👨🏫 Notes

Money Market Securities

Money Market Securities are short term bonds (approx <1 year)

- Treasury bills: US govt. bonds with maturities ≤ 1 year

- Commercial paper: Corporate bonds with maturities typically of 1 – 2 months A Money Market Mutual Fund (MMMF) is just a mutual fund that invests in money market securities.

US Government Bonds

- Treasury Notes and Bonds

- Maturities

- T-Bills – Maturities up to 52 weeks

- Notes – Maturities 1 to 10 years

- Bonds – Maturities from 11 to 30 years

- US Savings Bonds

- Par Value – $1,000

- Interest paid semiannually on Notes and Bonds

- Quotes – Percentage of par

- Maturities

- TIPS (Treasury Inflation-Protected Securities)

- Principal adjusted in proportion to changes in the CPI (face value increases as prices increase). Because of this it provide inflation protection.

- Federal Agency Debt

- Debt of mortgage-related agencies such as Fannie Mae, Ginnie Mae and Freddie Mac

Municipal Bonds

- Issued by state and local governments

- Interest is exempt from federal income tax and is usually exempt from state and local taxation in the issuing state

- Types

- General obligation bonds: Backed by taxing power of issuer

- Revenue bonds: backed by project’s revenues or by the municipal agency operating the project.

- Tax-Exempt Debt Outstanding: Muni debt increased substantially during the Great Financial Crisis. General obligation bonds significantly more prevalent than revenue bonds.

Calculating the after-tax rate of a corporate bond

- For a corporate bond, you multiply by (1-t) to find the after-tax return. Consider a 9% corporate bond and assume a tax rate of . The after-tax return on the corporate bond is 7.2%:

- The 9% corporate is equivalent to a tax-free 7.2% muni because both have a 7.2% yield after taxes.

- To choose between taxable and tax-exempt bonds, compare after-tax returns on each bond, using the formula above.

- Let t equal the investor’s marginal tax bracket

- Let r equal the before-tax return on the taxable bond and rm denote the municipal bond rate.

- If rc(1 - t ) > rm, then the taxable bond gives a higher return; otherwise, the municipal bond is preferred.

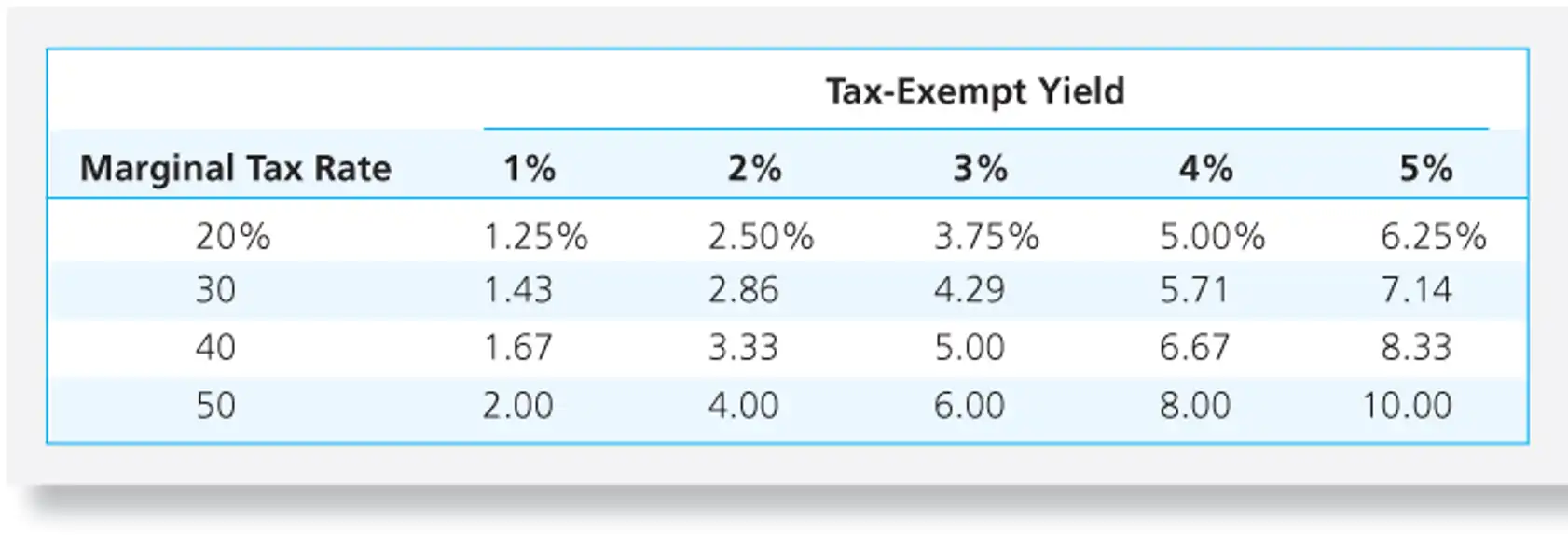

Equivalent Taxable Yields Corresponding to Various Tax-Exempt Yields

For example, consider a 7% muni. A 7% muni is equivalent to a 8.75% corporate:

In summary:

- To find the after-tax rate of a taxable bond, you multiply the taxable rate by (1-t)

- To find the equivalent taxable yield, you divide the muni rate by (1-t)

✏️ You are selling muni bonds with a yield of 6%. For a customer with an effective marginal tax rate of 26%, what yield of corporate bond would this be competitive with?

✔ Click here to view answer

Equivalent Taxable Rate = 6%/(1-26%) = 8.11% ✅

E.g. suppose and . Then,

Corporate Bonds

- Issued by private firms

- Semi-annual interest payments; face (par) value paid on maturity

- Subject to larger default risk than government securities

- Two types:

- Secured bonds (backed by collateral)

- Debentures (no collateral)

- Subordinated debentures (lower priority claim on firm’s assets)

- Special provisions of some corporate bonds

- Callable bonds - Issuer has the option to buy the bond from the holder at a stipulated price

- Convertible bonds - Bondholder has the option to convert each bond into a stipulated number of shares of stock

- Puttable Bonds - Give the holder an option to retire or extend the bond

- Floating-rate bonds - Have adjustable coupon rate

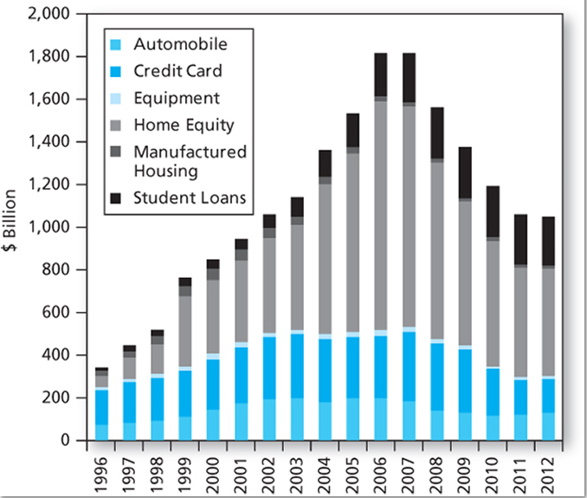

Asset-Backed Securities

- Created by the securitization of loans

- Auto loans

- Credit card debt

- Student loans

- Loans on equipment

- Asset-Backed Securities Outstanding

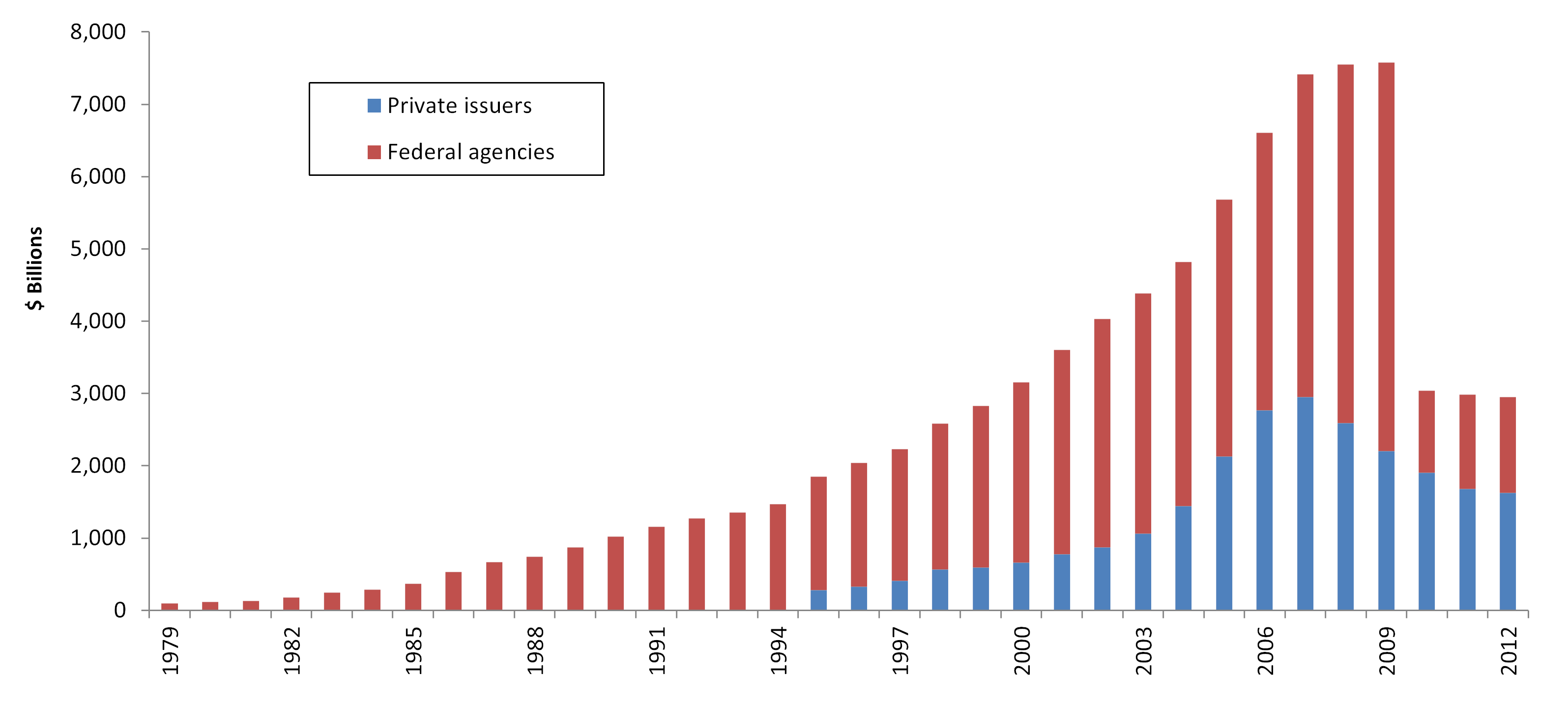

Mortgage-backed securities (most common type of Asset Backed Security)

- Proportional ownership of a mortgage pool or a specified obligation secured by a pool

- Produced by securitizing mortgages

- Mortgage-backed securities are called pass-throughs because the cash flows produced by homeowners paying off their mortgages are passed through to investors. Subprime MBS

- Historically, most were issued by Fannie Mae and Freddie Mac

- Traditionally, were comprised of conforming mortgages, which met standards of credit worthiness

- Later on, “Private-label” issuers securitized large amounts of subprime mortgages, made to financially weak borrowers

- Fannie and Freddie were allowed and even encouraged to buy subprime mortgage securities

Mortgage-Backed Securities Outstanding

An ABS or MBS is a special purpose vehicle (trust or corporation). It turns the cash flows from various loans into securities (i.e. bonds)

| Assets | Liabilities |

|---|---|

Auto loans, Credit card debt, Student loans, OR Loans on equipment (generally not a mix) | Bonds |

Additional data: Relative values of the different types of fixed income securities:

https://www.sifma.org/resources/research/fixed-income-chart/

International Bonds

- Bonds issued by

- Foreign governments (sovereign debt)

- Foreign companies

- Eurobond

- a bond denominated in a currency different from the currency of the country in which the bond is issued

- Example:

- A bond denominated in dollars issued in Germany (called a “Eurodollar” bond)

- A bond denominated in yen issued in Singapore (called a “Euroyen” bond)

- Yankee and Samurai bonds (Foreign Bonds)

- a bond issued in a foreign country, denominated in the currency of that country

- Example: Dollar-denominated bond issued in the US by a French company

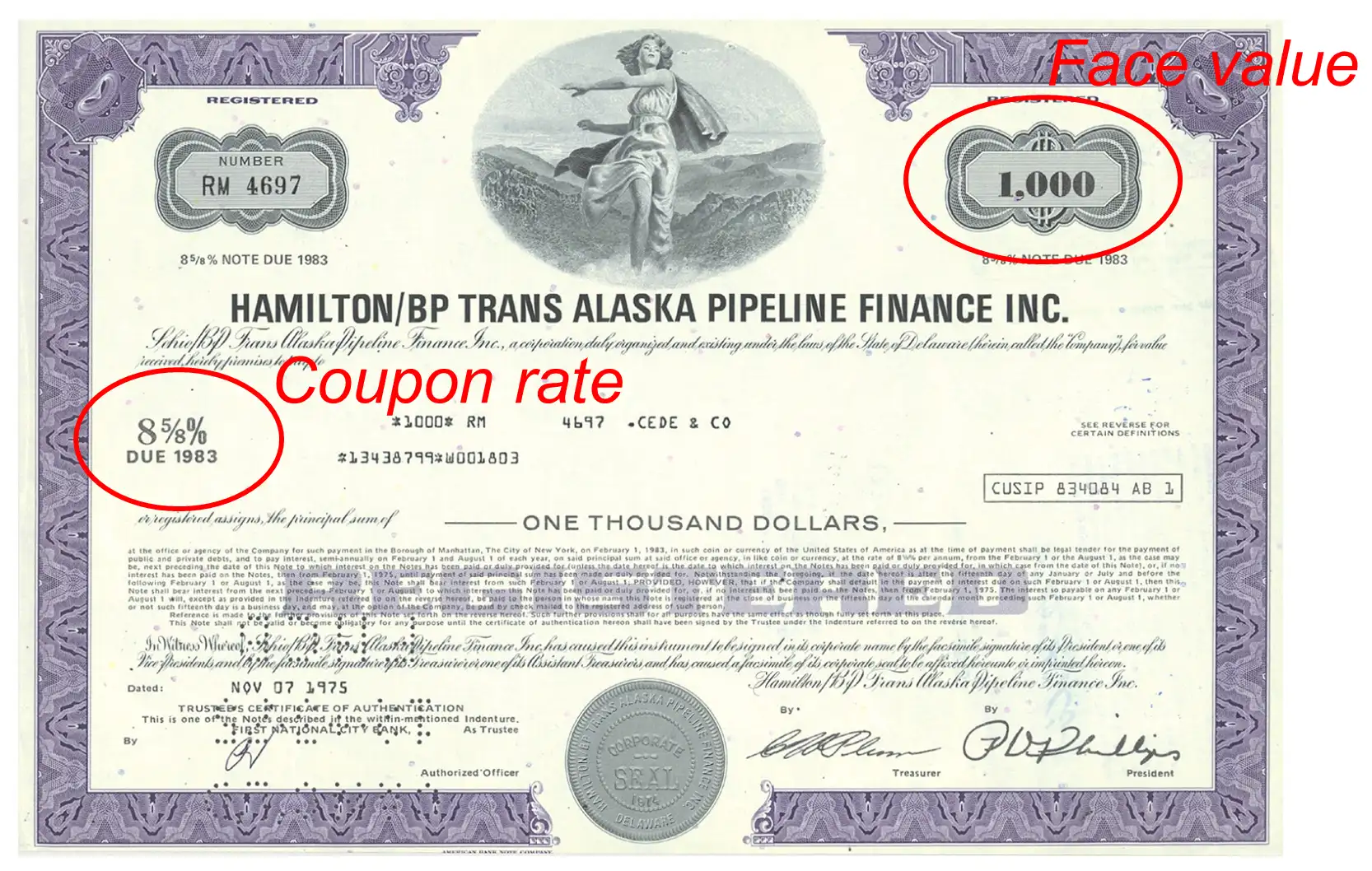

Components of a Bond

Terminology

- Bonds are debt obligations of issuers (borrowers) to bondholders (creditors)

- Face or par value is the principal repaid at maturity, typically $1000

- The coupon rate determines the interest payment (“coupon payments”) paid semiannually

- The indenture is the contract between the issuer and the bondholder that specifies the coupon rate, maturity date, and par value

Notation

F= Face value (also called par value)

c= Coupon rate

Fc= Coupon payment

T= Years to maturity

i= Interest rate (or discount rate, or yield)

The Relationship Between i, c, PB and F

- When i > c, PB < F

- When i = c, PB = F

- When i < c, PB > F

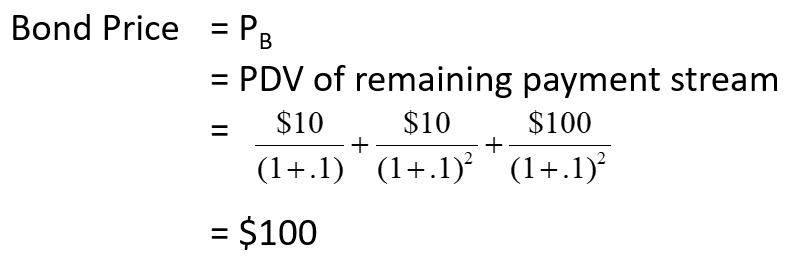

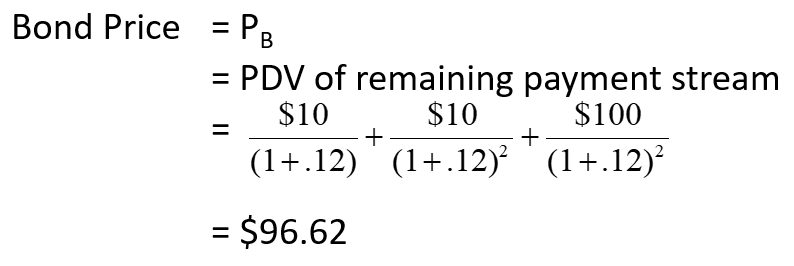

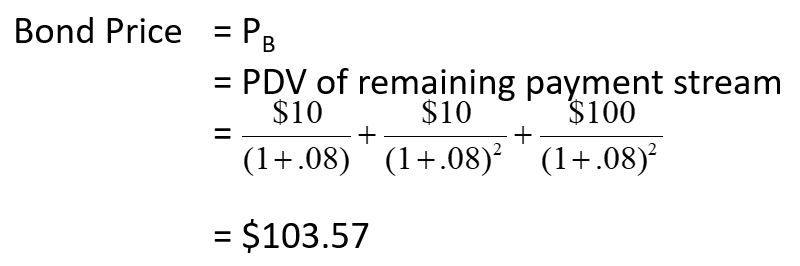

He illustrated this relationship with the following examples:

| Scenario I: i Stays at 10%  This illustrates that when i = c, PB = F |

| Scenario II: i goes up to 12%  This illustrates that when i > c, PB < F |

| Scenario III: i goes down to 8%  This illustrates that when i < c, PB > F |

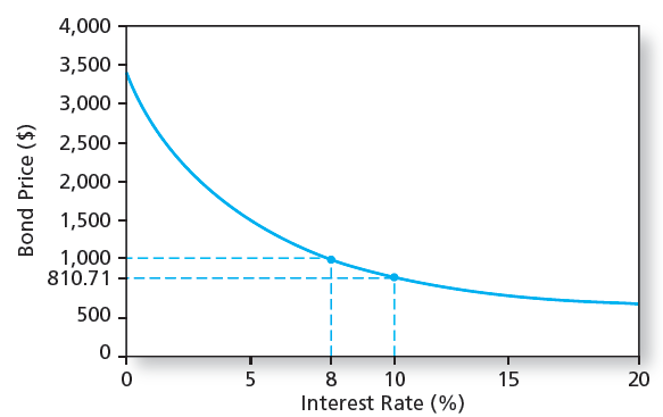

The above illustrates the inverse relationship between price and yield: when yield (aka discount factors) are high, bond prices are low. When yield is low, bond prices are high. We can also see this in the following graph, which we will explore further in the next lecture:

The Inverse Relationship Between Bond Prices and Yields:

If you identify one of the traits in a row all of the traits from that row apply.

| Discount Bond | PB < F | yield > c | The bond price is discounted from the face value. This compensates for a low coupon rate. |

|---|---|---|---|

| Par Bond | PB = F | yield = c | The bond price equals the face value. Your entire yield comes from the coupon. |

| Premium Bond | PB > F | yield < c | You pay a premium for the bond. This lowers the yield until it’s below the coupon. |

Bond prices are constantly changing. Bond prices and yields move inversely:

When i⬇️, PB⬆️

When i⬆️, PB⬇️

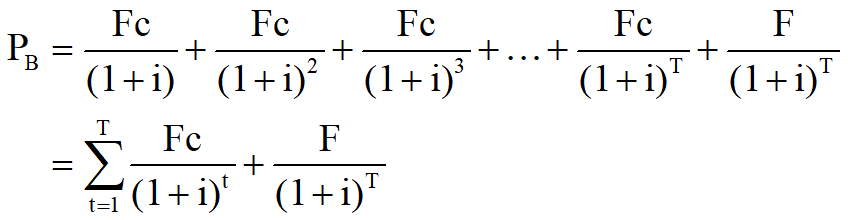

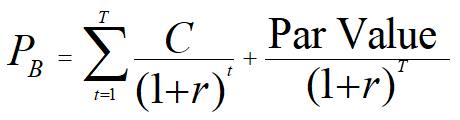

Bond Pricing Formulas

These bond pricing formulas can be found in a more concise form (with integrated tips for Spreadsheet entry) in my formula sheet at https://robmunger.com/1452sheet

General Bond Pricing Formula

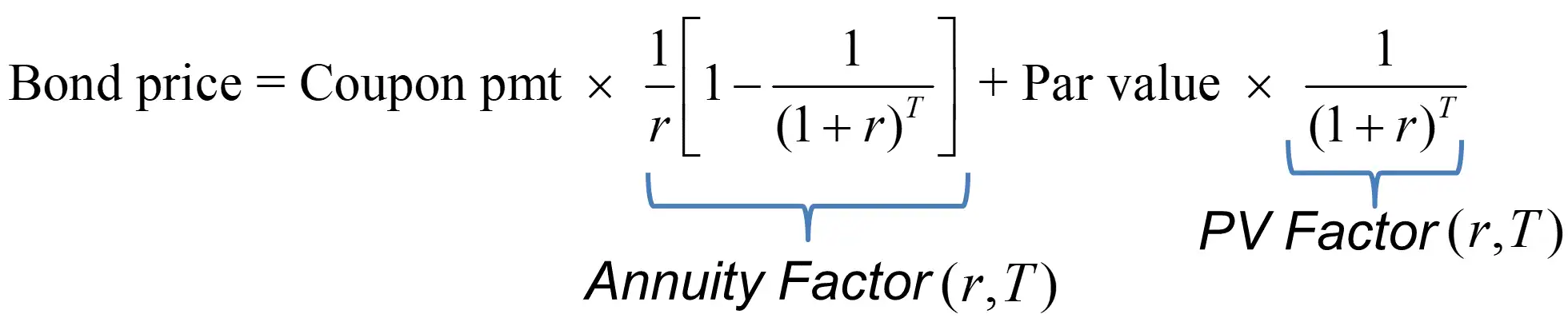

”Shortcut” Bond Pricing Formula

With computers available, this formula is becoming much less relevant. Nonetheless, it is the formula that is behind the most commonly used bond pricing keys on a financial calculator.

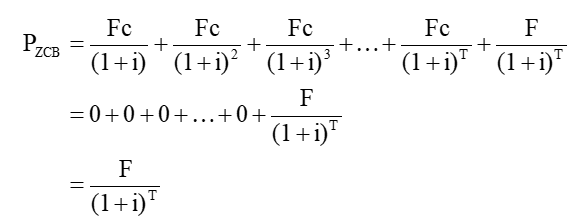

Zero Coupon Bonds

- For a zero coupon bond, c = 0. So, what would the bond pricing formula be?

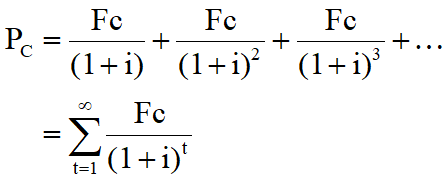

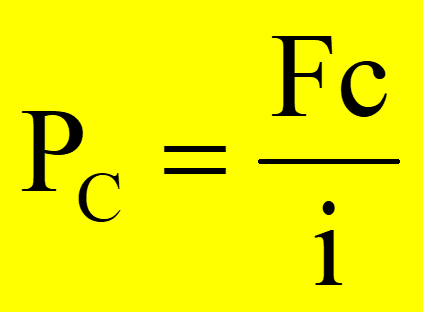

Consols

- For a consol, T → ∞

- Pricing formula becomes:

- Mathematically, this is just the sum of an infinite geometric series, which turns out to be:

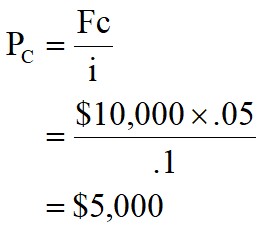

Consol Example

- F = $10,000

- c = 5%

- i = 10%

Calculating the Return on a Bond

Yield to Maturity

- Interest rate that makes the present value of the bond’s payments equal to its price is the yield to maturity (YTM)

- Solve the bond formula for r

- YTM of a consol: Price = Fc/i ⇨ i = Fc/Price

To calculate bond price or yield on a coupon bond or a zero coupon bond, just use a spreadsheet or a calculator. For a consol, you will need to use the formula.

✏️A consol pays $10,000 every year. Its yield to maturity is 5%. What is its price?

✔ Click here to view answer

✏️ A consol that pays $10,000 every year costs $180,000. What is its yield to maturity?