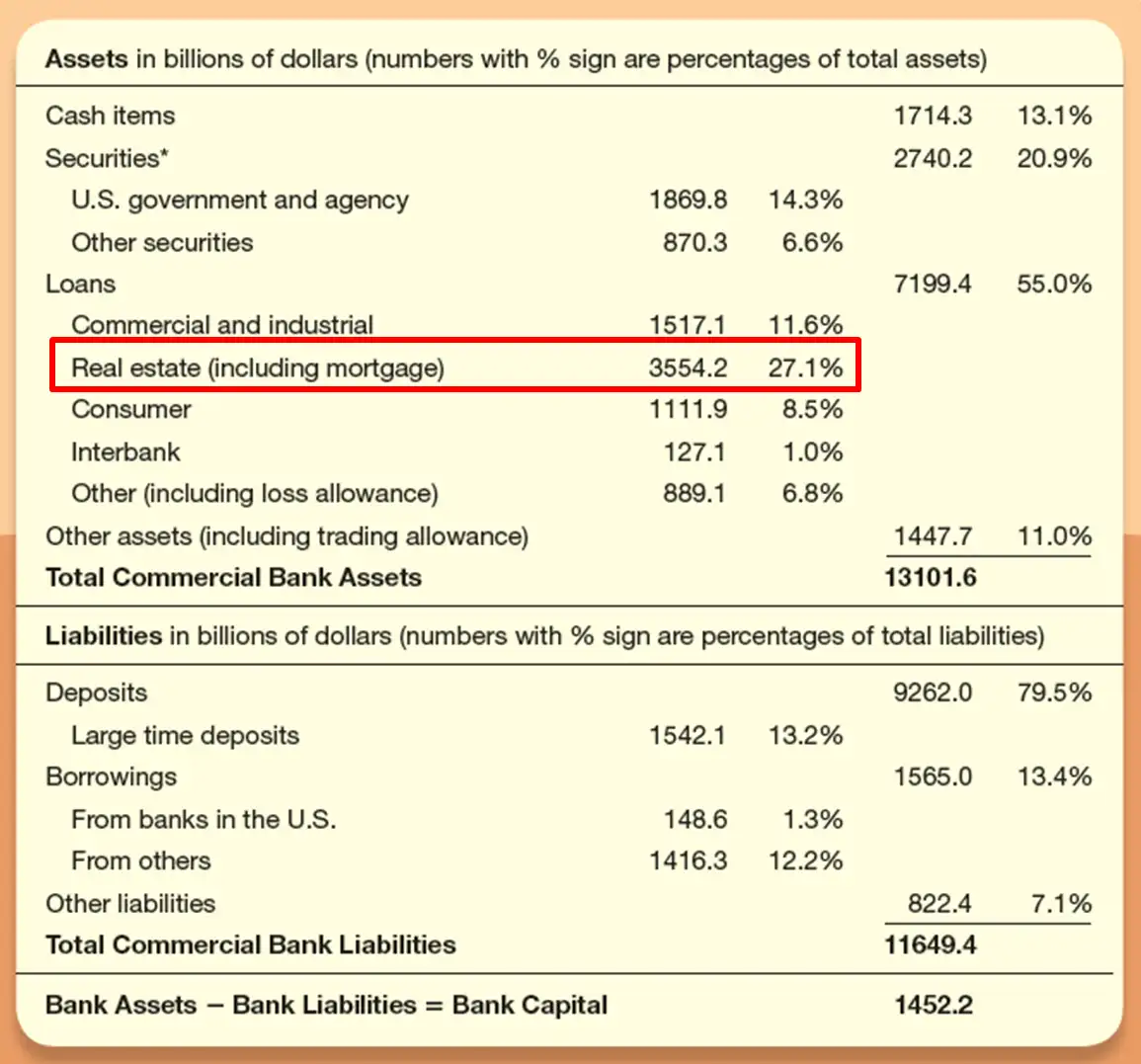

Aggregate Bank Balance Sheets, 2013

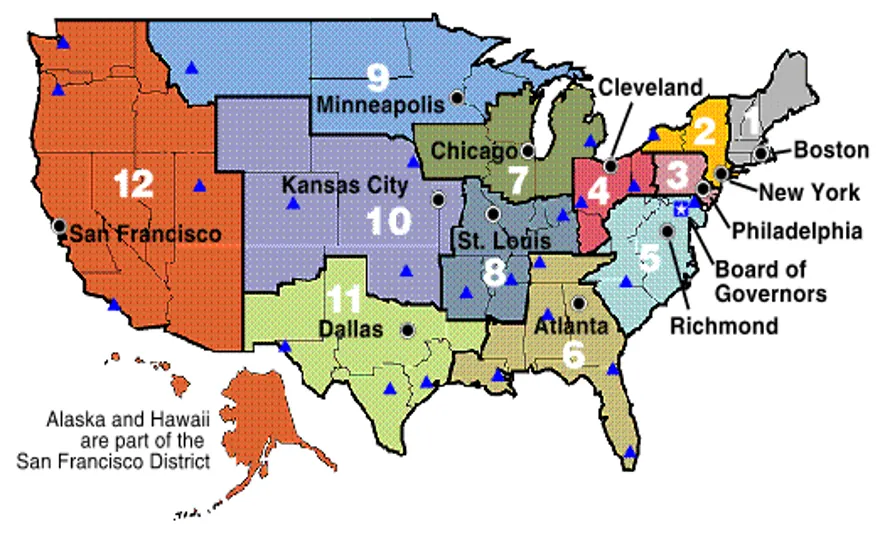

The Twelve Federal Reserve Districts

Federal Reserve Building, Washington

Boston Fed Building

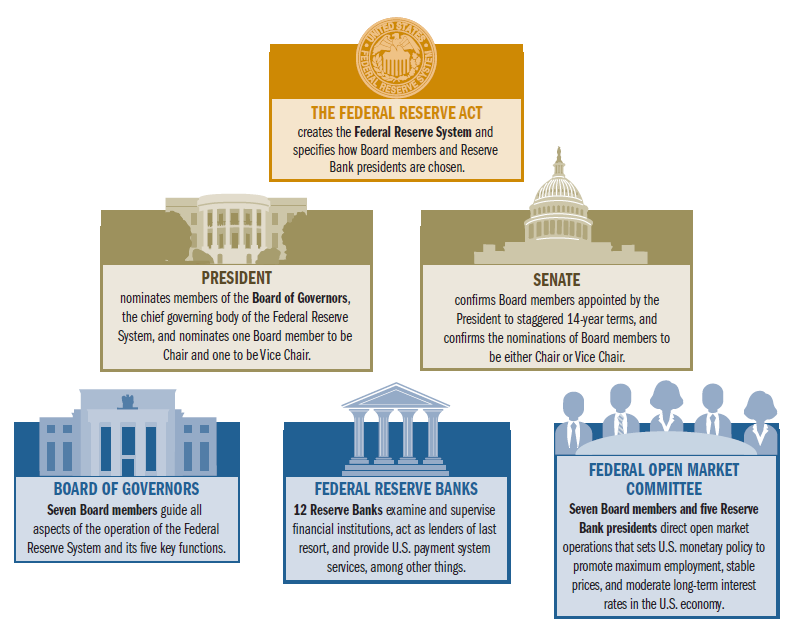

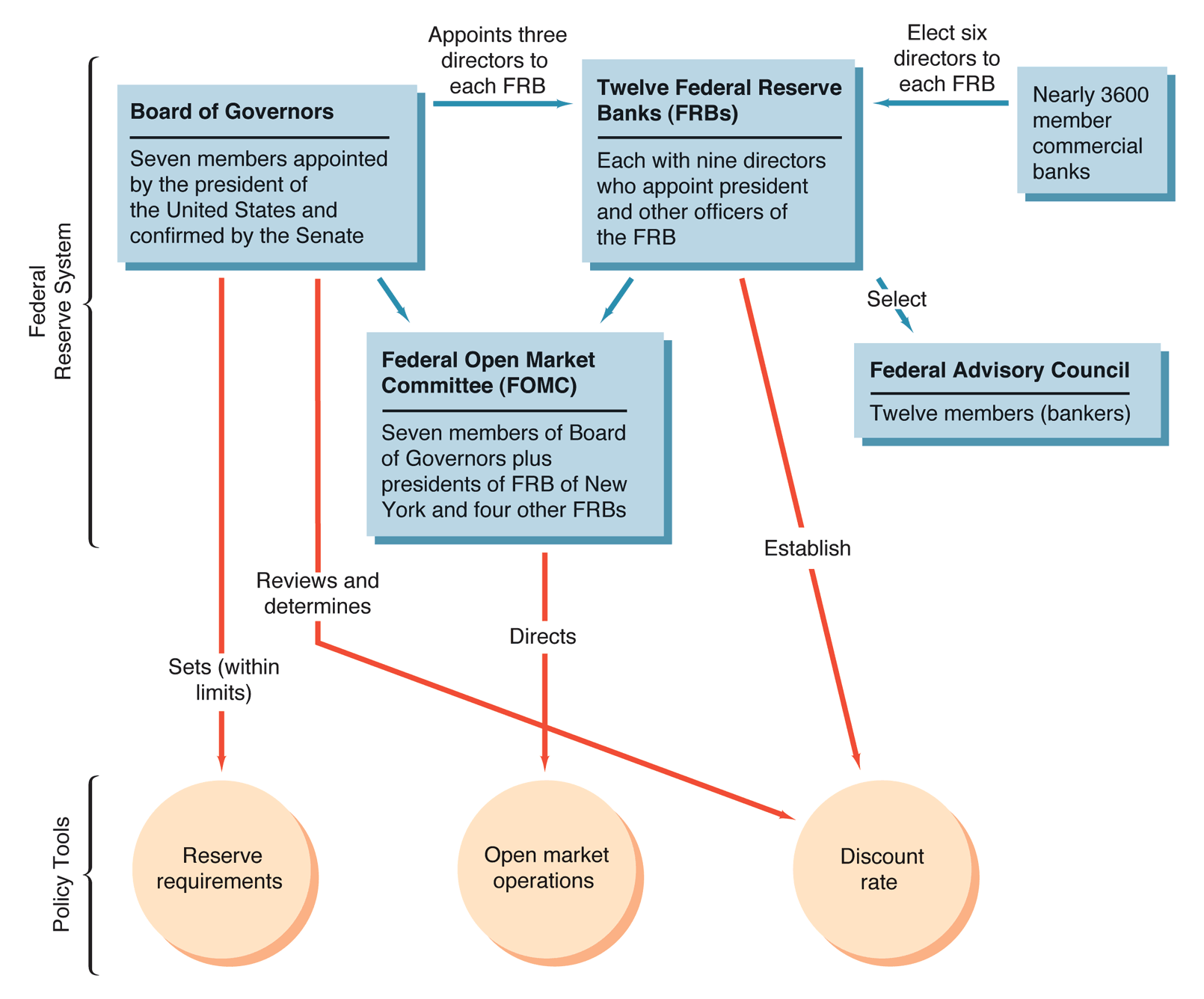

Formal Structure of the Fed

Formal Structure of the Federal Reserve System

Informal Structure of the Federal Reserve System

- Since its inception, the Federal Reserve System has slowly acquired responsibility for promoting a stable economy. This, in turn, has caused the Fed to evolve into a more unified central bank.

- Legislation during the 1930’s granted the Fed authority over the determination of interest rates and therefore economic activity

- The Board of Governors have continued to gain some control over the 12 district banks, through salaries and review of policy.

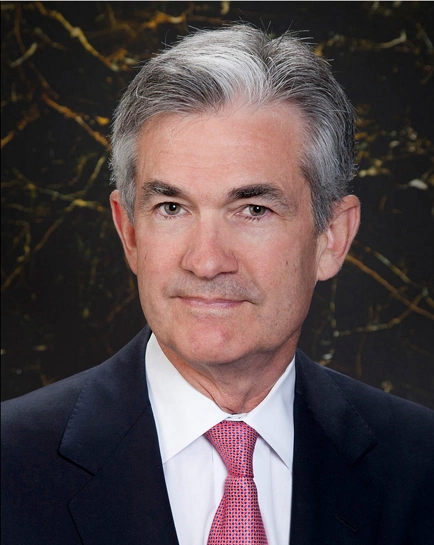

Current Board of Governors

Jerome Powell

- Appointed to the Board of Governors by Obama in 2012

- Selected to be Chair by Donald Trump in 2018

- Reappointed as chair by Biden in 2022

Chairman of the Federal Reserve System

- Spokesperson for the entire Federal Reserve System

- Negotiates, as needed, with Congress and the President of the United States

- Sets the agenda for FOMC meetings

- With these, the chairman has effective control over the system, even though he doesn’t have legal authority to exercise control over the system and its member banks.

What Does the Fed Do?

Federal Reserve Bank Functions

- Clear checks

- Issue new currency and remove damaged currency

- Evaluate bank mergers and expansions

- Lender to member banks

- Liaison between local community and the Federal Reserve System

- Perform bank examinations

- Conduct Monetary Policy

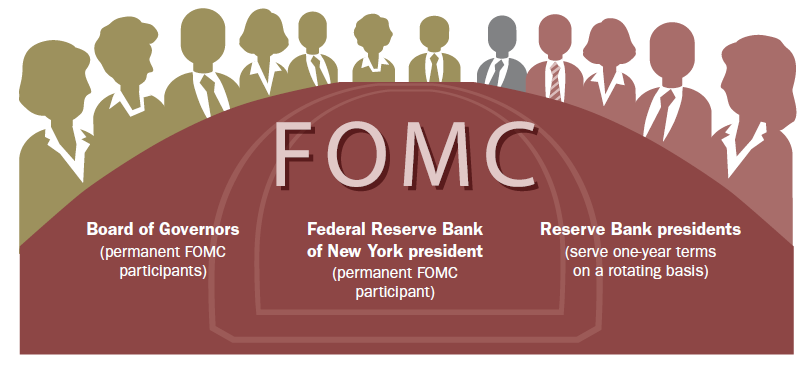

Federal Open Market Committee(FOMC)

FOMC Meeting

Critical Dates: FOMC Meetings

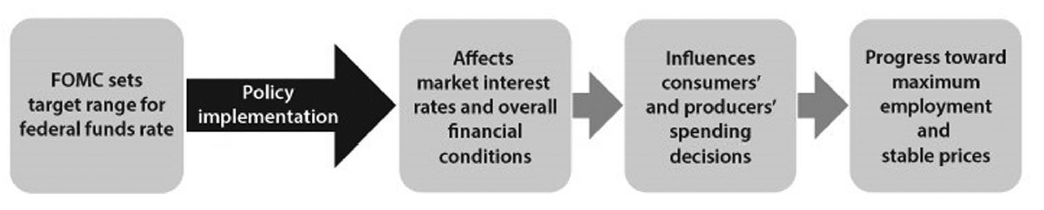

What: When the Fed’s Federal Open Market Committee meets to decide on interest rates

When: 8 times per year

Roughly every six weeks

Special meetings may be called any time

Why Critical: Changes in interest rates decided at the meetings trigger a chain of events that affect other short-term interest rates, foreign exchange rates, long-term interest rates, the amount of money and credit, and, ultimately, a range of economic variables, including employment, output, and prices of goods and services.

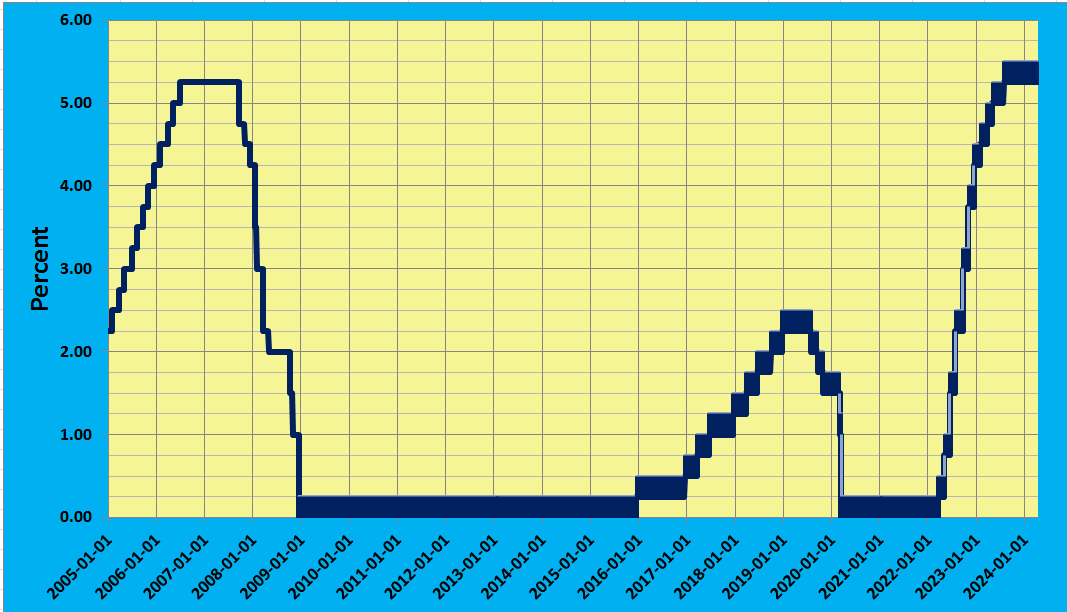

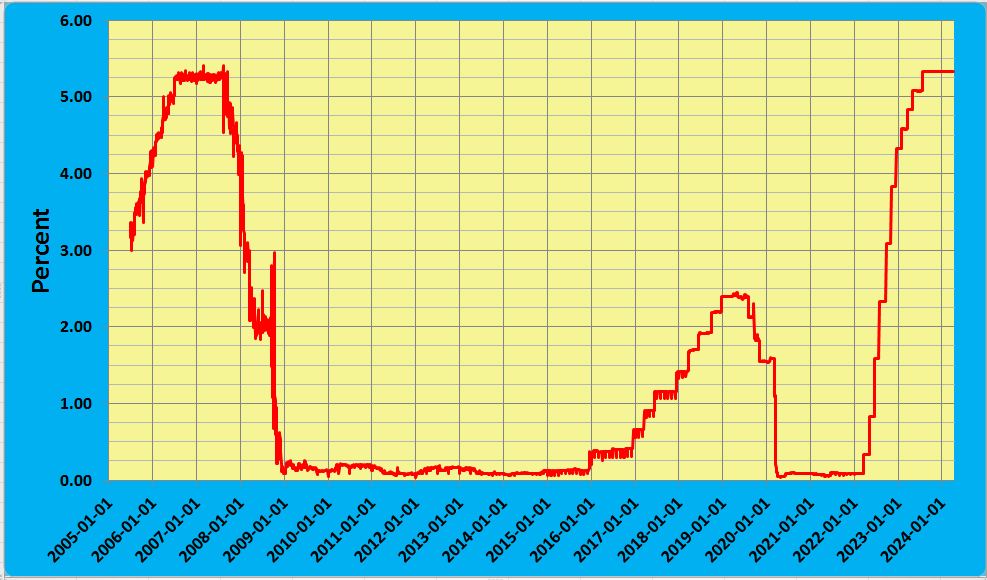

Target Fed Funds Rate in Recent Years

Actual Fed Funds Rate in Recent Years

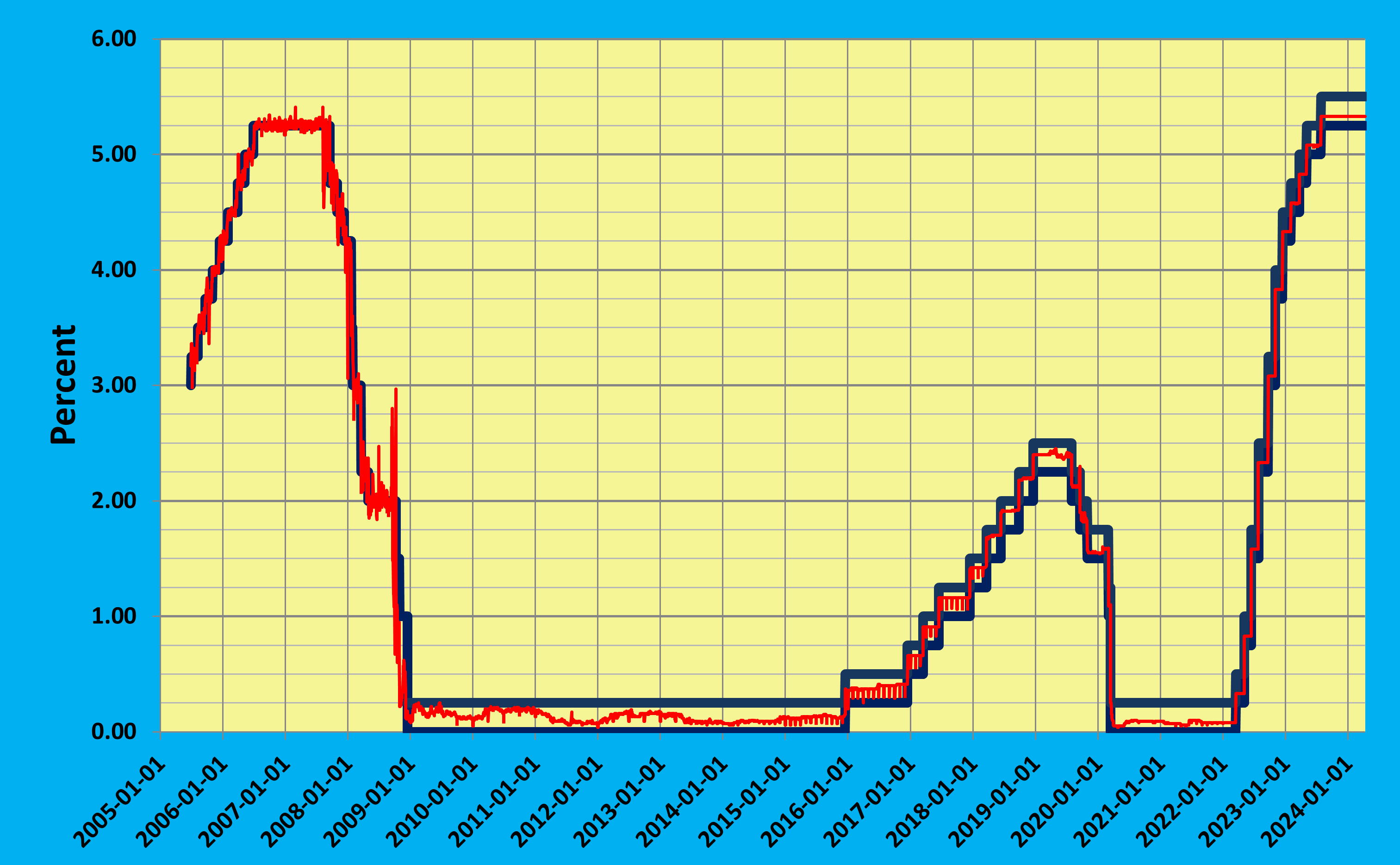

Hitting the Target: Target and Actual Fed Funds Rate in Recent Years

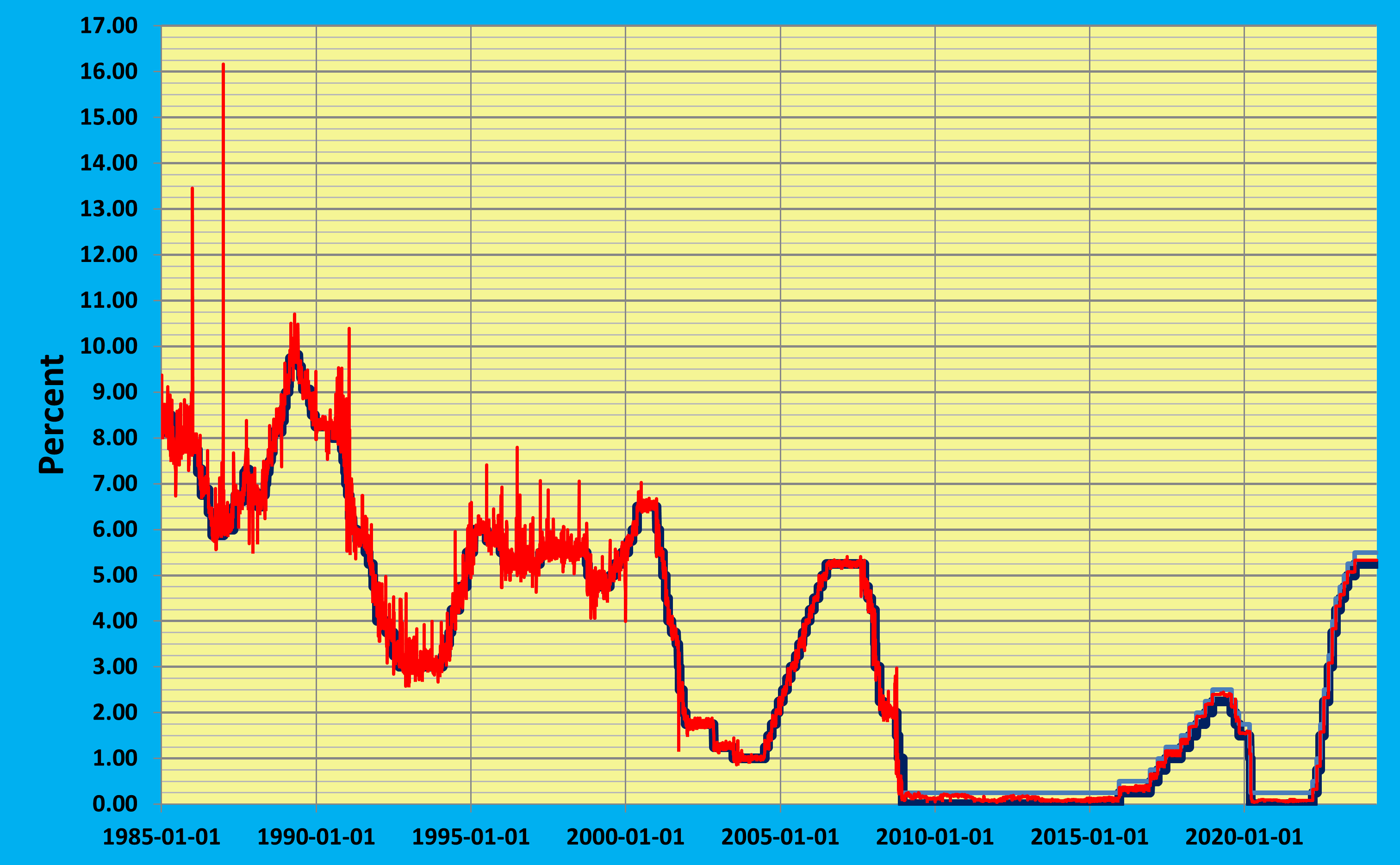

Target and Actual Fed Funds Rate Since 1985

Fed Monetary Policy Tools

- Set the Reserve Requirement (R)

Currently, R = 0% - Set the discount rate

Set the Reserve Requirement (R) - Conduct Open Market Operations

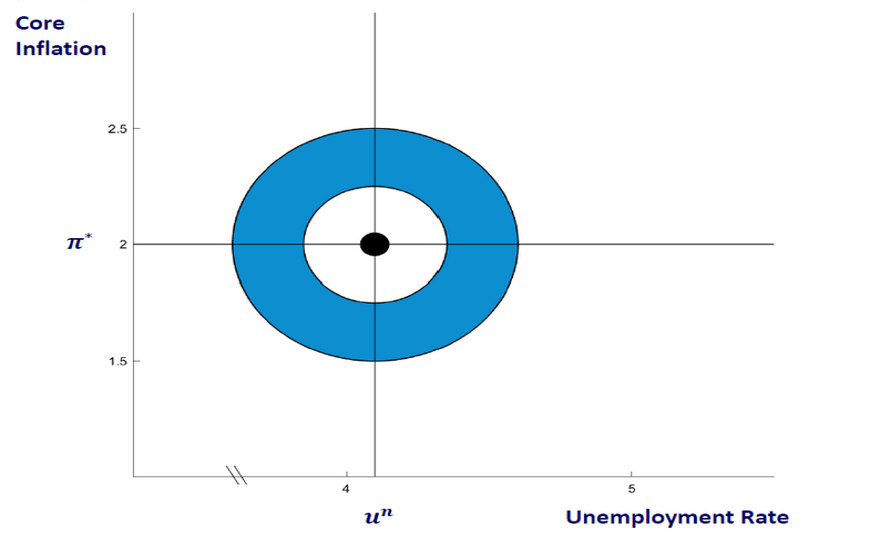

The Fed’s “Dual Mandate”

- “Maximum employment” (Whatever the hell that means!)

- Price stability

The Dual Mandate “Bullseye”

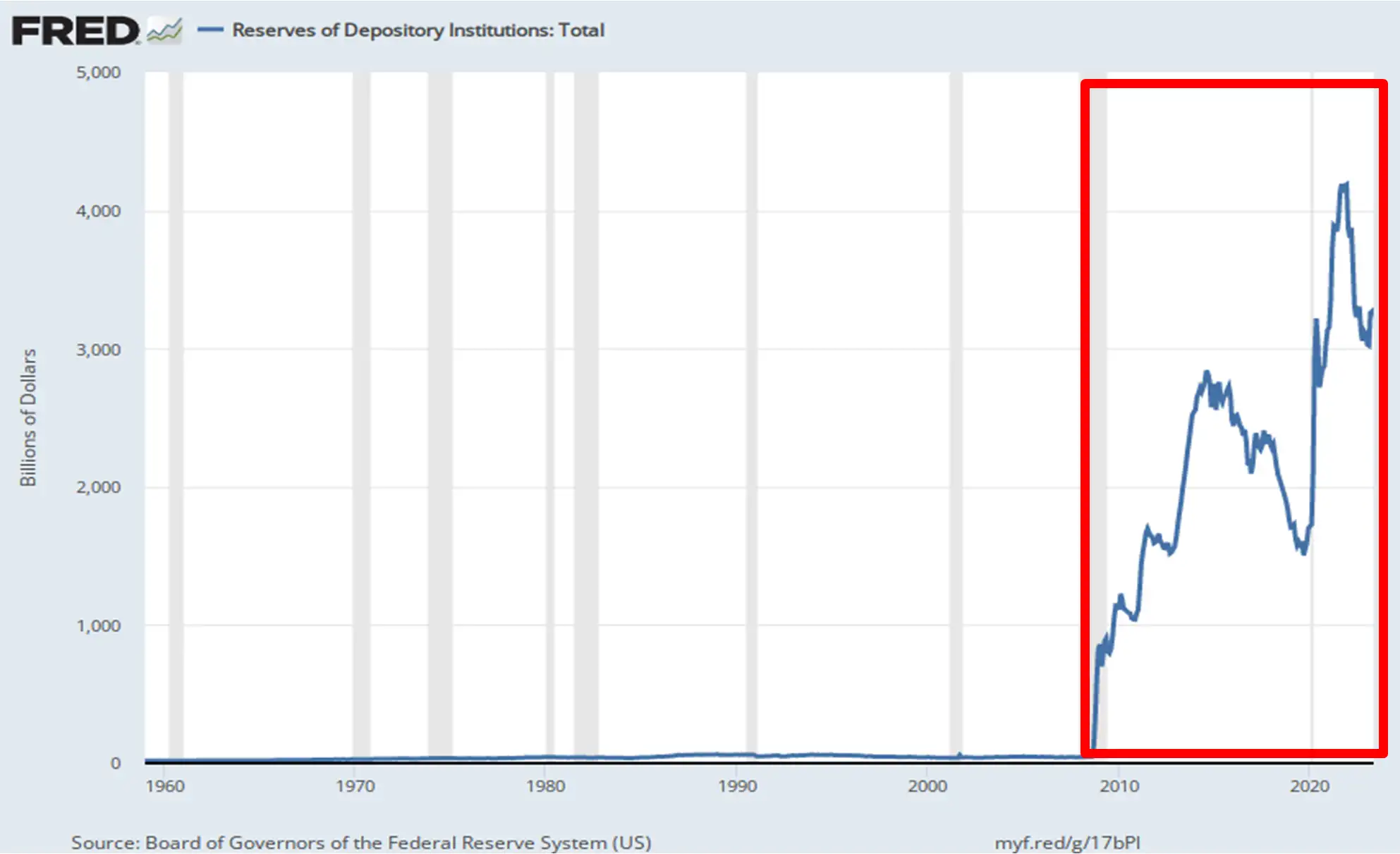

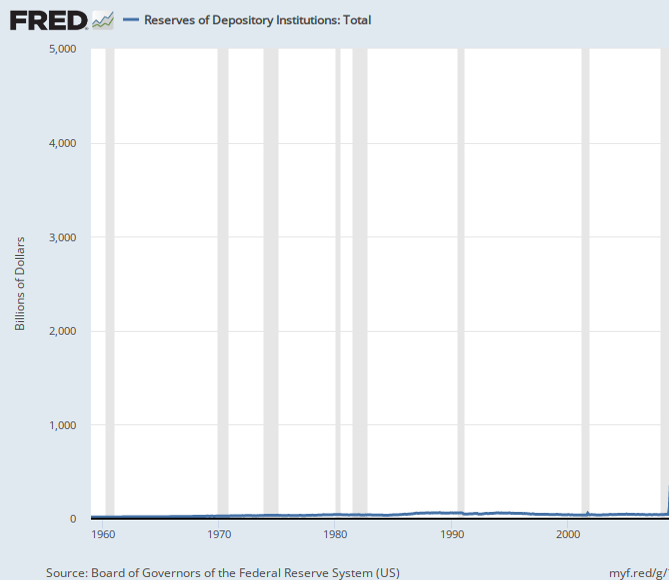

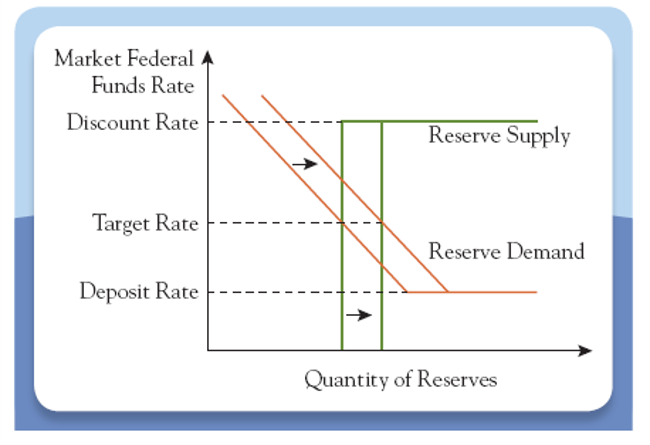

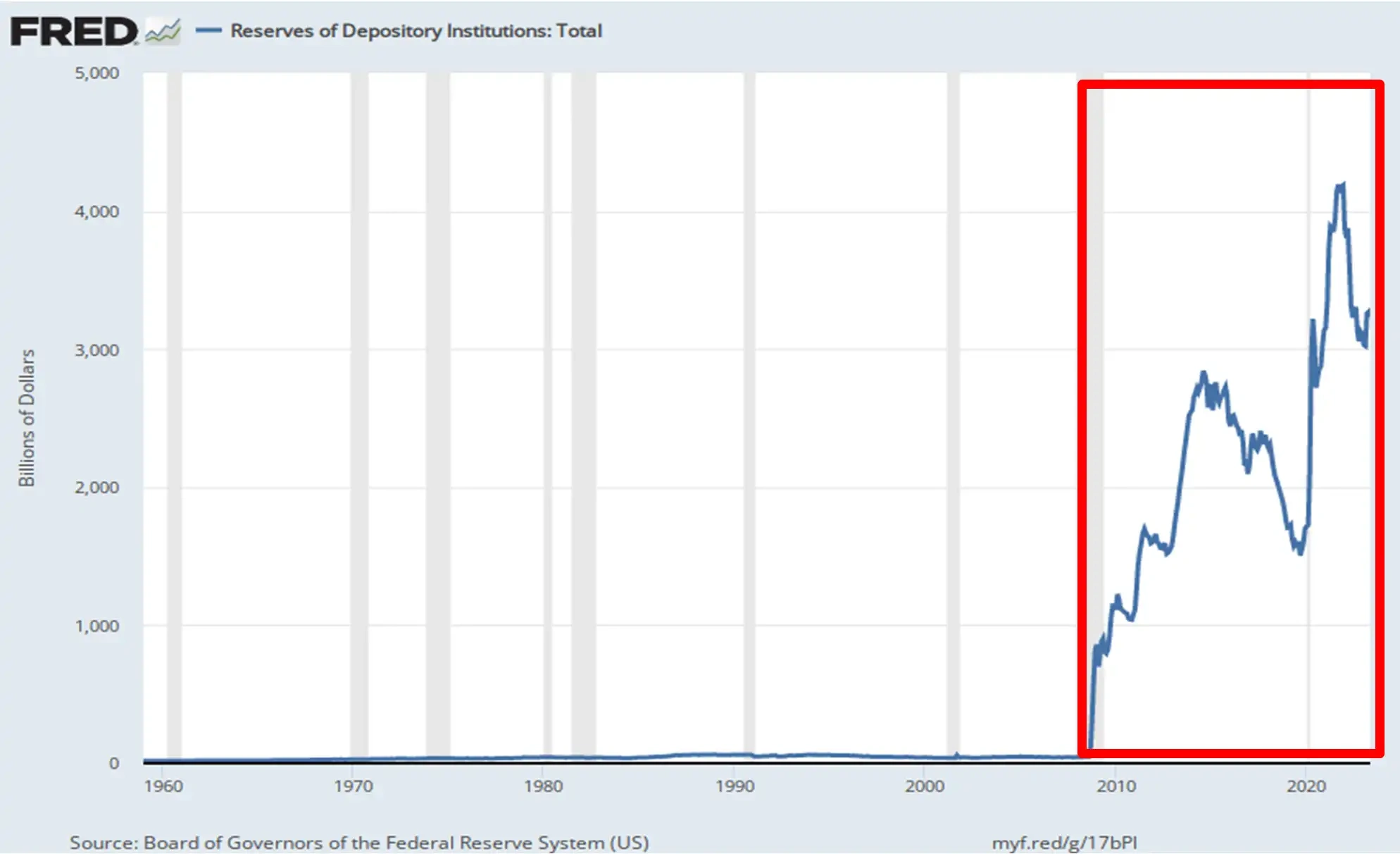

Limited vs. Ample Reserves

- Prior to the financial crisis of 2007-2009, there were limited reserves in the banking system

- Chief monetary policy tool: Open Market Operations

- During and after the financial crisis of 2007-2009, reserves ballooned!

- Chief monetary policy tool in the “ample reserves regime”: Administered Interest Rates

Reserves of Depository Institutions 1959 - 2023

Monetary Policy with Limited Reserves

Bank Balance Sheet

| Assets | Liabilities |

|---|---|

Reserves | Deposits |

Bank Capital |

Monetary Policy

- Prior to the financial crisis of 2007-2009, there were limited reserves in the banking system

- Chief monetary policy tool: Open Market Operations

Reserves of Depository Institutions 1959 - 2009

Monetary Policy Tools in the Old Limited Reserves Regime

- Establish the “discount rate” at which member banks may borrow from the Federal Reserve Bank (subject to BOG review) and determine which bank receive loans

- Establish the reserve requirement

- Conduct open market operations (OMOs)

- In an OMO the Fed Buys or Sells T-Bonds

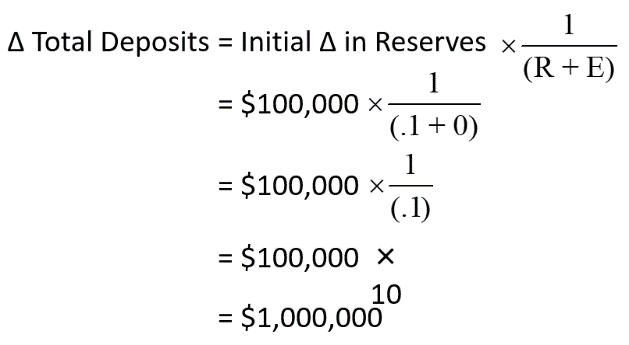

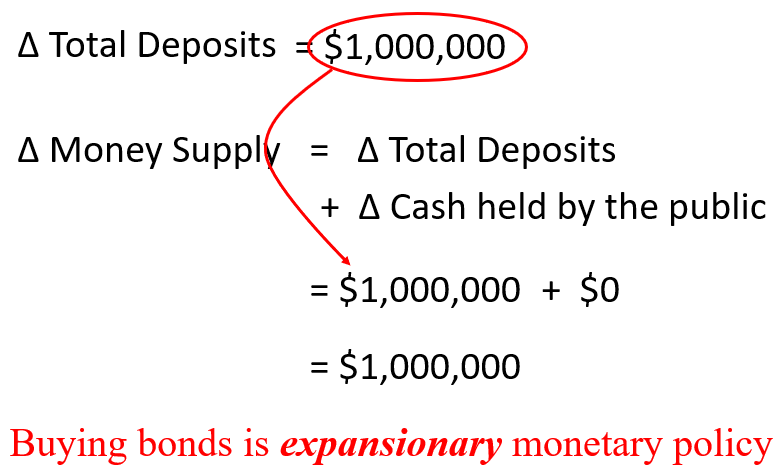

An Open Market Operation

- The Fed buys a $100,000 T-Bond from a bond dealer, and pays for it by electronic transfer of $100,000 to the bond dealer’s checking account

Fed Buys $100,000 Bond

Bond Trader’s Balance Sheet

| Assets | Liabilities |

|---|---|

T-Bonds -100,000 |

An Open Market Operation

- The Fed buys a $100,000 T-Bond from a bond dealer, and pays for it by electronic transfer of $100,000 to the bond dealer’s checking account

- Consequently, the bond dealer’s bank’s balance sheet shows a $100,000 increase in reserves

Fed Buys $100,000 Bond

Bank’s Balance Sheet

| Assets | Liabilities |

|---|---|

Reserves +100,000 | Deposits +100,000 |

Fed Buys $100,000 Bond

Fed Buys $100,000 Bond

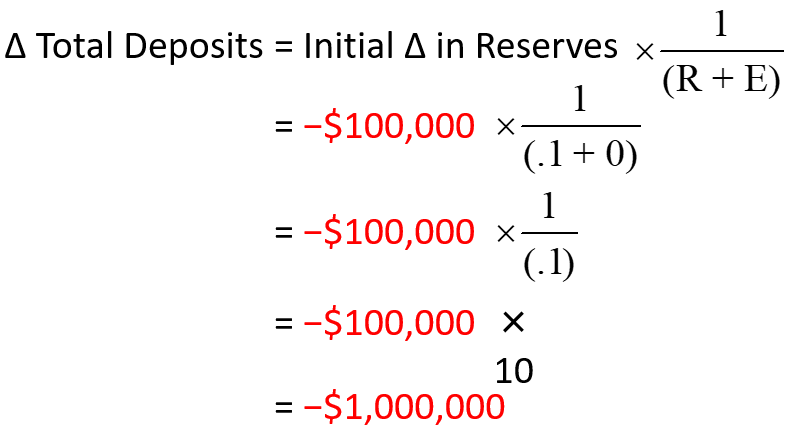

An Open Market Operation

- The Fed sells a $100,000 T-Bond to a bond dealer, and the bond dealer pays for the bond by an electronic transfer of $100,000 from their checking account

Fed Sells $100,000 Bond

Bond Trader’s Balance Sheet

| Assets | Liabilities |

|---|---|

T-Bonds +100,000 |

An Open Market Operation

- The Fed sells a $100,000 T-Bond to a bond dealer, and the bond dealer pays for the bond by an electronic transfer of $100,000 from their checking account

- Consequently, the bond dealer’s bank’s balance sheet shows a $100,000 decrease in reserves

Fed Sells $100,000 Bond

Bank’s Balance Sheet

| Assets | Liabilities |

|---|---|

Reserves -100,000 | Deposits -100,000 |

Fed Sells $100,000 Bond

Fed Sells $100,000 Bond

The Target Federal Fund Rate and Open Market Operations

- On any given day, banks targeted the level of reserves they wanted to hold at the close of business.

- That could leave them with more or less reserves than they wanted.

- That gave rise to a market for reserves.

- Some banks would lend out excess reserves.

- Some banks would borrow to cover a shortfall.

The Target Federal Fund Rate and Open Market Operations

- Without this market, banks would have needed to hold substantial quantities of excess reserves as insurance against shortfalls.

- These transactions were all bilateral agreements between two banks.

- Loans were unsecured so the borrowing bank had to be credit worthy in the eyes of the lending bank.

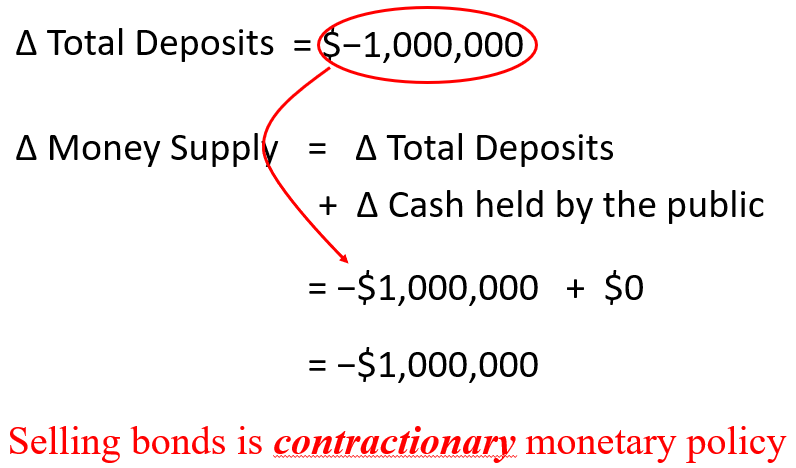

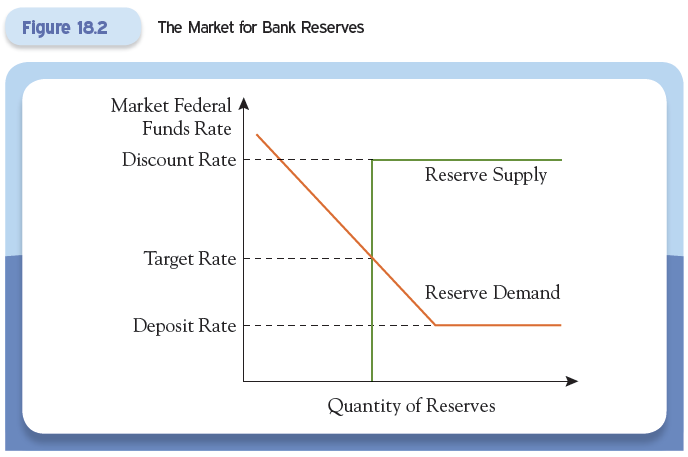

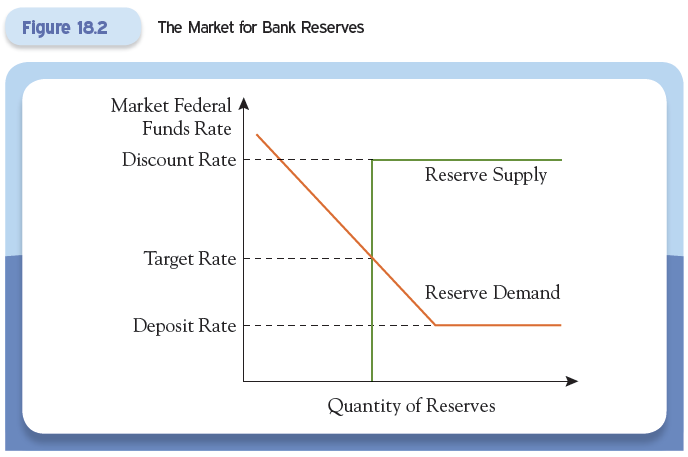

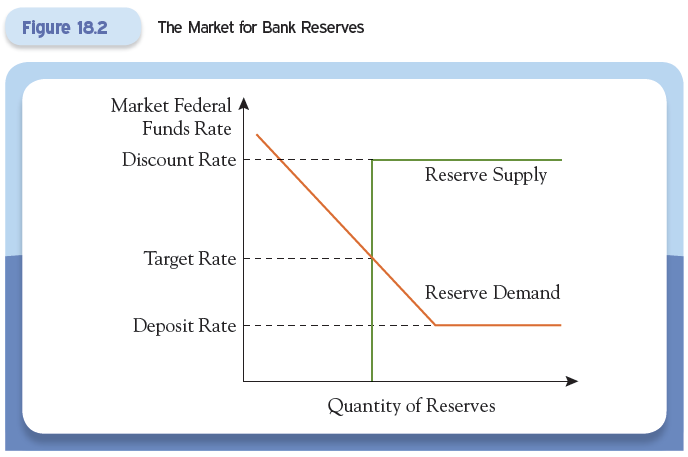

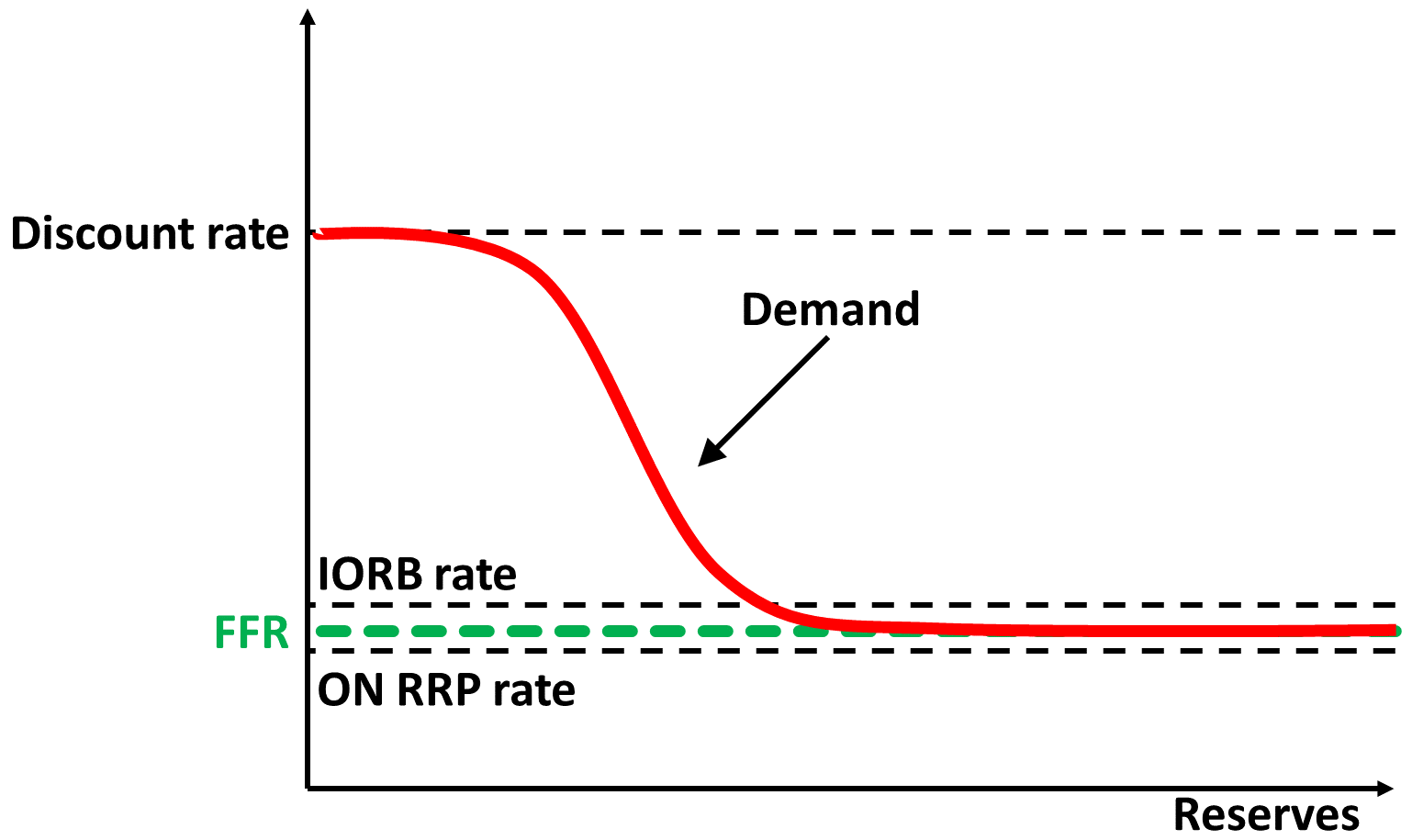

The Market for Bank Reserves

The Target Federal Fund Rate and Open Market Operations

- If the federal fund rate climbed to the discount rate, banks could borrow from the Fed at the discount rate.

The Market for Bank Reserves

The Target Federal Fund Rate and Open Market Operations

- If the federal fund rate climbed to the discount rate, banks could borrow from the Fed at the discount rate.

- If the market federal funds rate fell to the deposit rate, banks could deposit their excess reserves at the Fed at the deposit rate.

The Market for Bank Reserves

The Target Federal Fund Rate and Open Market Operations

- If the federal fund rate climbed to the discount rate, banks could borrow from the Fed at the discount rate.

- If the market federal funds rate fell to the deposit rate, banks could deposit their excess reserves at the Fed at the deposit rate.

- The Fed could adjust the width of the so-called channel around the target federal funds rate.

The Market for Bank Reserves

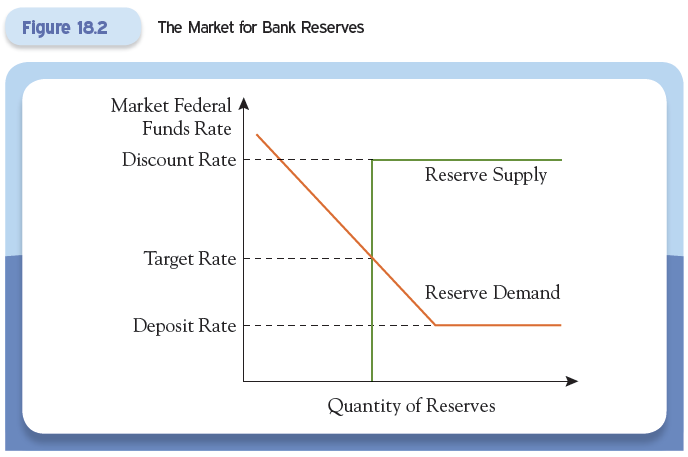

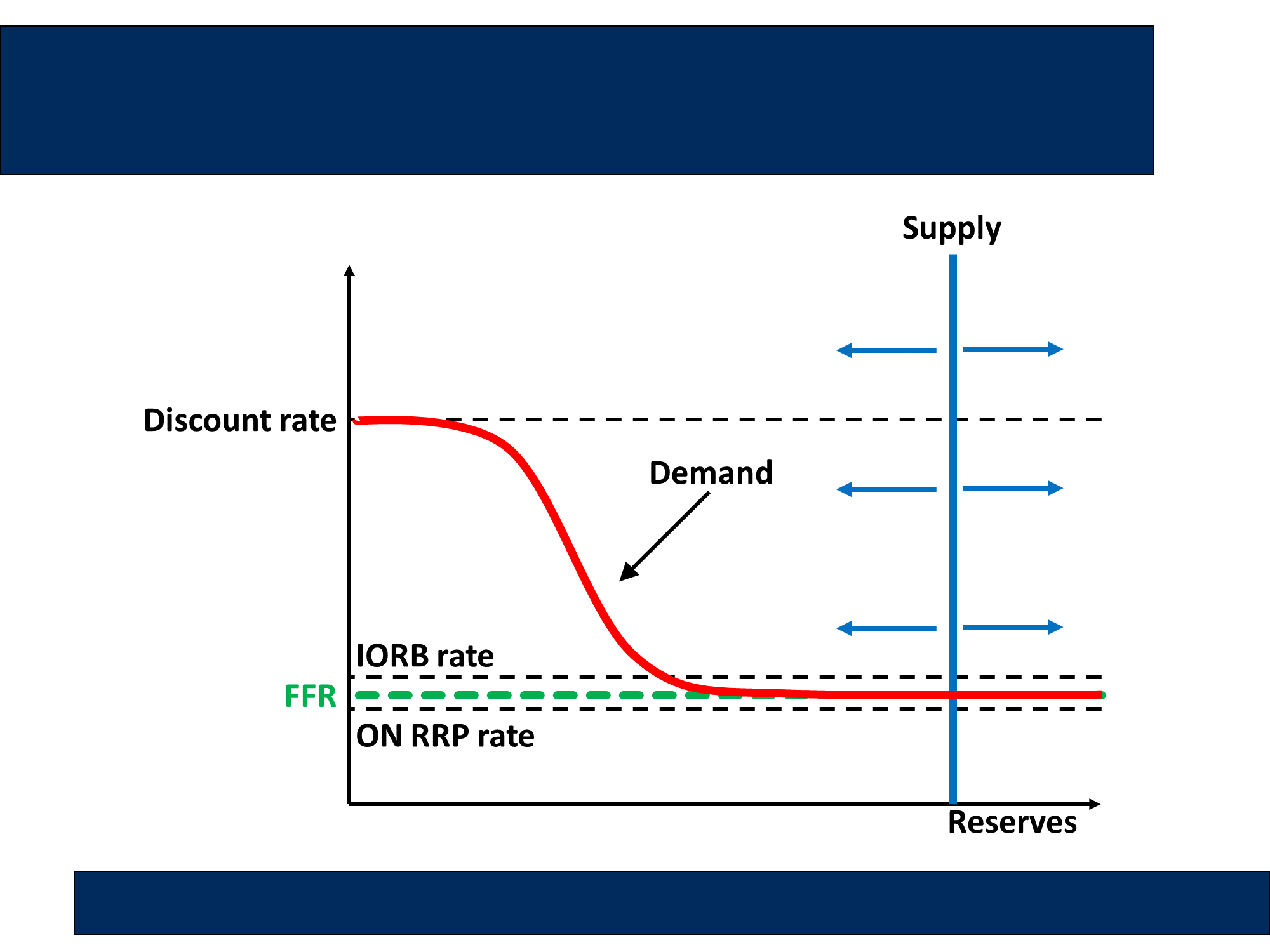

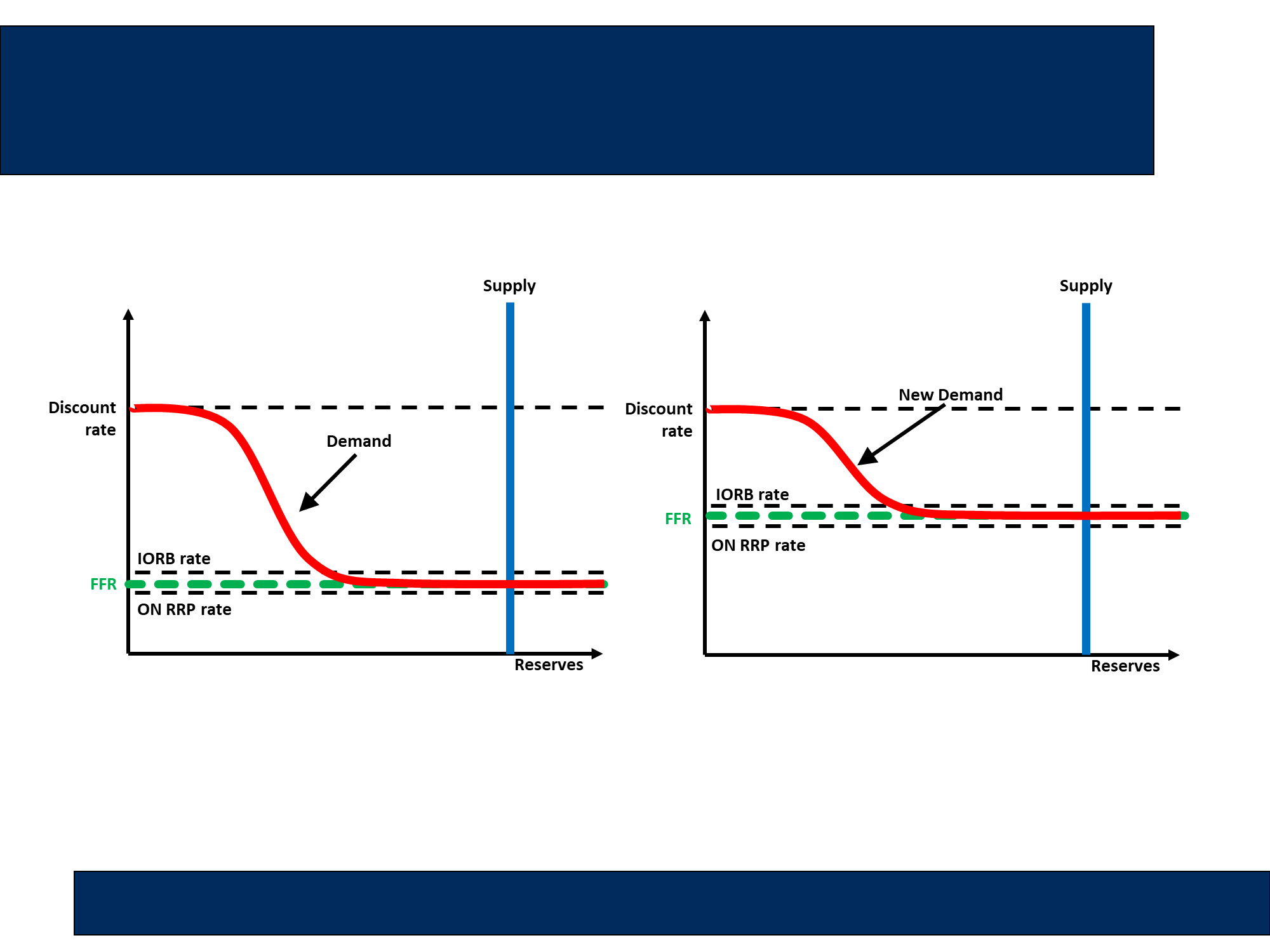

The Target Federal Fund Rate and Open Market Operations

- Within a day, the federal funds rate could fluctuate in a range from the deposit rate to the discount rate.

- As the reserve demand shifted, the Fed staff used open market operations to shift the daily reserve supply curve to accommodate the change.

- This ensured that the market federal funds rate stayed near the target.

The Target Federal Fund Rate and Open Market Operations

- An increase in reserve demand is met by an open market purchase

- The vertical portion of reserve supply shifts to the left to keep the federal funds rate at the target level.

Monetary Policy

- During and after the financial crisis of 2007-2009, reserves ballooned!

Reserves of Depository Institutions 1959 - 2023

Monetary Policy

- After the financial crisis of 2007-2009, reserves ballooned!

- Chief monetary policy tool in the “ample reserves regime”:

- Administered Interest Rates

Administered Rates

- Interest on Reserve Balances (IORB)

- Now the principal monetary policy tool

- Overnight reverse repurchase agreement rate (ON RRP)

- Discount rate

Administered Rates

- Why is the IORB a lower bound on the FFR?

- Why is the discount rate an upper bound on the FFR?

- The role of arbitrage!!

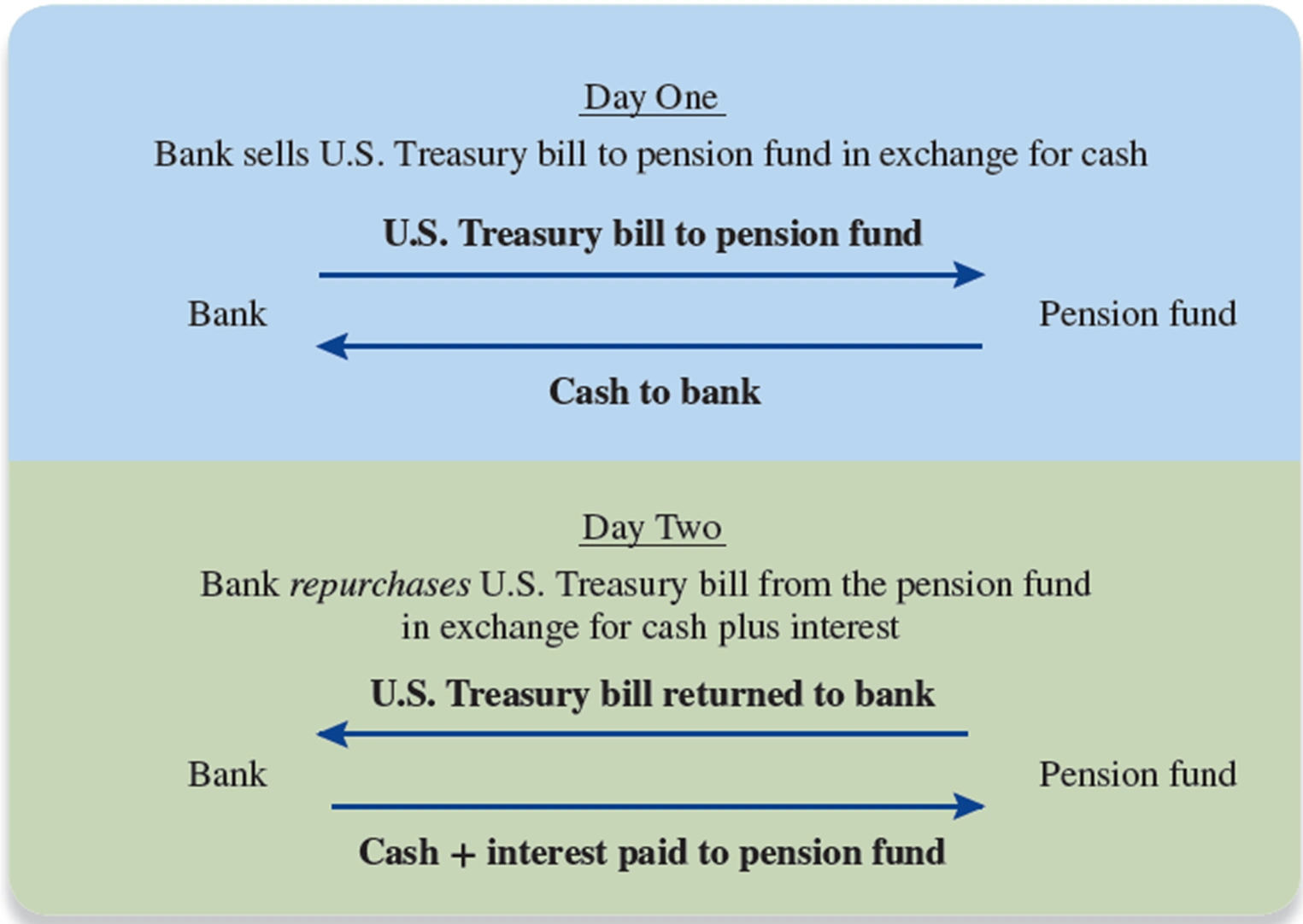

Repo vs Reverse Repo

- Repo (Repurchase Agreement)

- Day 1: Fed buys a US govt. security from a NBFI

- Day 2: NBFI buys the security back from the Fed at a slightly higher price

- Reverse Repo (Reverse Repurchase Agreement)

- Day 1: Fed sells a US govt. security to a NBFI

- Day 2: Fed buys the security back from the NBFI at a slightly higher price

Repo vs Reverse Repo

The “Transmission Mechanism”

- For Banks, the IORB is the risk-free rate

- Any loan must involve a risk-premium over the IORB

- For example - assume the IORB is 2%, and some risk premia are as follows:

Risk Premia Example

- Business loans at the “prime rate” … 3%, so nominal loan rate = 2% + 3% = 5%

- Small business loans … 5%, so nominal rate

- = 2% + 5% = 7%

- Consumer loans … 7%, so nominal rate

- = 2% + 7% = 9%

Transmission Mechanism

- So, when the Fed raises the IORB (and the Repo Rate) from 2% to 4%, and the risk-premia stay the same, all the other rates go up accordingly

- Prime rate business loans from 5% to 7%

- Small business loans from 7% to 9%

- Consumer loans from 9% to 11%, Etc.

Economic Consequences of Fed Actions

- Fed lowers rates: i ⬇️

- ⇨ Consumption ⬆️, Investment ⬆️, Net Exports ⬆️

- ⇨ Aggregate Demand ⬆️

- ⇨ National Income ⬆️

- ⇨ Inflation ⬆️ (sooner or later)

- Fed raises rates: i ⬆️

- ⇨ Consumption ⬇️, Investment ⬇️, Net Exports ⬇️

- ⇨ Aggregate Demand ⬇️

- ⇨ National Income ⬇️

- ⇨ Inflation ⬇️ (sooner or later)

Financial and Economic Consequences of Fed Actions

Feedback? Email robecon1452@gmail.com 📧. Be sure to mention the page you are responding to.