👨🏫 Notes

Formulas for this lecture can be found in the formula sheet.

Derivatives

There are two ways to use any Derivative:

- Hedging involves engaging in a financial transaction that reduces or eliminates risk (risk management)

- Speculation involves taking on risk because you hope to make a profit (trading)

Jargon:

- long position: an asset which is purchased or owned (now or in the future). You want the price to go up. You take a long position if you are bullish (expect the price to go up).

- short position: an asset which must be delivered to a third party as a future date, or an asset which is borrowed and sold, but must be replaced in the future. You want the price to go down. You take a short position if you are bearish (expect the price to go down).

Options

European Options-can be exercised only on the expiration date

American Options-can be exercised any time up to the expiration date

See answer

✔

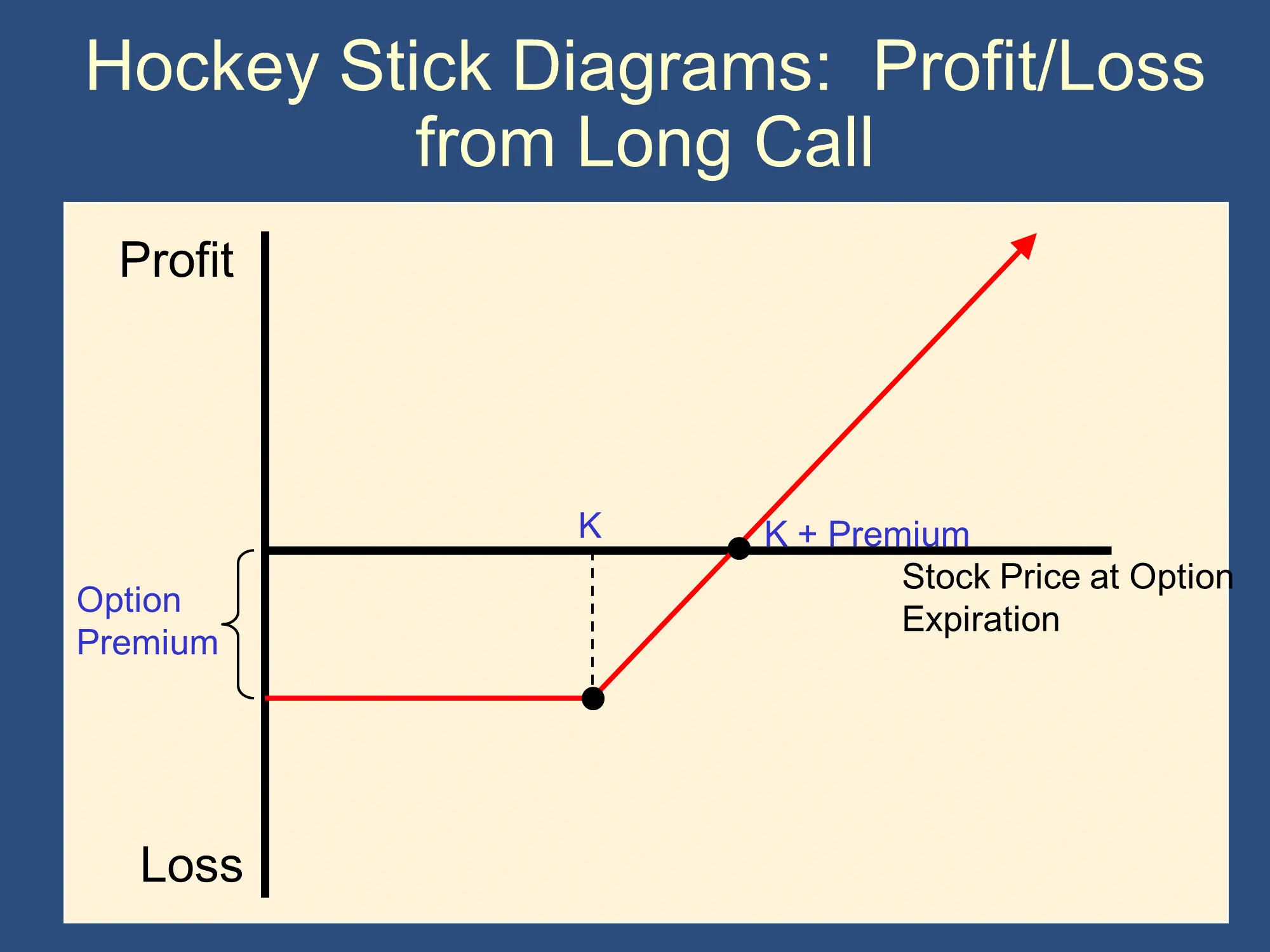

- You buy a call if you think the price will rise. There is unlimited upside, and limited downside. The only catch is that the premium will be high enough so that if you can’t outguess the market, you’ll lose money over time.

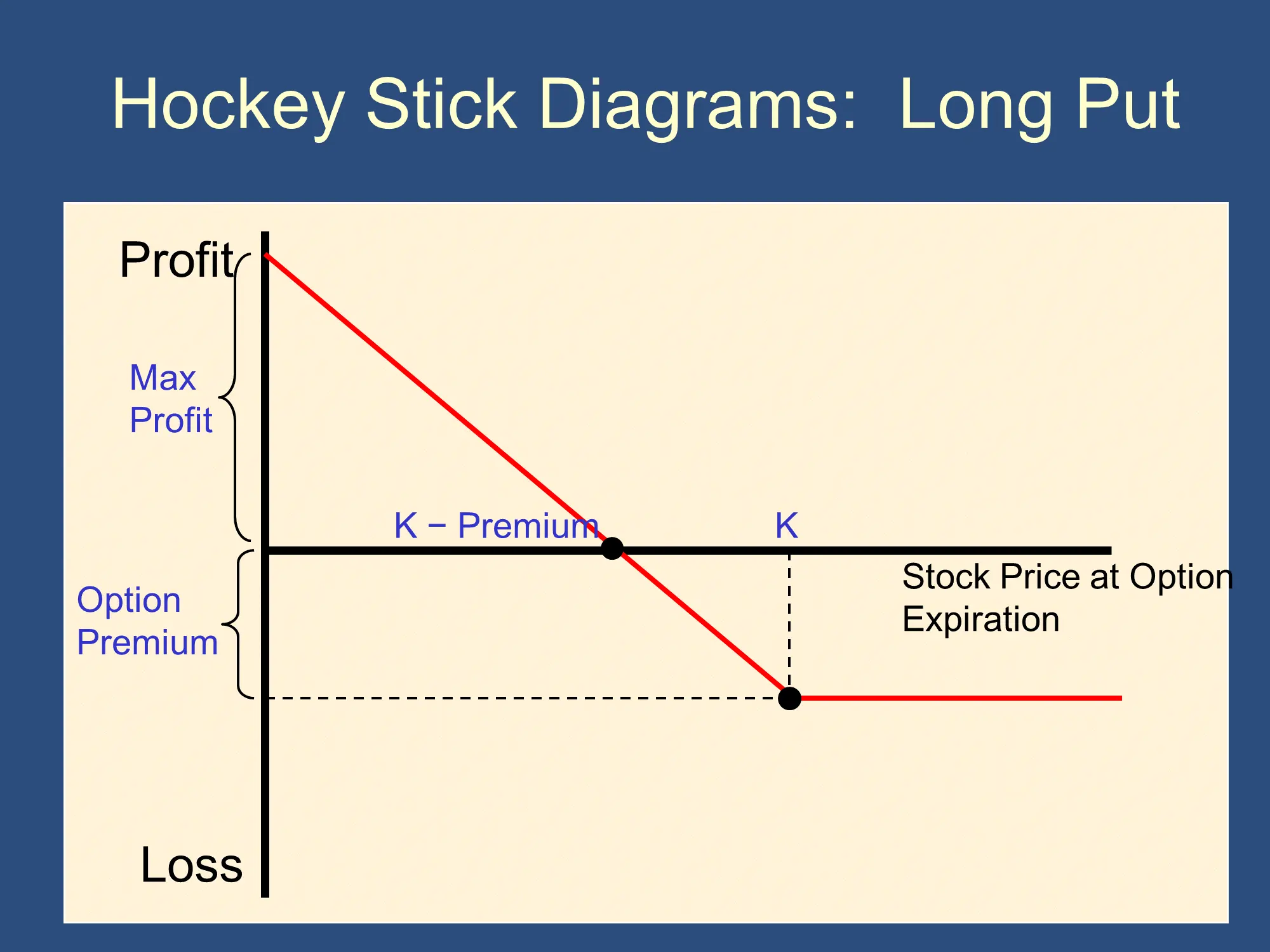

- You buy a put if you think the price will fall. Exactly like with buying a call, there is unlimited upside, and limited downside. The only catch is that the premium will be high enough so that if you can’t outguess the market, you’ll lose money over time.

- In general, only professionals with sophisticated data and hedging software should be selling calls or puts (short call or short put). It’s very dangerous. However, there is an argument that if you have a stock, you may be able to make some money by selling a call. This is known as a covered call.

Jargon:

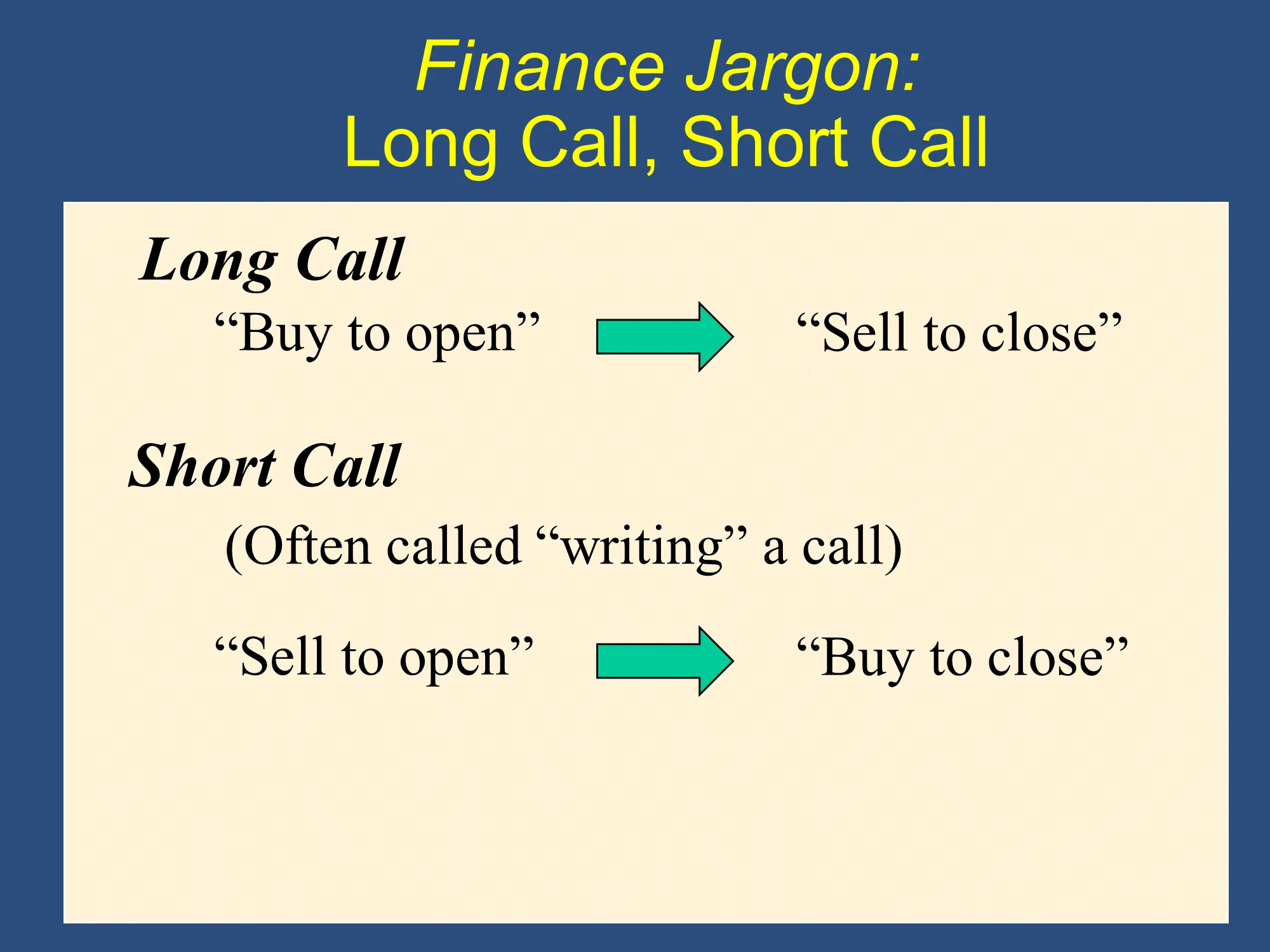

- “Long call” refers to when you buy a call

- ”Short call” refers to when you sell a call. This is also known as “writing a call"

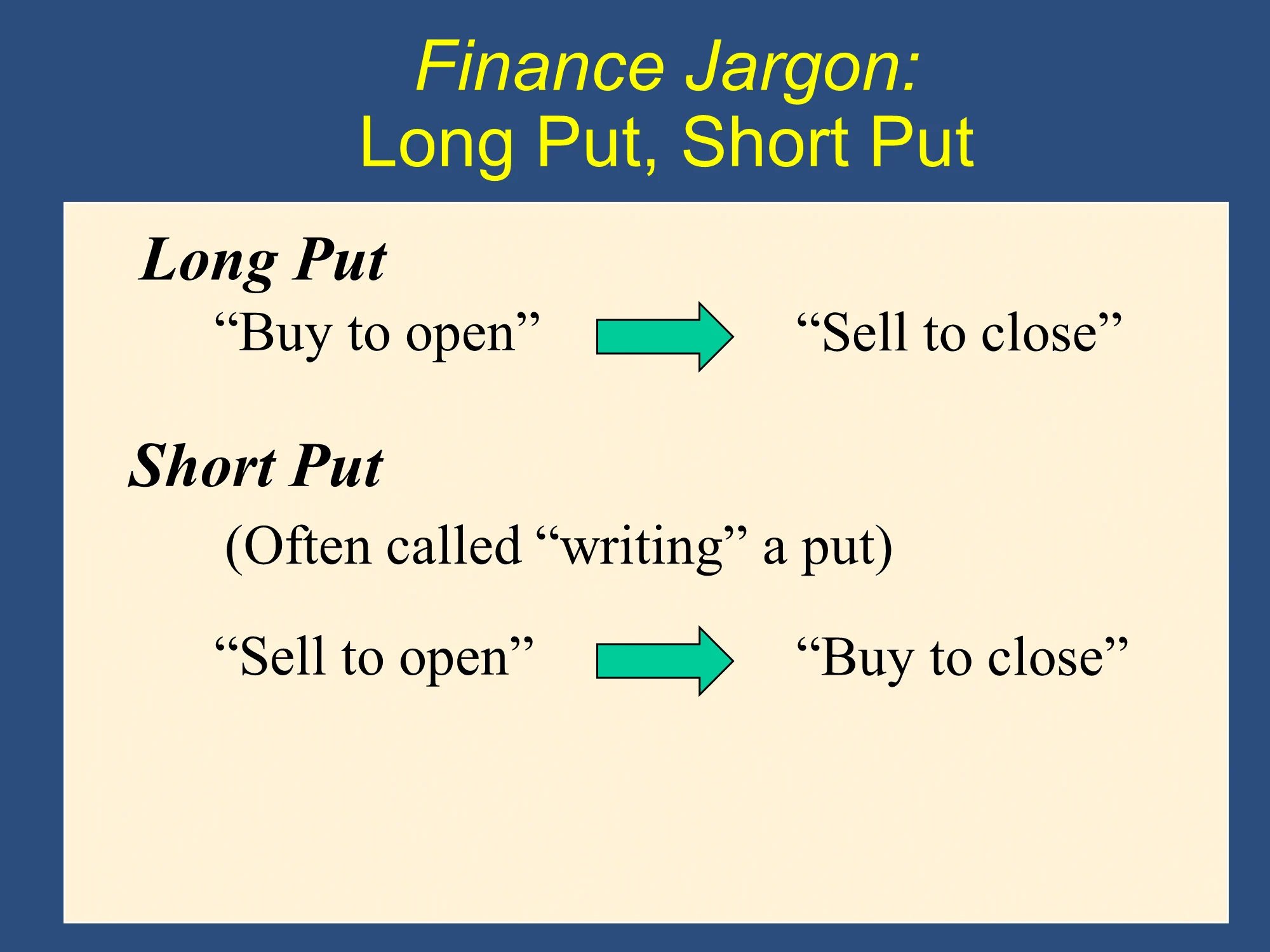

- "Long put” refers to when you buy a put

- ”Short put” refers to when you sell a put. This is also known as “writing a put” In other words, “long” means buying the option and “short” or “writing” means selling the option. It’s as simple as that! (Don’t let yourself overthink it.)

Calls and Puts

| Option Buyer (Long) | Option Seller/Writer (Short) | |

Call | A Long Call is: | A Short Call is: |

Put

If exercised: | A Long Put is: | A Short Put is: |

Call and Put | Buyer/Long always chooses whether to exercise, but always pays premium.  (Tina) | Seller/Writer/Short is obligated to abide by the buyer’s choice, but always receives premium.  (Jeff [Bridges/Lebowski]) Very risky. |

🙋♂️ Learning the summary table cold was the best start.

Call

- Etymology: A long call can “call” the stock over and buy it.

- You should think of the call buyer and the call writer as a pair. If the buyer of the call has the right to buy the stock, there must be someone lined up who well sell the shares to them. That person is the call writer. The buyer of the call can only buy the shares because the writer of the call is obligated to sell the shares to them.

- IV = Max(S-K, $0)

- If S>K, the call is in the money and call buyer will exercise it.

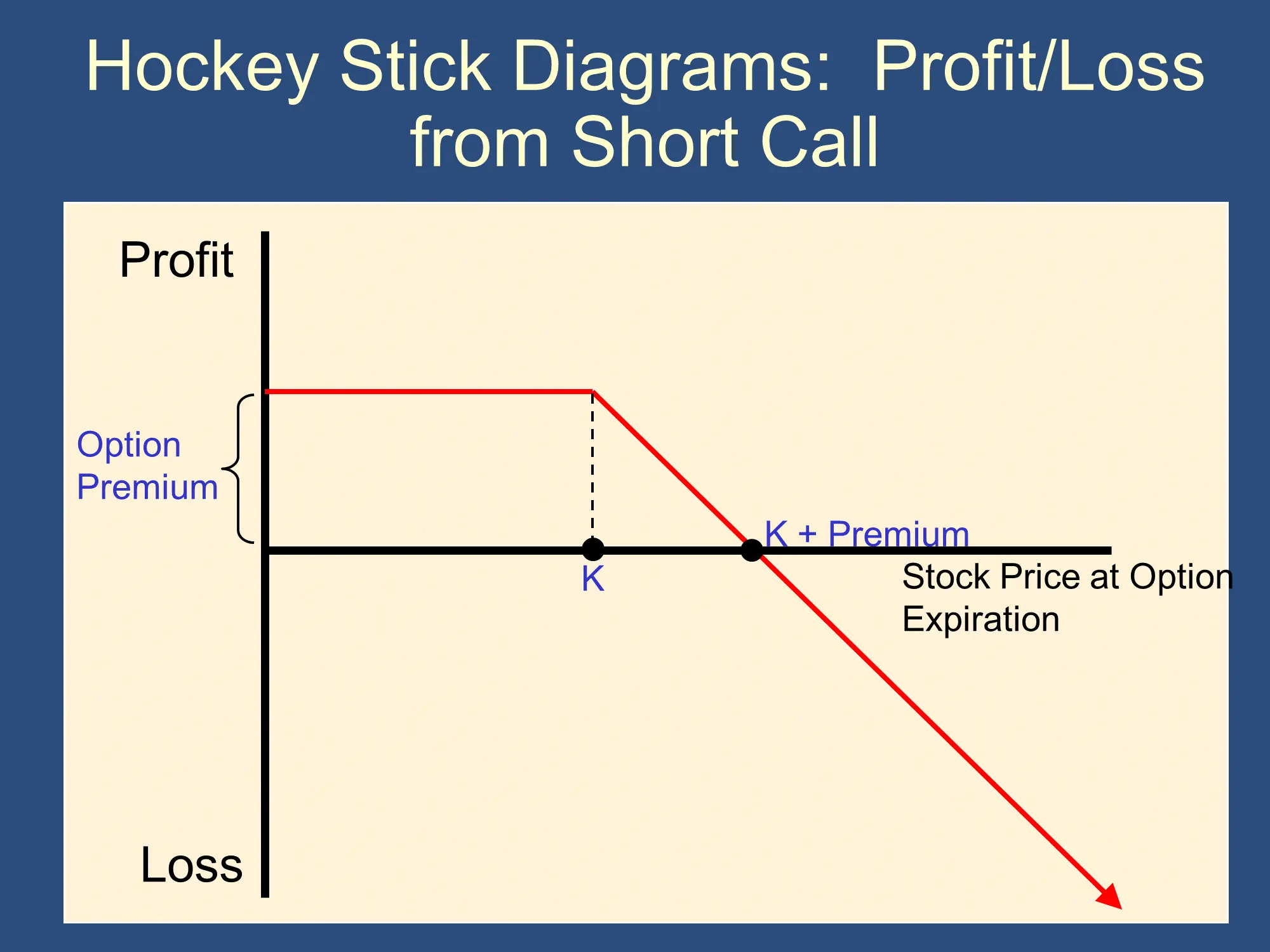

- If S>K+Prem, call buyer profits and call writer loses money.

- If S<K+Prem, call buyer loses money and call writer profits.

- Once S>K, the higher S goes, the better it is for the call buyer and the worse it is for the call seller.

Put

- Etymology: A long put can “put” the stock out in the market to sell it.

- You should think of the put buyer and the put writer as a pair. If the buyer of the put has the right to sell the stock, there must be someone lined up who well buy the shares from them. That person is the put writer. The buyer of the put can only sell the shares because the writer of the put is obligated to buy the shares from them.

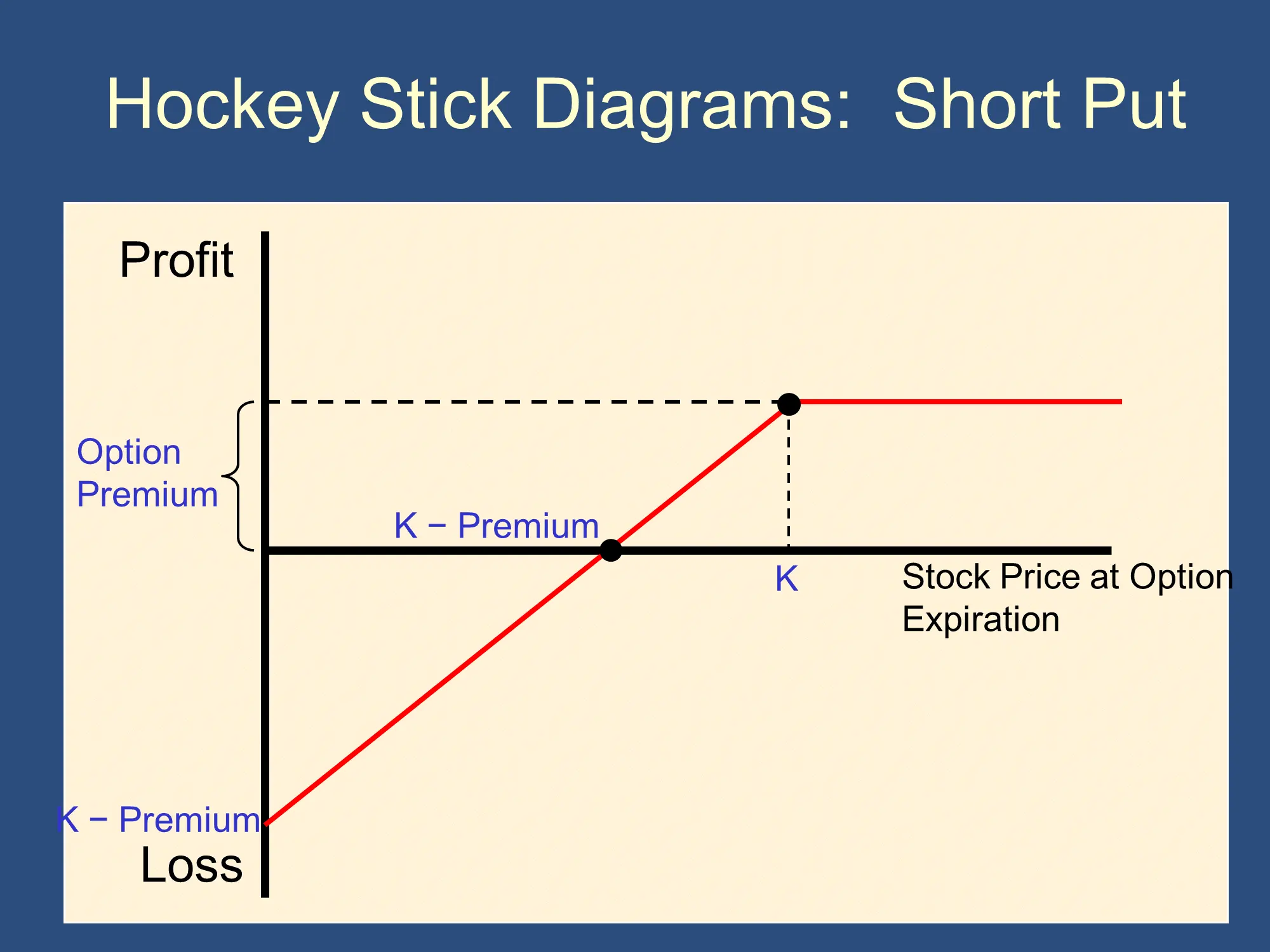

- If S<K, the put is in the money and put buyer will exercise it.

- If S<K-Prem, put buyer profits and put seller loses money.

- If S>K-Prem, put buyer loses money and put seller profits.

- Once S<K, the lower S goes, the better it is for the put buyer and the worse it is for the put seller.

Jargon: The Short Call is the counterparty to the Long Call and the Long Call is the counterparty to the Short Call.

Most common reasons to transact options

People buy call options to make bets that stock prices will rise.

People buy put options to make bets that stock prices will fall or if they own stock to lock in a price they can sell at.

Intrinsic Value Formulas:

IV tells you the profit (ignoring premium) to the LONG party. It is how much they can ‘rip off’ their counterparty.

Basic Profit and Loss formulas:

(for either call or put)

If you buy an option (call or put) you pay the premium but gets the Intrinsic Value

(for either call or put)

If you sell an option (call or put) you receive the premium but lose the Intrinsic Value

If we combine the above:

P/L from Buying a Call =

P/L from Buying a Put =

P/L from Selling a Call =

P/L from Selling a Put =

Time Value

An option’s premium can be broken down into TV and IV

Intinsic value is the money you can make by exercising the option immediately.

Time value ≥0 is the extra value you get from not having to decide whether to exercise the option right now.

Table of Hockey Sticks

Bullish = you think that the stock price will rise, so you bet S will be high.

Bearish = you think that the stock price will fall, so you bet S will be low.

Long Call  | Long Put  |

(Naked) Short Call  | Short Put  |

✏️ Can you use the hockey stick diagram to explain the following “When to use each” list?

When to use each:

Use a long call if you like the stock and expect S↑.

Unlimited gains if S↑. You can only lose Prem if S↓

Use a long put if you dislike the stock and expect it’s price to fall.

Very large gains if S↓. You can only lose Prem if S↑

Naked short calls are risky and best for professional market makers

Naked call: Unlimited losses if S↑. You only gain Prem if S↓.

If you own the stock, you can make some income with a covered call, but it is very similar to a Short Put in some ways.*

Short puts are very risky and best for professional market makers

Very large losses if S↓. You only gain prem if S↑

✔ Click here to view answer

Just look for whether the red line is above or below the axis to the left and right of the strike price, K.

Covered Call - You own the stock and sell a call. If the S>K, then your counterparty will exercise the call and you will sell the shares for only $K. If S<K, then you keep the shares, but they will be worth less. Either way, you get to keep the premium.

Jargon reference

Jargon is the same for puts and calls. You Buy to open a long position and Sell to open a short position. You do the opposite to close your position.

Calls  | Puts  |

| Position | Buy or Sell Underlying Stock? | Who decides? | Intrinsic Value | Profit or Loss |

| Buy/Long a Call | Buy | You | ||

| Sell/Short a Call | Sell | Counter-party | ||

| Buy/Long a Put | Sell | You | ||

| Sell/Short a Put | Buy | Counter-party |

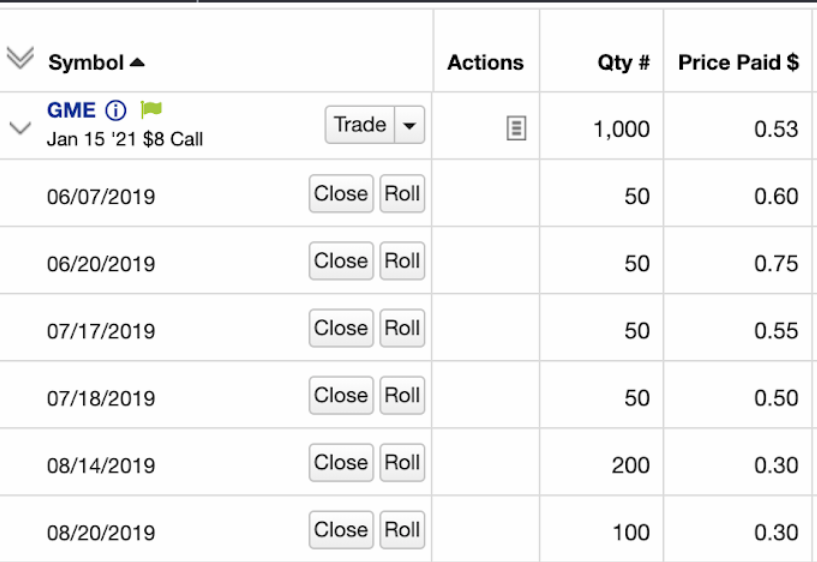

✏️ Suppose Keith likes Gamestop and believes in its future. On August 14th, 2019, Gamestop stock, GME, closed at $3.32. Suppose Keith purchased 200 out of the money GME call options with a strike price of $8 for a premium of $.30 each (ie $.30 per share). What would his profit or loss be, based on the stock price at expiration (S)? Fill in the following table:

| S | P/L |

| $1 | |

| $3 | |

| $5 | |

| $7 | |

| $9 |

✔ Click here to view answer

This will be easier if we fill out the intrinsic values along the way:

| S | P/L | IV/Gain/Ripoff | Explanation |

|---|---|---|---|

| $1 | -$0.30 | $0 |

You have the option to buy something worth S=$1 |

| $3 | -$0.30 | $0 |

|

| $5 | -$0.30 | $0 |

|

| $7 | -$0.30 | $0 |

|

| $9 | +$0.70 | $1 |

|

| This example is inspired by the actual posted brokerage statements that helped inspire the 2020 Gamestop rally. Keith Gill posted them testified before congress about his experience. Here are the statements. We will be investigating the penultimate row in the following screenshot:  Underlying Gamestop stock price:   |

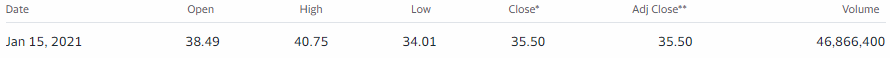

✏️ The options expired on Jan 15, 2021. The actual stock price at expiration was S=$35.50. What would Keith’s actual P/L be if he held the options to expiration and they expired at S=$35.50? Recall, he purchased 200 contracts. How much did he pay for those 200 contracts. What was his return on the money that he invested?

✔ Click here to view answer

| S | P/L | IV/Gain/Ripoff | Explanation |

|---|---|---|---|

| $35.50 | $27.20 | $0 |

|

Keith makes $27.20 per share.

There are 100 shares in the contract, so per contract he makes

Based on the published alleged brokerage statements, he purchases 200 contract on April 14, 2019, and, in total, he could have made .

His initial investment was per contract and in total.

His return is profit/investment = or 90.6x. He might refer to this investment as a “91-bagger,” meaning his profit was 91 times his initial investment.

✏️ Whenever someone buys a call, someone else must be selling the call. For Keith Gill, it was other speculators. Famously, there were also hedge funds betting against Gamestop because it is a bricks and mortar retailer and that sector is shrinking. Melvin Capital famously had very large losses on Gamestop.

Let’s assume that on August 14th, 2019, a trader named Melvin sold the 200 $8 GME calls to Keith Gill. Suppose also that Melvin kept that position until the contracts expired. What would Melvin’s P/L be?

✔ Click here to view answer

In all derivatives contracts, one party’s gain is the other party’s loss. Therefore, Melvin’s P/L would be the exact opposite of Keith’s. From above, we have the following formulas:

Above, we calculated the following:

| S | Keith’s P/L | IV = Amount that Keith Ripped Melvin Off By |

|---|---|---|

| $1 | -$0.30 | $0 |

| $3 | -$0.30 | $0 |

| $5 | -$0.30 | $0 |

| $7 | -$0.30 | $0 |

| $9 | +$0.70 | $1 |

| $35.50 | $27.20 | $27.50 |

Let’s reuse the IV column and use our two formulas from above:

| S | IV = Amount that Kevin Ripped Melvin Off by | P/L for Keith | P/L for Melvin |

|---|---|---|---|

| $1 | $0 | $0-$.30=-$0.30 | |

| $3 | $0 | ||

| $5 | $0 | ||

| $7 | $0 | ||

| $9 | $1 | ||

| What actually happened: S=$35.50 | $27.50 |

|

|

✏️ Suppose that Keith had purchased puts. What would his P/L be? Assume that K=$8 and premium = $5. (Don’t worry about why I chose such a high premium. However, if you are interested, here is an explanation:

YOU ARE NOT RESPONSIBLE FOR THIS:

Here is how you could estimate a premium of $5:

GME was selling for $3.32 on August 14th, 2019.

Therefore, on 2019,

. I estimated a time value of $0.32.

)

✔ Click here to view answer

Calculating P/L for puts is almost identical to calculating P/L for calls. The only difference is that the formula for IV is instead of . Basically, you just use K-S instead of S-K because the Long Call sells the stock for $K instead of buying it. The long call “gets paid $K but gives up the stock worth $S” (K-S).

| S | P/L | IV/Gain/Ripoff | Explanation |

|---|---|---|---|

| $1 | $7 | ||

| $3 | $5 | ||

| $5 | $3 | ||

| $7 | $1 | ||

| $9 | $0 |

|

✏️ Suppose that Melvin had sold puts. What would his be? Assume that K=$8 and premium = $5.

✔ Click here to view answer

Once again, we use the IVs we previously calculated:

| S | IV/Gain/Ripoff | P/L for Keith | P/L for Melvin |

|---|---|---|---|

| $1 | $7 | ||

| $3 | $5 | ||

| $5 | $3 | ||

| $7 | $1 | ||

| $9 | $0 |