👨🏫 Notes

Macdonald’s reported second quarter earnings today

Year over year earnings was flat, falling short of analyst expectations

Profits were down 12%, more than analysts had forecast

The main reason: INFLATION

- Asset Price Bubbles - How Should the Fed Respond?

- Fiscal Policy

- The Global Economy and Financial Performance

- The Domestic Economy and Financial Performance

- Demand shocks

- Supply shocks

- Business Cycles

- Industry sensitivity ot business cycles

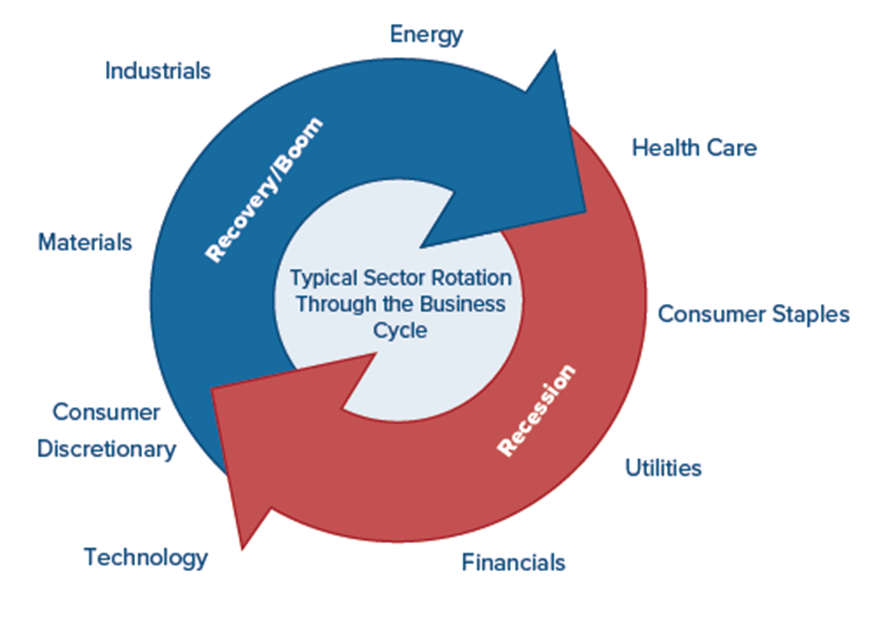

- Sector rotation

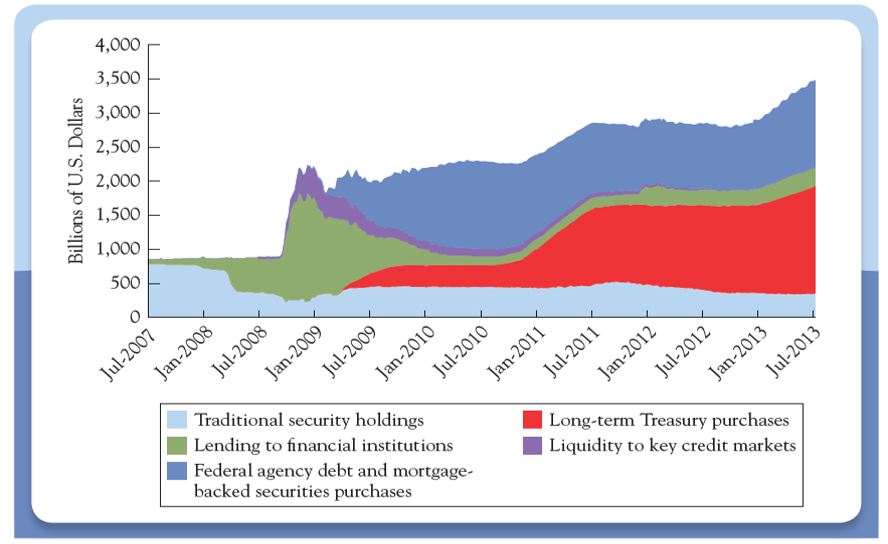

Fed Activity During the Crisis

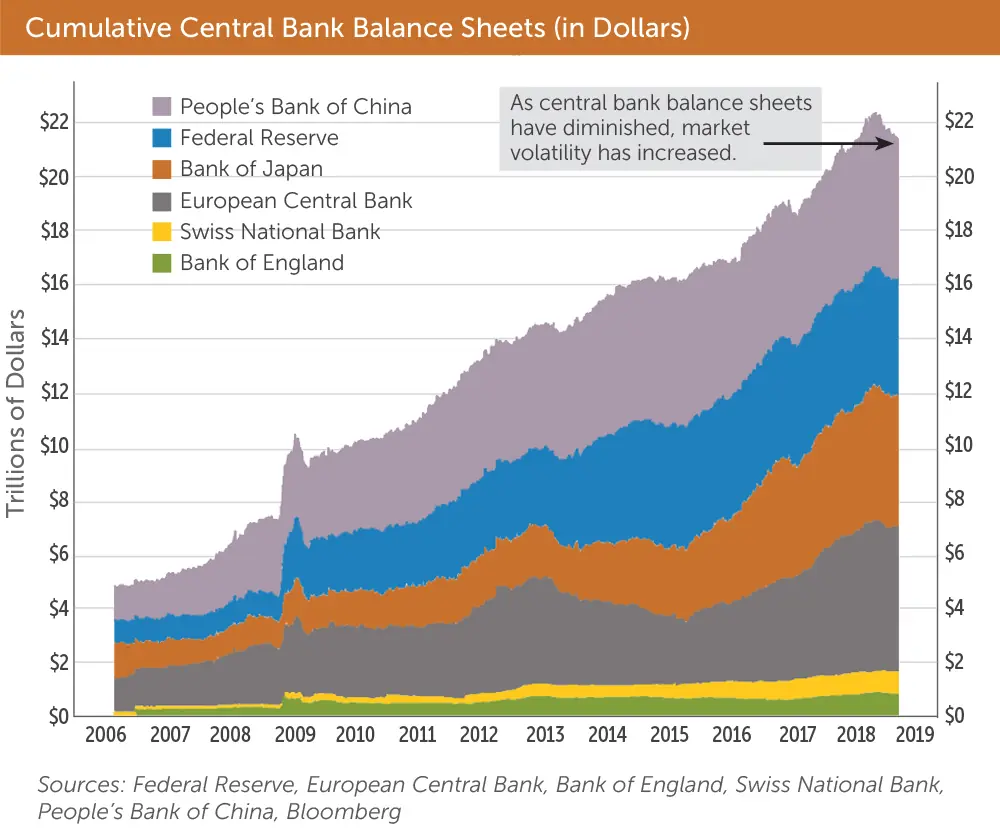

Central Bank Balance Sheets

Asset Price Bubbles - How Should the Fed Respond?

Stability: The Primary Objective of All Central Banks

Central bankers work to reduce the volatility of the economic and financial systems by pursuing five specific objectives:

- Low and stable inflation.

- High and stable real growth, together with high employment.

- Stable financial market and institutions.

- Stable interest rates.

- A stable exchange rate.

Should Central Banks’ Respond to Asset-Price Bubbles? (Lessons from the Global Financial Crisis)

Asset pricing bubbles occur when

- asset’s prices climb above fundamental values

- … then fall back to the fundamental value (or below) quite rapidly

What should central banks do about pricing bubbles?

- Should response be different from inflation and employment goals?

- Should response minimize damage when bubble bursts?

- Clean-up after bubble bursts?

To help answer this, we first must define the types of pricing bubbles.

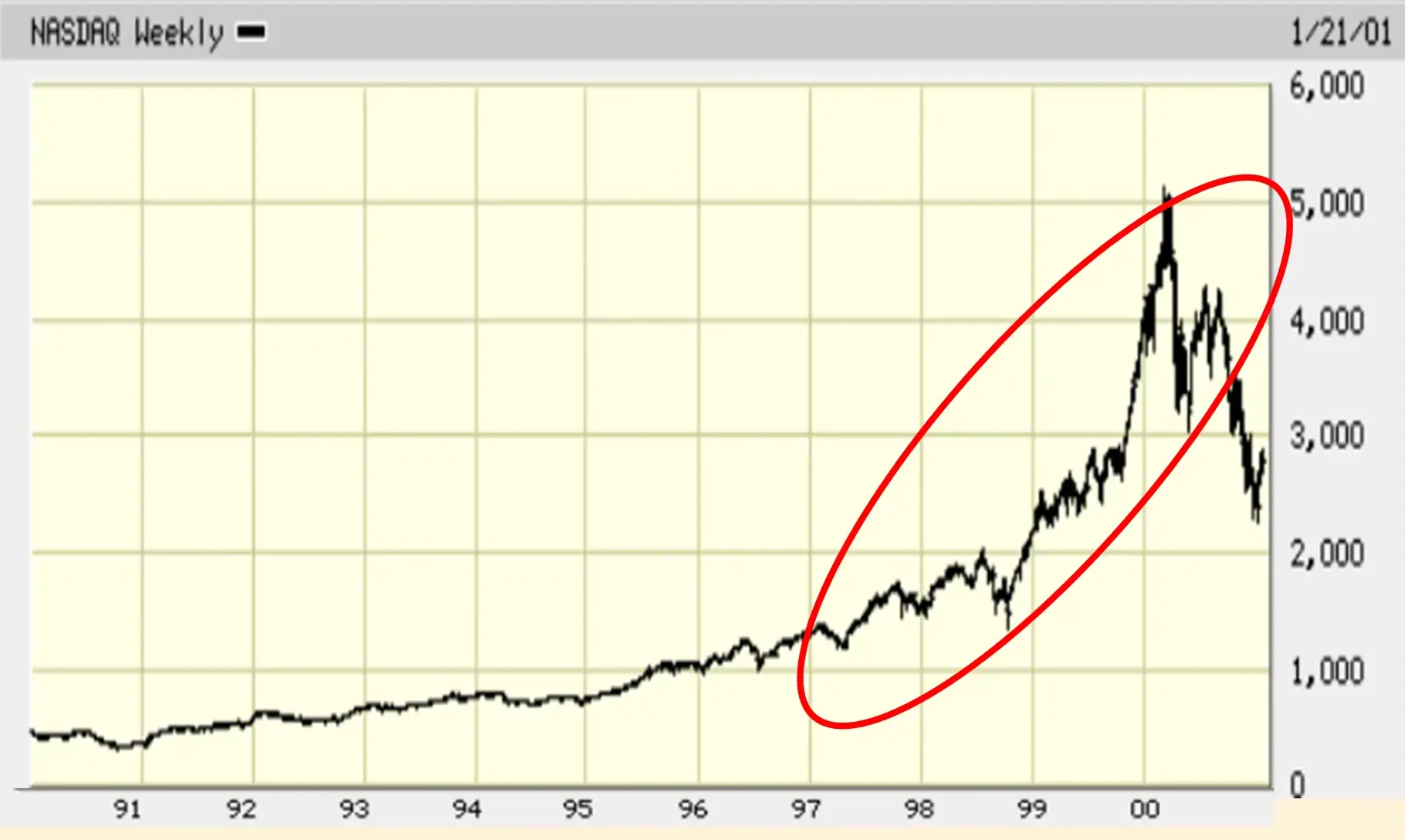

- Optimism-driven bubble: driven by overly optimistic expectations of asset pricing. Ex., the tech bubble of the late-1990s.

- These bubbles are less dangerous, as the impact on the financial system is limited. Resulting wealth transfers are not good for the economy.

The Dot Com Bubble

Another type of pricing bubble:

- Credit-driven bubble: created when easy credit terms spill over into asset prices. And as asset prices increase, further lending is encouraged.

- Very dangerous when the bubble ends - the downward spiral can be more damaging than the asset bubble.

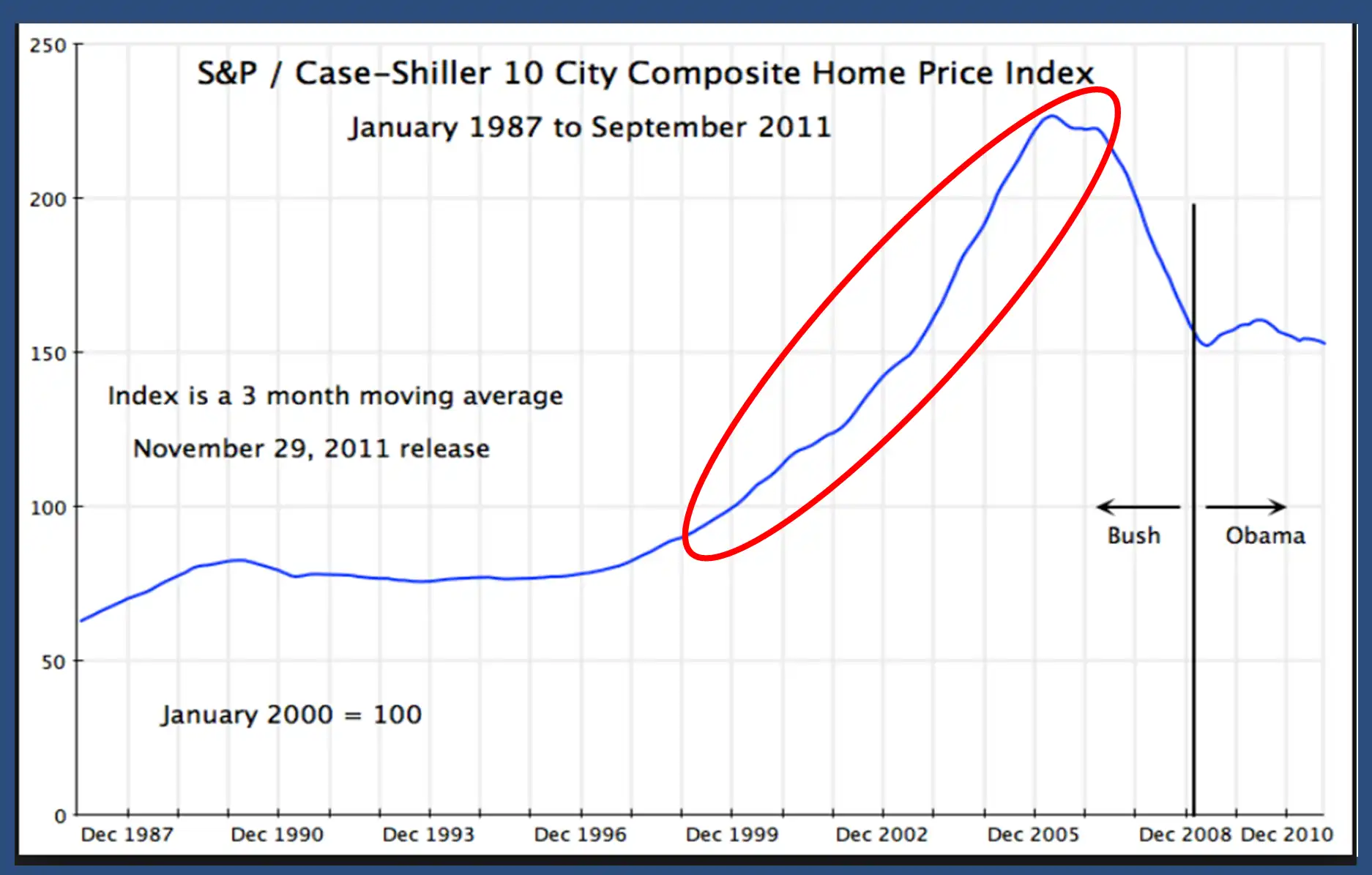

House Price Bubble

So, should central banks respond?

The “Greenspan” doctrine for why the answer is no:

- Bubbles are difficult to identify

- Rate changes may do nothing

- Rates are a blunt instrument - affect many asset prices in the economy

- Resulting slow economy, unemployment, etc., may be worse than the bubble.

- Policy reactions after the bubble bursts may keep damage at a reasonable level.

The global financial crisis suggests the answer is yes:

- Suggests leaning against credit-driven bubbles.

- Seems easy to identify, but what policies are most effective?

Fundamental Analysis

- A firm’s intrinsic value comes from its earnings prospects, which are determined by:

- The global economic environment

- Economic factors affecting the firm’s industry

- The position of the firm within its industry

The Layers of Fundamental Analysis

- The Global Economy

- The Domestic Macroeconomy

- Monetary Policy

- Fiscal Policy

- Industry Analysis

- Analysis of the Firm

The Global Economy

- The international economy affects firm prospects.

- Export prospects

- Price competition it faces from competitors

- Profits it makes on investments abroad.

- Performance in countries and regions can be highly variable.

- Harder for businesses to succeed in a contracting economy than in an expanding one.

- Political risk:

- Sovereign debt crises

- Brexit

- Ukraine war and responses/disruptions

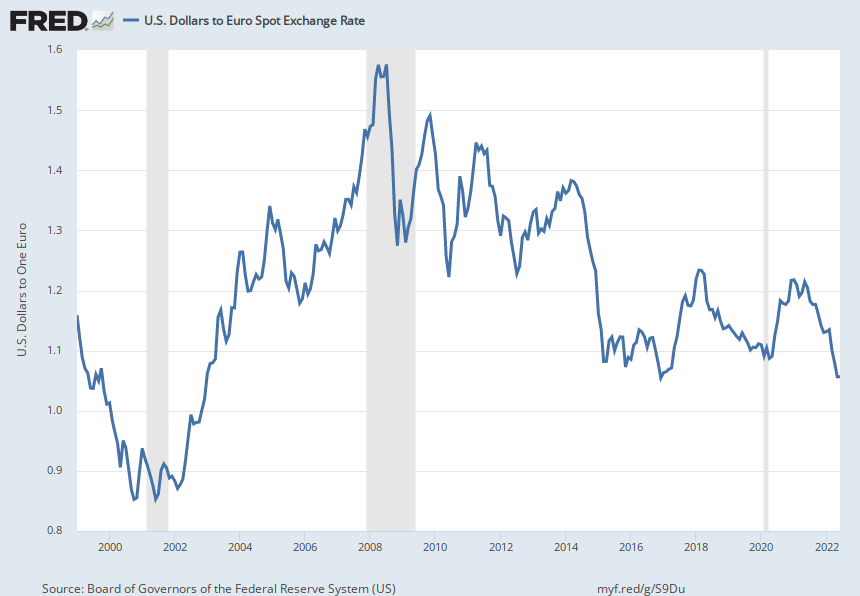

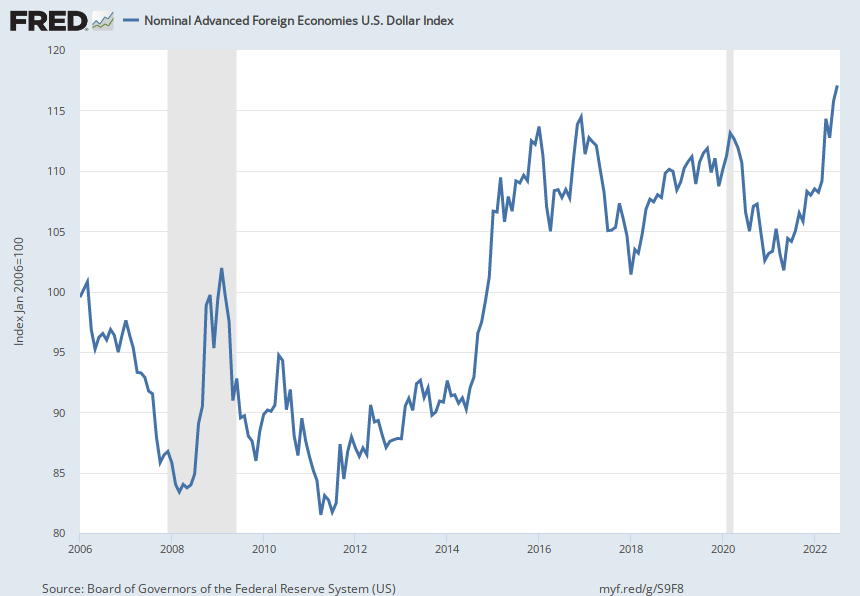

- Exchange rate risk:

- Changes the prices of imports and exports.

- Honda manufacturing in North America

- Changes the prices of imports and exports.

Euros/Dollar Jan 1999 - June 2022

Nominal Advanced Foreign Economies U.S. Dollar Index

The Domestic Macroeconomy

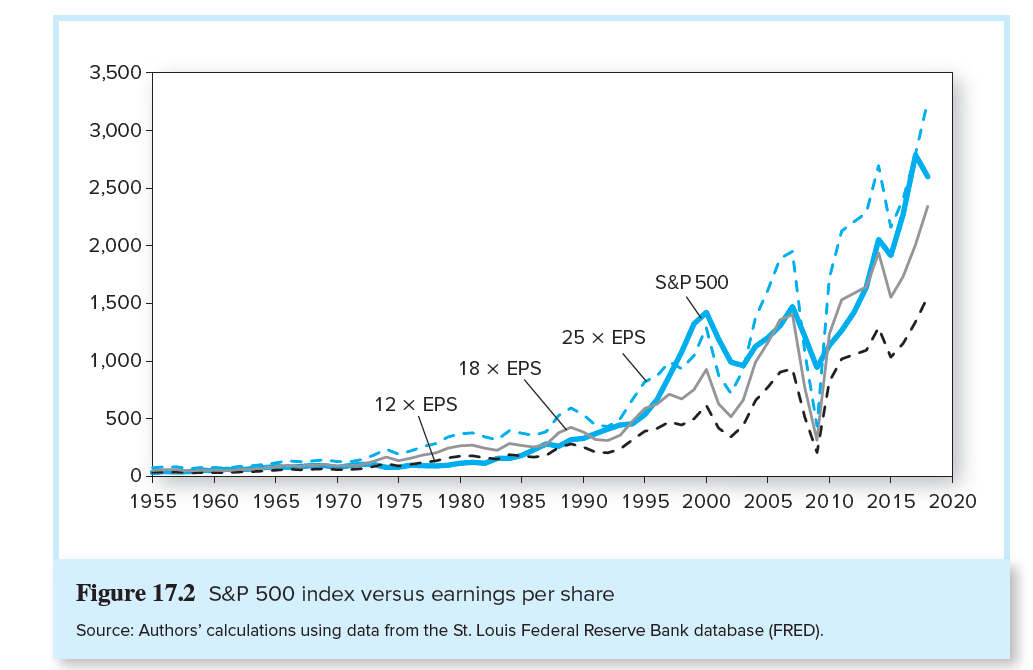

- Stock prices rise with earnings.

- P/E ratios are normally in the range of 12-25.

- The first step in forecasting the performance of the broad market is to assess the status of the economy as a whole.

S&P 500 Index versus Earnings Per Share

The Domestic Macroeconomy: Key Variables

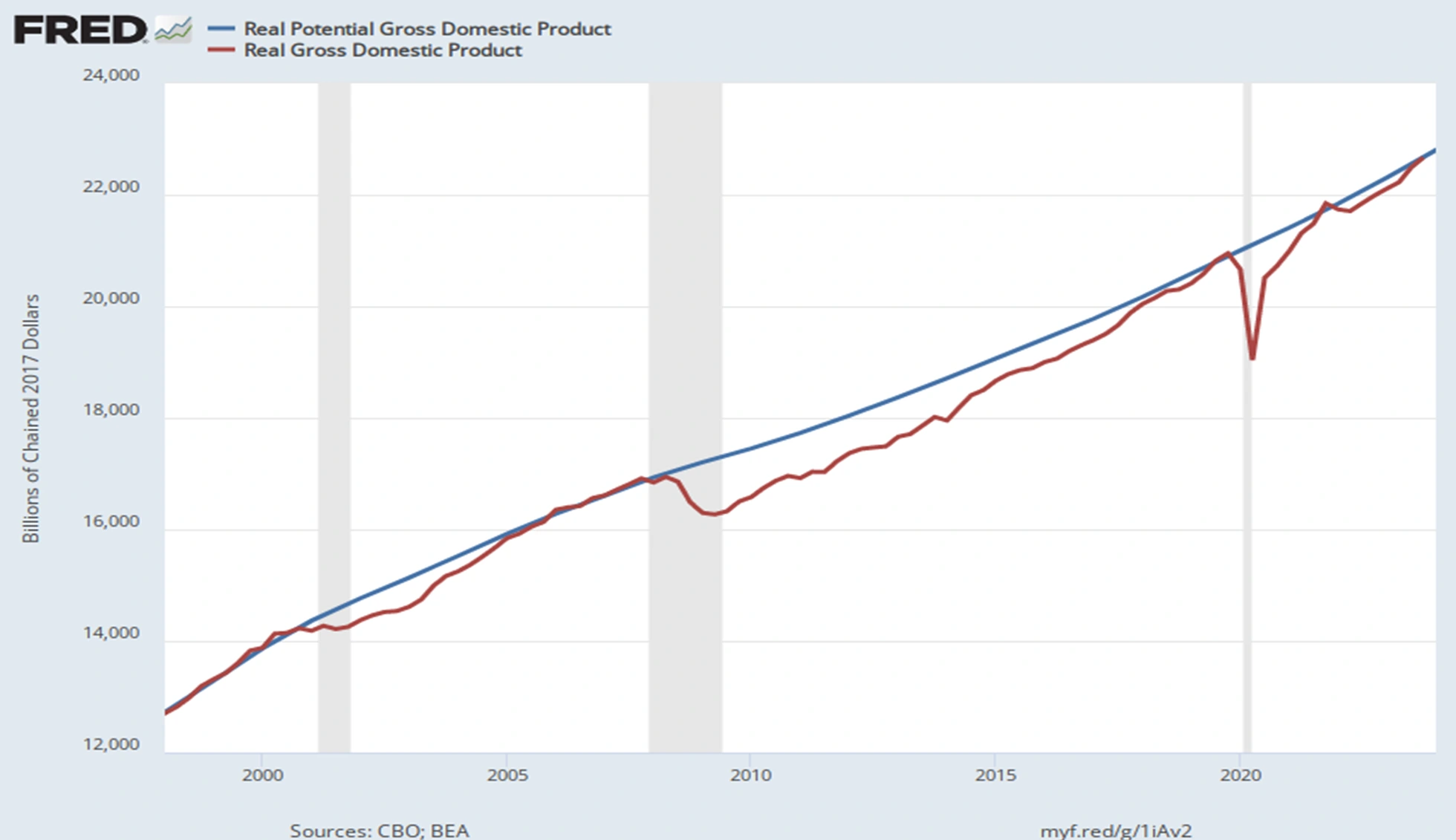

- Gross domestic product (GDP) measures the economy’s total production of goods and services.

- Industrial production measures manufacturing economic activity.

- Employment

- unemployment rate: Percentage of total labor force yet to find work.

- Capacity utilization rate: Ratio of actual output from factories to potential output.

- Inflation is the rate at which the general level of prices rise.

Demand and Supply Shocks

Demand

- An event that affects demand for goods and services in the economy

- Positive demand shocks

- Reductions in tax rates

- Increases in the money supply

- Increases in government spending

- Increases in foreign export demand

Supply

- An event that influences production capacity and costs in the economy

- Examples

- Changes in price of energy

- Freezes, flood, or droughts that might destroy crops

- Changes in educational level of an economy’s workforce

- Pandemics

Demand-Side vs. Supply-Side Policies

- Demand-side policy has been of primary interest for much of postwar history

- Focus on increasing demand for goods/services

- E.g., government spending, taxes, and monetary policy

- Focus on increasing demand for goods/services

- Supply-side economics has been gaining attention since the 1980s

- Focus on enhancing productive capacity of the economy

- E.g., national policies on education, infrastructure, and research and development Maynard Keynes is famous as an advocate of demand side policies. Reagan famously advocated for Supply-side policies.

- Focus on enhancing productive capacity of the economy

Demand-Side Policy

- Monetary policy - manipulation of the money supply

- Fiscal policy - the government’s spending and taxing actions

- Government purchases

- Transfer payments

- Taxes

Demand side policies are often used to stabilize the economy. This means to lessen the effect of the business cycle (ie to lessen recessions and booms). In particular, they often involve stimulating demand when the country is in a recession. It can also mean slowing down the economy when there is a boom and inflation is a problem.

Lags in Stabilization Policy

- Recognition Lag - it takes a while for decision makers to recognize that there is a recession to correct.

- Decision Lag - it takes a while for them to reach a decision on the appropriate response.

- Impact Lag - once the policy is decided upon, it can take a while for it to take effect.

We can use Fiscal and Monetary policy to manage demand.

| Mon. Pol. | Fiscal Pol. | |

|---|---|---|

| Recognition Lag | — | — |

| Decision Lag | Short | Long |

| Impact Lag | Long | Short |

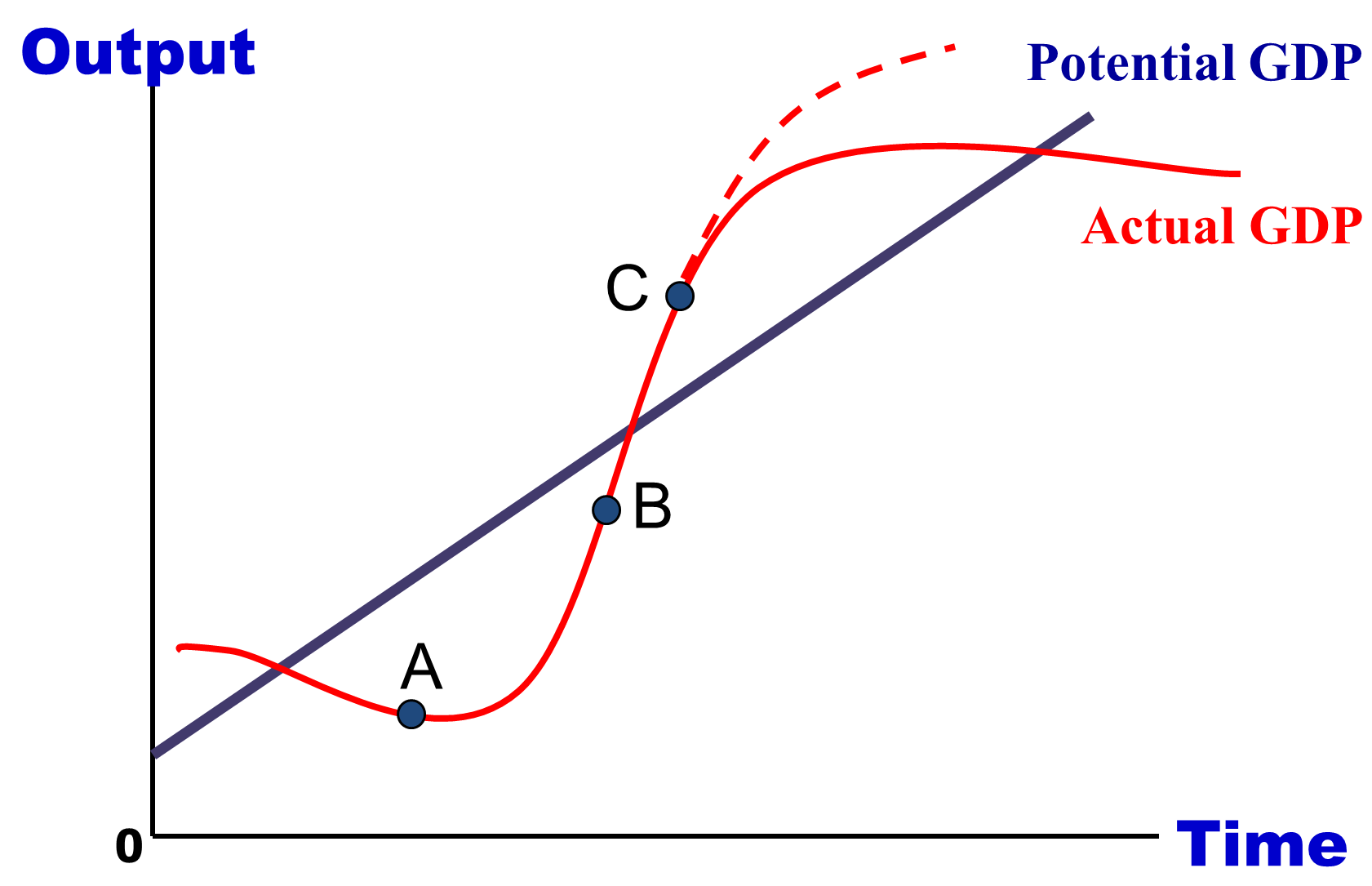

Why Lags in Stabilization Policy Can Actually Destabilize the Economy

Fiscal Policy

- Fiscal policy means cutting taxes, increasing spending, or increasing transfers.

- To summarize the net effect of fiscal policy, look at the budget surplus deficit

- Deficit stimulates the economy because:

- it increases the demand for goods (via spending) by more than it reduces the demand for goods (via taxes)

Monetary Policy

Monetary policy can change the interest rate and money supply. This can increase or decrease demand.

Supply-Side Policies

- Goal: To create an environment in which workers and owners of capital have the maximum incentive and ability to produce and develop goods.

- Supply-siders focus on how tax policy can be used to improve incentives to work and invest.

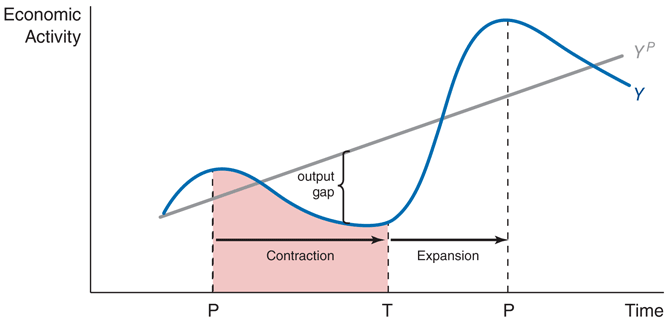

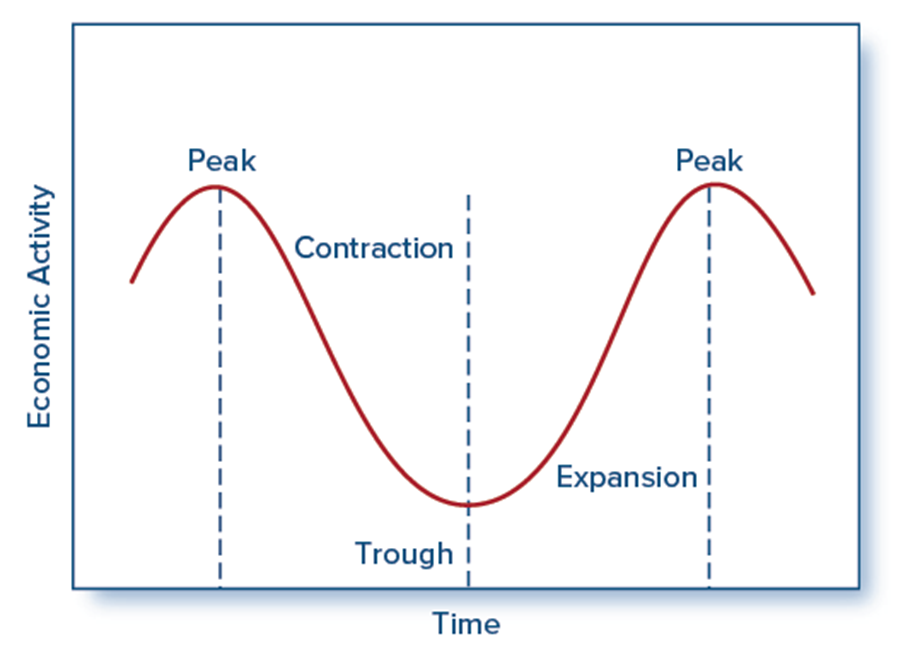

Business Cycles

- The transition points across cycles are called peaks and troughs.

- A peak is the transition from the end of an expansion to the start of a contraction.

- A trough occurs at the bottom of a recession just as the economy enters a recovery.

Anatomy of a Business Cycle

Actual and Potential GDP 1998 - 2023

What is a business cycle?

- Business cycle is the recurring pattern of recession and recovery.

- The transition points across cycles are called peaks and troughs.

- The peak is the transition from the end of an expansion to the start of a contraction.

- A trough occurs at the bottom of a recession just as the economy enters a recovery.

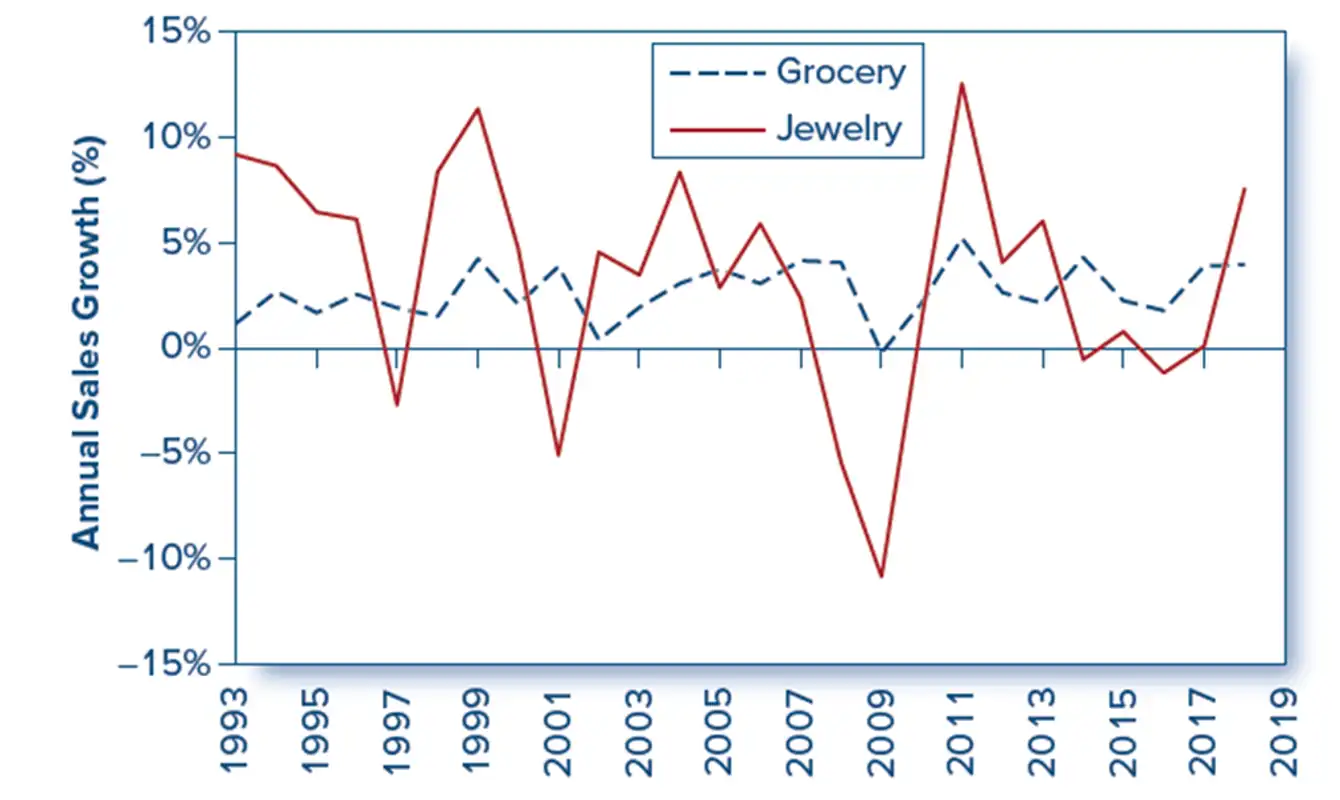

Cyclical Industries Above-average sensitivity to the state of the economy

- For example, producers of durable goods, such as automobiles

High betas

Defensive Industries

Little sensitivity to the business cycle.

Examples

- Food producers and processors.

- Pharmaceutical firms,

- Public utilities.

Low betas.

Sensitivity to the Business Cycle

- Three factors determine the sensitivity of a firm’s earnings to the business cycle.

1. Sensitivity of sales.

- Necessities versus discretionary goods.

- Items that are not sensitive to income levels (such as tobacco) versus items that are very sensitive (such as machine tools, steel, and autos).

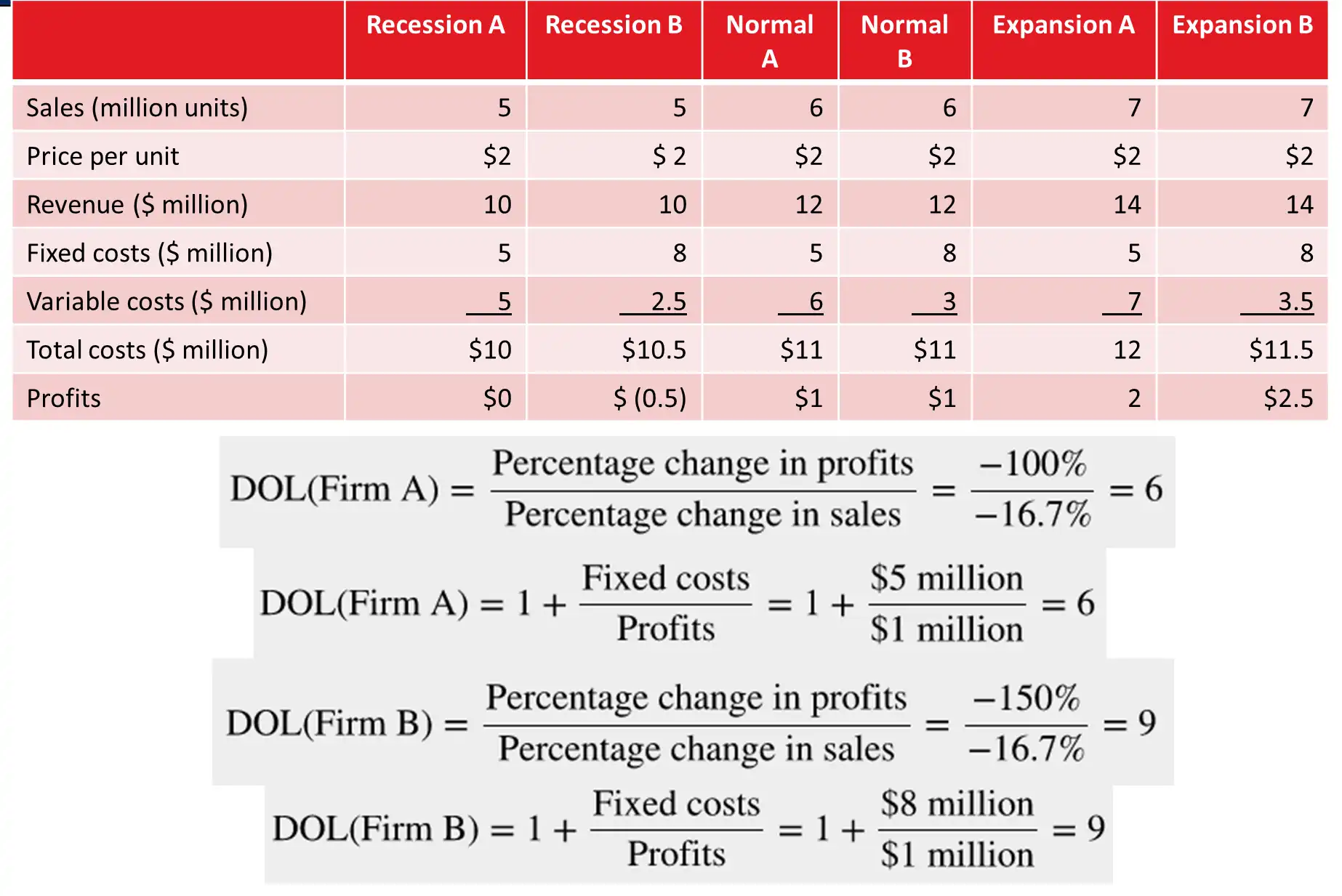

Operating Leverage

🙋♀️ Jackie’s point: If you have high fixed costs, you have problems in a recession!

- Refers to division between fixed and variable costs.

- Profits of firms with greater variable costs (low-operating leverage) will be less sensitive to business conditions.

- Profits for firms with high fixed costs (i.e., high-operating leverage) will swing more widely with sales.

- Degree of Operating Leverage (DOL) is measured:

3. Financial leverage.

- The use of borrowing.

- Interest acts as a fixed cost that increases the sensitivity of profits to the business cycle, like operating leverage.

Sector rotation is an investment strategy which entails shifting the portfolio into industry sectors that are forecast to outperform others based on macroeconomic forecasts.

Peak of the business cycle.

- Economy might be overheated, with high inflation and interest rates and price pressures on basic commodities.

Trough of the business cycle.

- Good time to invest in capital goods industries, such as equipment, transportation, or construction.

Sector Rotation