Just like last week, investment is a tradeoff between risk and return.

Therefore, just like in last week, your eye out for the formulas for expected return and standard deviation.

Last week, they were for the “complete portfolio”:

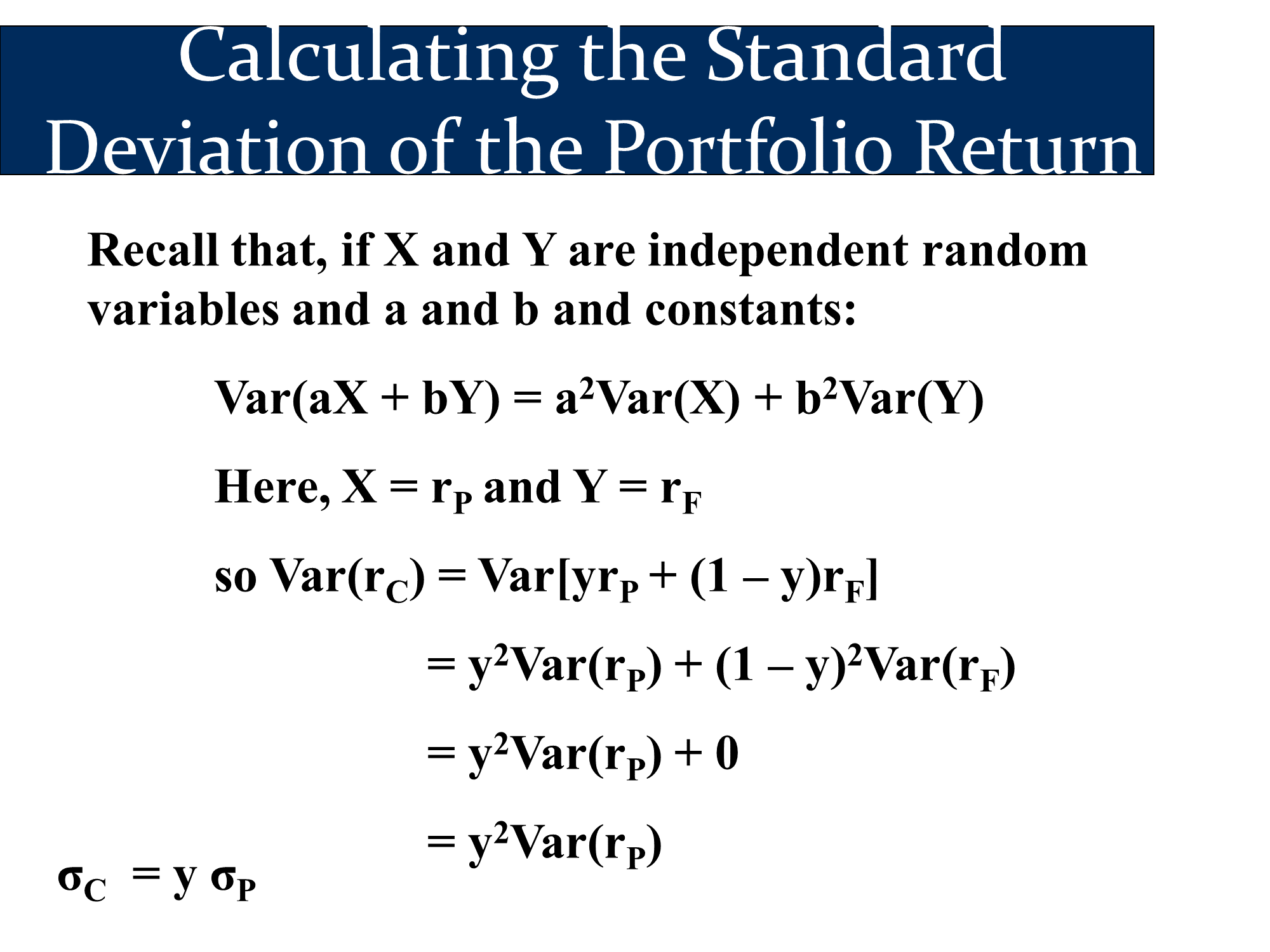

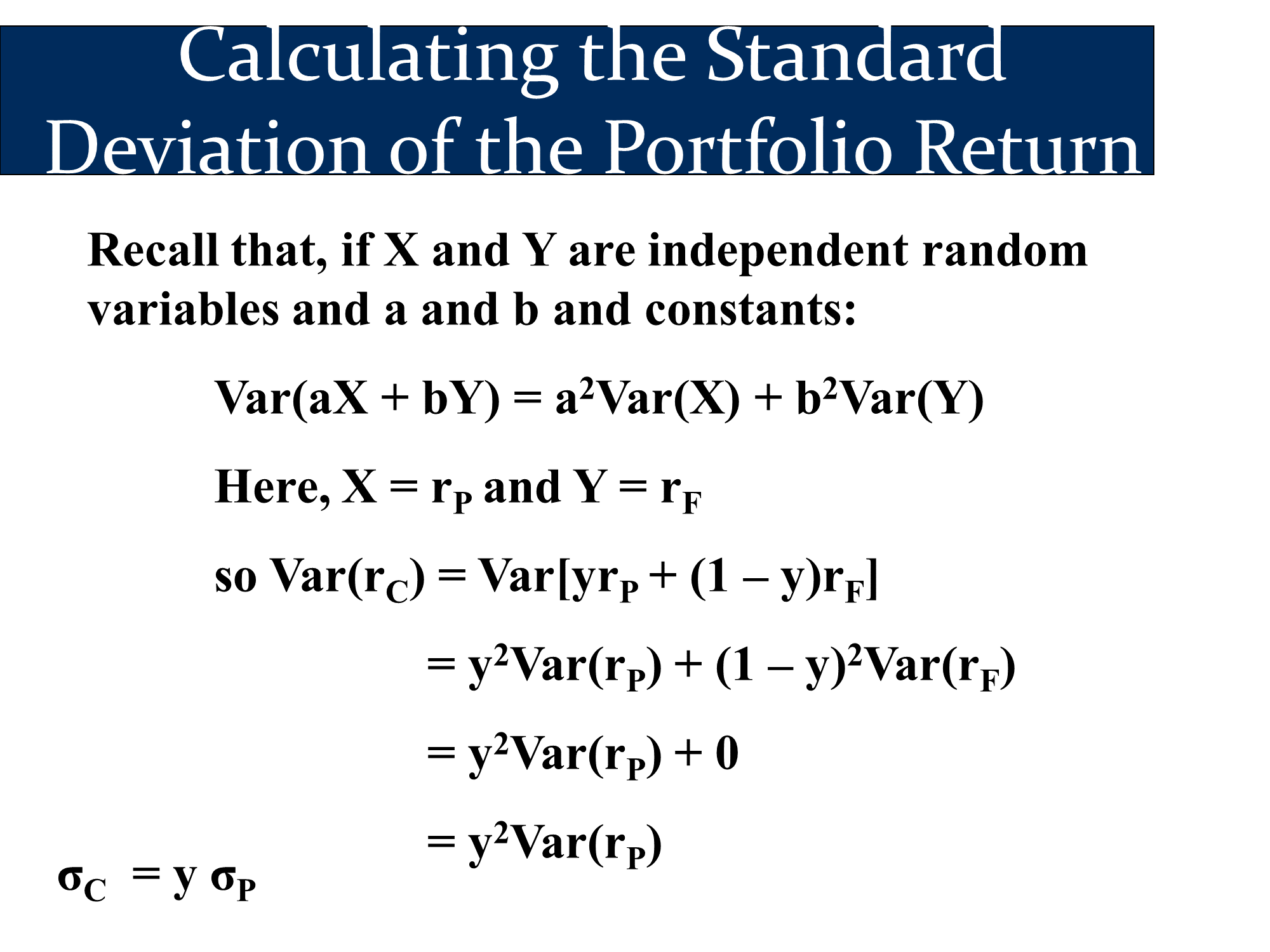

E(rC)=rF+y(E(rP)−rF)

or E(rc)=yE(rP)+(1−y)E(rF)

σC=yσP

Now, we have equations for combing two risky assets into a optimal risky portfolio:

E(rp)=w1E(r1)+w2E(r2)

σp=SQRT(σ12w12+σ22w22+2w1w2Cov(1,2))

Optimal Risky Portfolios & CAPM

| Name | Equation |

|---|

| Expected Return of 2+ risky assets | E(rp)=(Er1×w1)+(Er2×w2) … |

| If you have a target for E(rP) | w1=(E(r1)−E(r2))(E(rp)−E(r2)) → w2=1−w1 |

| Standard Deviation 2 risky assets | σp=SQRT(σ12w12+σ22w22+2w1w2Cov(1,2))

σp=SQRT(σ12w12+σ22w22+2w1w2σ1σ2ρ(1,2)) |

Standard Deviation 2 risky assets

(Spreadsheet-friendly formula) | σp=SQRT((σ12×w12)+(σ22×w22)+(2×w1×w2×Cov(1,2))

σp=SQRT((σ12×w12)+(σ22×w22)+(2×w1×w2×σ1×σ2×ρ(1,2))) |

| Standard Deviation 3 risky assets | =SQRT((σ12×w12)+(σ22×w22)+(σ32×w32)+

(2×w1×w2×Cov(1,2) + (2×w1×w3×Cov(1,3))+(2×w2×w3×Cov(2,3))) |

| Covariance (r1,r2) | = E[(r1−Er1)×(r2−Er2)] |

| Correlation Coefficient (ρ1,2) | ρ1,2=Covr1,r2)((σ1×σ2) → (ρ is between -1 and 1)

Cov(r1,r2)=σ1×σ2×ρ1,2 |

| Utility Function | U=E(r)−21Aσ2 |

| Capital Asset Pricing Model (CAPM) | ErP=rF+(B×(ErM−rF)) |

w1 = portion invested in asset 1

w2=(1−w1) = portion invested in asset 2

E = expected

r = return for asset

σ = Standard Deviation | ρ1,2 = correlation between assets 1 and 2

p = portfolio

rF = risk-free rate

β = Beta |