👨🏫 Notes

For clarity, I have tried to distinguish between text taken directly from Bruce’s slides and my own commentary on that material. If you see the word “Slide:” it is a slide. If you see the word “Commentary:” it is my commentary.

Outline:

- Arbitrage

- Efficient Markets Hypothesis (EMH)

- Three Forms

- Theoretical Foundations

- Empirical Foundations

- Empirical Challenges

- Theoretical Challenges

- Behavioral Finance

- Two Foundations of Behavioral Theory

Theoretical Foundations of EMH

EMH presumes that every security has a true value.

If a security sells for less than its true value, “arbitrageurs” can buy the security and make a profit.

As a result a result of the arbitrageurs purchasing the security, the price of the security will rise until it’s no longer underpriced - ie until it’s price reflects its true value.

Conversely, if a security is overpriced (ie you can sell it short and make a profit), this will drive it’s price down to its fair/intrinsic value.

We imagine that everyone can calculate the intrinsic value in the way that German described learning about in his business valuation course.

Arbitrageurs make money by “riding the price up.”

We are all arbitrageurs when buy stocks, so we all make the stock price more efficient. Whenever you do stock analysis and correctly identify that a stock is underpriced. If you buy it, you raise the price, incorporating your individual perspective and insights into the market price. This is what we mean when we say that according to EMH, the market price incorporates all available information.

Markets are efficient because people like us are trying to make money and collectively we are very smart.

EMH suggests that at any given time, the market price of a security must reflect all available information about the true intrinsic value of the security. In other words, the security won’t be mispriced. … or, at least, it won’t be mispriced based on the market’s best guess of the security’s fair value, given all of the available information.

Because the price is determined by the available information, the price can’t change unless the available information changes.

Therefore, the price will only change when new unanticipated information arrives. If a new announcement is anticipated, it won’t change the stock price, because it will already have been incorporated into the stock price. Therefore, only unanticipated new information will move the stock price.

If we knew that the information would be positive, then we have anticipated something. Therefore, the new stock price changes must be equally likely to be positive or negative.

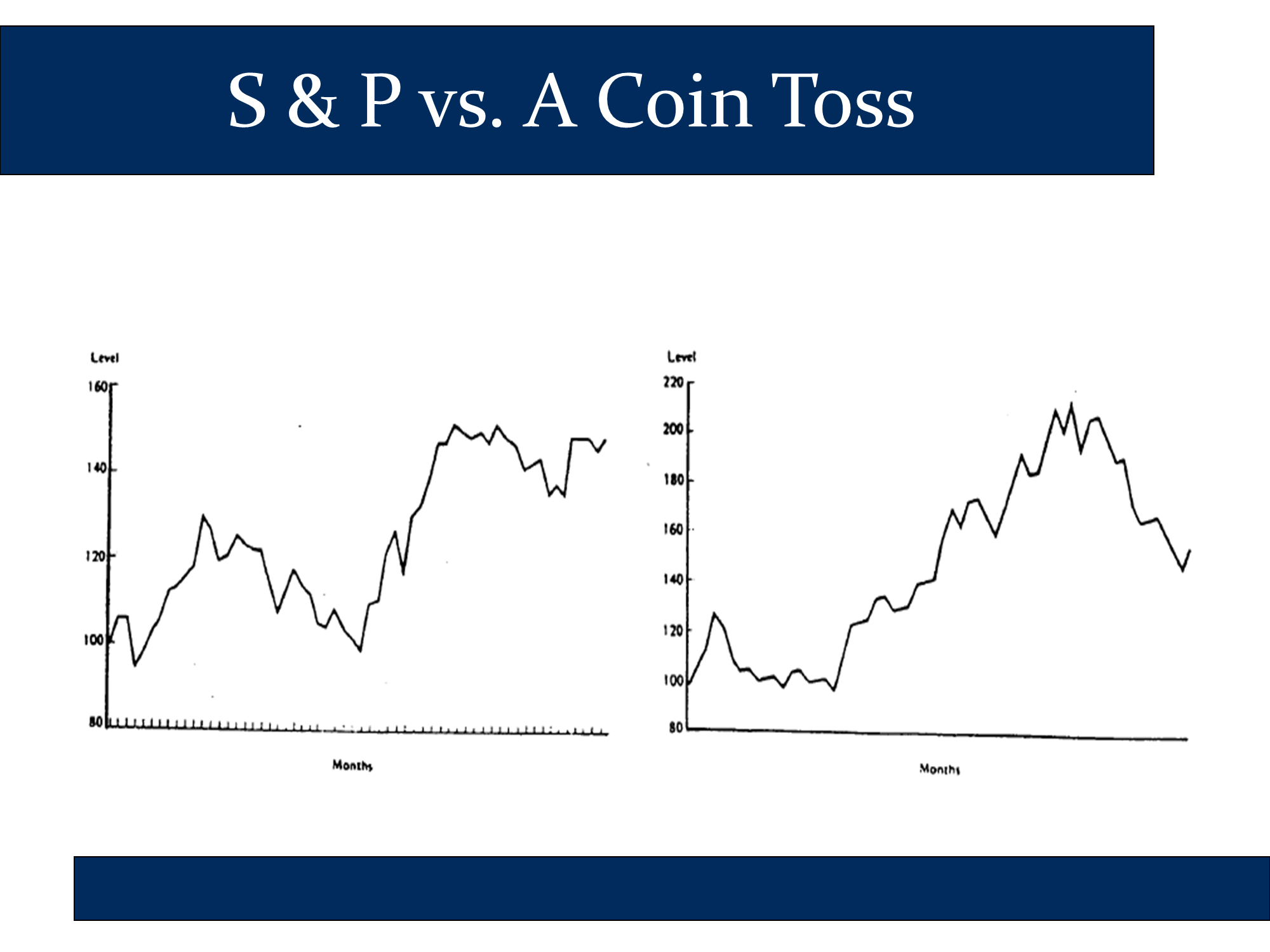

If you have a stock price that is just as likely to go up as to go down, this is known as a “random walk.” It’s completely random whether the stock price walks “up” or walks down.

Mathematicians often describe a random walk as how a drunk person would walk. Either to the left or to the right. No one knows in advance; it’s hard to predict.

The data suggests that there are many significant ways in which stock prices resemble a random walk.

Commentary:

Bruce introduces the Law of One Price to Introduce “Spatial Arbitrage,” and then he uses “Spatial Arbitrage” to introduce arbitrage over time. It is arbitrage over time that leads to the EMH.

Law of One Price = the same security can’t sell for different prices on different exchanges, spatially far from each other.

Arbitrage = finding a riskless way to make a profit*

* Caveat: when discussing arbitrage in EMH, sometimes we discuss risky strategies. As such, arbitrage basically means using you brain to make money.

While the law of one price isn’t always completely true (to the penny), it is very close to true because of arbitrageurs:

- Suppose the same security sold for different prices on different, spatially separated markets, at the same time.

- Traders would buy the security for the lower price on one market and sell it for the higher price on another market, making a quick and low risk profit. These traders are known as arbitrageurs.

- By buying the security on the lower priced market, they drive the price up there. By selling it on the higher price market, the drive the price down there. This continues until the two prices are equal.

The exact same logic applies when you can perfectly predict a future price. Arbitrageurs would trade so that, almost immediately, the perfect prediction of the future stock price will be incorporated into the current stock price.

EMH says that the arbitrageurs are so effective that their activity immediately incorporates all available information into the security’s current price.

As a result of this, the security’s price will only change when new information arrives (after all, the stock price is just a reflection of the “true value” of the security). (Defenders of EMH say that if people’s “risk attitudes” change, then stock prices might change dramatically. For example, during the financial crisis, risk attitudes dropped precipitously.)

Therefore, the security price will follow a “random walk.”

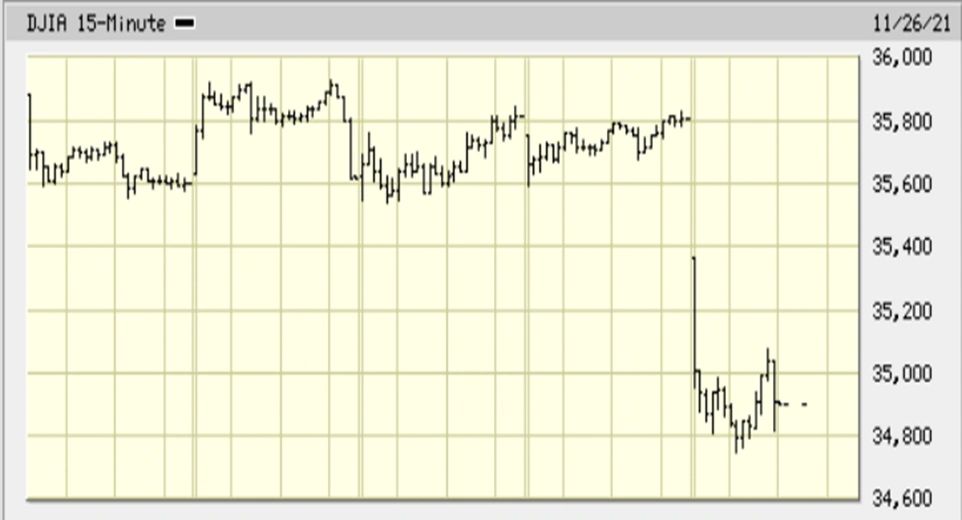

Dow Jones Industrial Average, 11/19/21 - 11/26/21:

Slide:

- Maurice Kendall (1953) found no predictable pattern in stock price changes.

- Prices are as likely to go up as to go down on any particular day.

- How do we explain random stock price changes?

Slide:

- EMH says stock prices already reflect all available information

- A forecast about favorable future performance leads to favorable current performance, as market participants rush to trade on new information.

- Result: Prices change until expected returns are exactly commensurate with risk.

Commentary:

Returns are exactly commensurate with risk means that:

you can earn an expected return equal to the market.

In fact, if you purchase riskier stocks, you can get an above-market return.

It just says that there is no free money.

Grossman Stiglitz: ❔EMH FAQ (Frequently Asked Questions)

The smartest people can earn risk-adjusted returns above the market. Of course they could also use their talents to make money in other ways.

Even normal people can earn risk-adjusted returns above the market if they put effort into it. However, these high returns will only just compensate them for the effort that they put in.

Slide:

- New information is unpredictable; if it could be predicted, then the prediction would be part of today’s information.

- Stock prices that change in response to new (unpredictable) information also must move unpredictably.

- Stock price changes follow a random walk.

Slide:

Law of One Price ⇒ Arbitrage ⇒ EMH ⇒ Stock prices follow a random walk ⇒ Best estimate of a stock’s future value is its value today

Commentary:

- Because we can’t predict what new information will arrive going forward, the best estimate of the security’s future value is its value today.

Slide:

Say there are 3 possible prices a stock can be at on the first of next month:

12 | 18 | 24

- The probability of each price is

- What will the stock sell for today?

- It will sell for its expected value:

Commentary:

- Given the uncertainty related to securities prices, when we refer to a stock’s future price we mean Expected Value.

Slide:

- Weak form: Past prices cannot help you predict future prices

- Semi-strong form: No publicly available information can help you predict future prices

- Strong form: No public or private information can help you predict future prices

Commentary:

- Strong Form implies Semi-strong, which implies the weak form.

- Weak form means you can’t earn excess returns using Technical analysis

- excess returns = returns above those “commensurate with the risk” you are taking, as discussed above.

- Semi-strong form means you can’t earn excess returns using Fundamental analysis

Slides:

- Technical Analysis - using prices and volume information to predict future prices

- Success depends on a sluggish response of stock prices to fundamental supply-and-demand factors.

- Weak form efficiency

- Relative strength

- Resistance levels

- Fundamental Analysis - using economic and accounting information to predict stock prices

- Try to find firms that are better than everyone else’s estimate.

- Try to find poorly run firms that are not as bad as the market thinks.

- Semi strong form efficiency and fundamental analysis

”Three Lines of Defense for the EMH from theory”

Bruce provides “Three Lines of Defense” used to defend EMH. These are called “Theoretical Foundations” because they are logical and mathematical arguments.

Slide: The Three Lines of Defense:

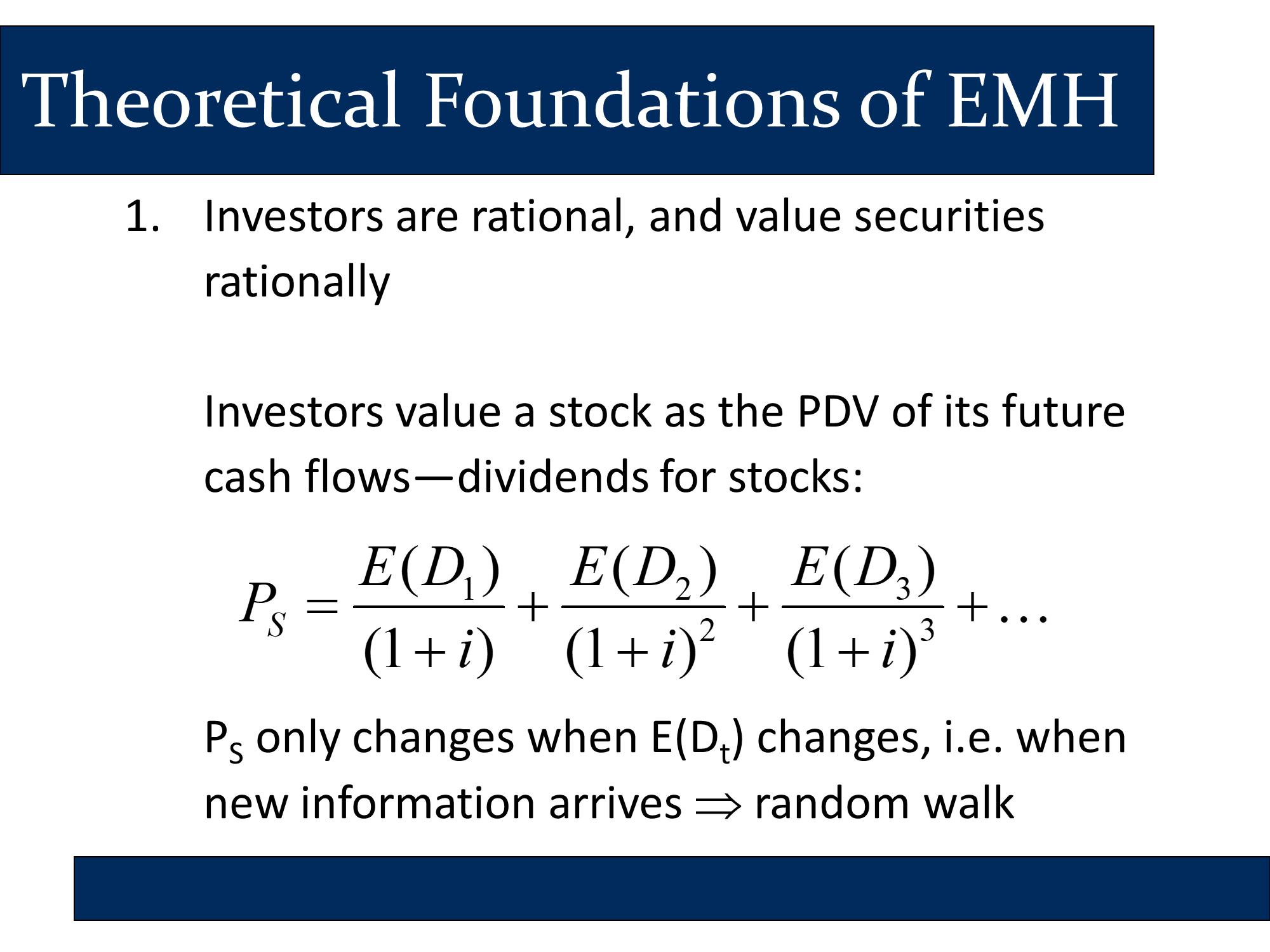

- Investors are rational, and value securities rationally

- Any trades made by irrational investors (called “noise traders”) cancel each other out, assuming their trading strategies are uncorrelated

- Even when irrational investors’ trades are correlated, rational arbitrageurs can eliminate the deviation of prices from fundamental values

Commentary:

- The first line of defense establishes an idealized price (described below) based on EV and PDV of future dividends. It says that because individual investors are rational, the market price will match this true, idealized price.

- The second line of defense says that the market price will match this true, idealized price because even though people can be somewhat irrational, their biases are uncorrelated, so the biases will cancel each other out.

- The third line of defense says that even if most investors are absolute idiots and their idiocy is correlated with each other, super smart hedge fund investors can make money betting against them and thereby bring the market price back to this true, idealized price. [While the super-smart, rational hedge fund managers will bring some additional rationality to the market, I suspect the effect is quite small]

The first line of defense is that “Investors are rational, and value securities rationally.” What does it mean to value securities rationally?

Slide:

- Investors value a stock as the PDV of its future cash flows - dividends for stocks:

- only changes when changes, i.e. when new information arrives ⇒ random walk

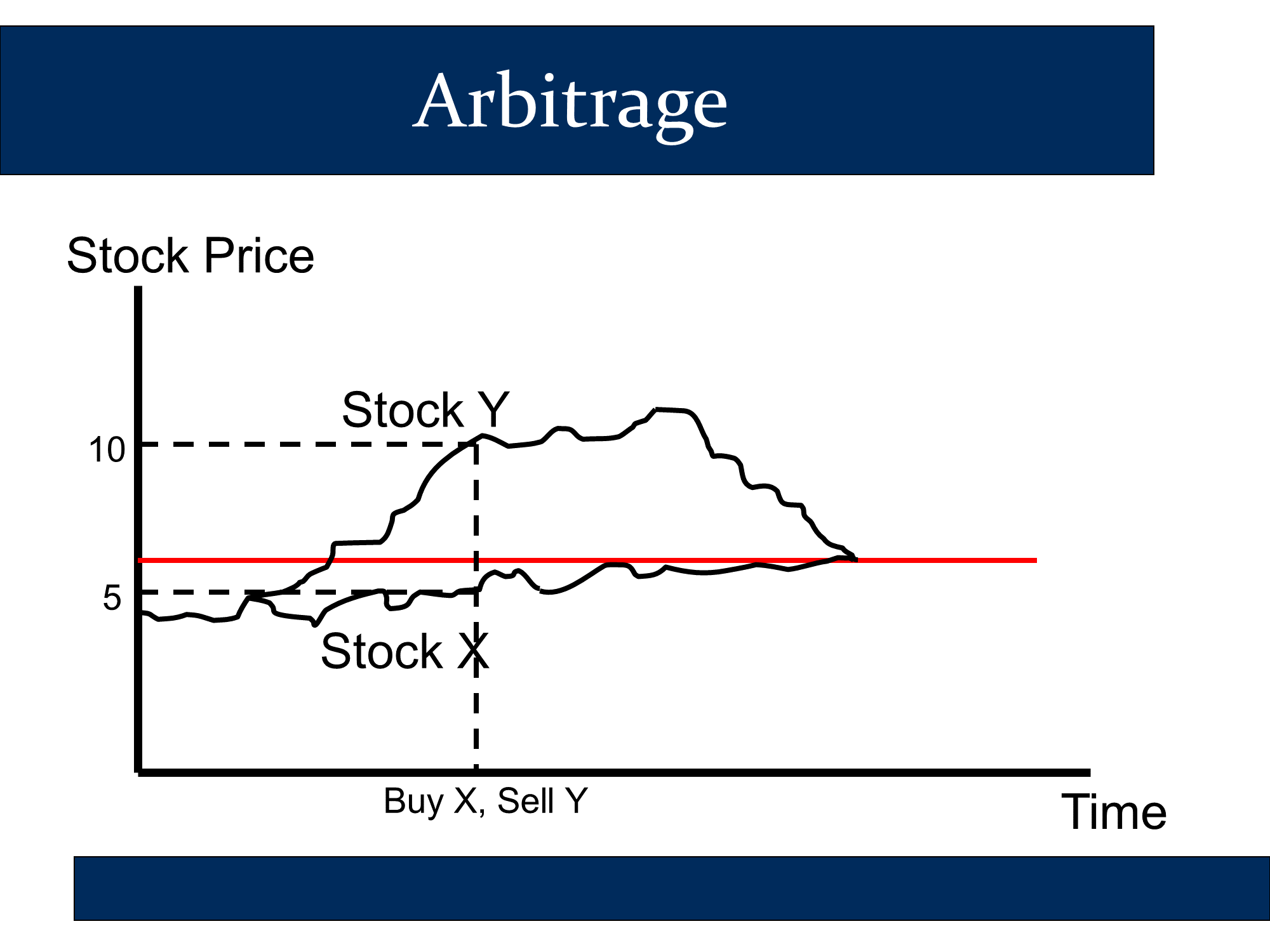

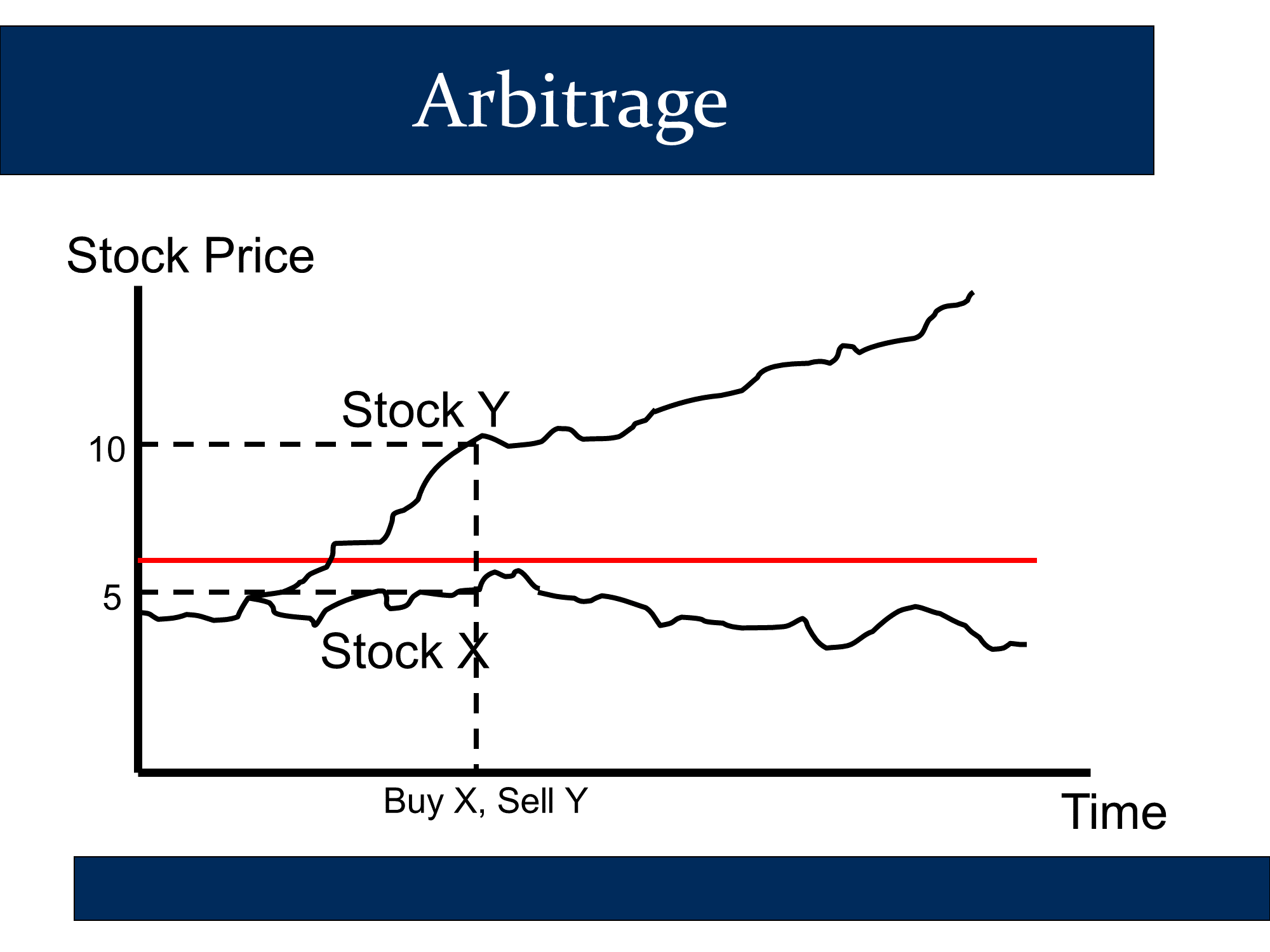

The third line of defense assumes that the following graph will be accurate. However, it doesn’t always happen that way, so arbitrage is risky, as we will see below.

If two securities should, theoretically, have the same price, arbitrage profits can be made by betting that they will converge to the same price. Sometimes they do (like on the left). Sometimes they don’t (like on the right). As a result, arbitrage can be very risky, and I don’t put much stock in the third line of defense, above.

Arbitrage is safe if this always happens fairly quickly.  | Because this often happens, arbitrage can be very risky.  |

|---|

Empirical approaches (Evidence)

Slide:

- News is incorporated into a stock’s price very quickly and correctly

⇒ prices don’t overreact or underreact

⇒ there should be no price trend after a news announcement - Implication: “Stale” information is worthless in trying to make money.

- What does “making money” mean? A return higher than the market average.

- Applies to weak, semi-strong and strong forms of EMH

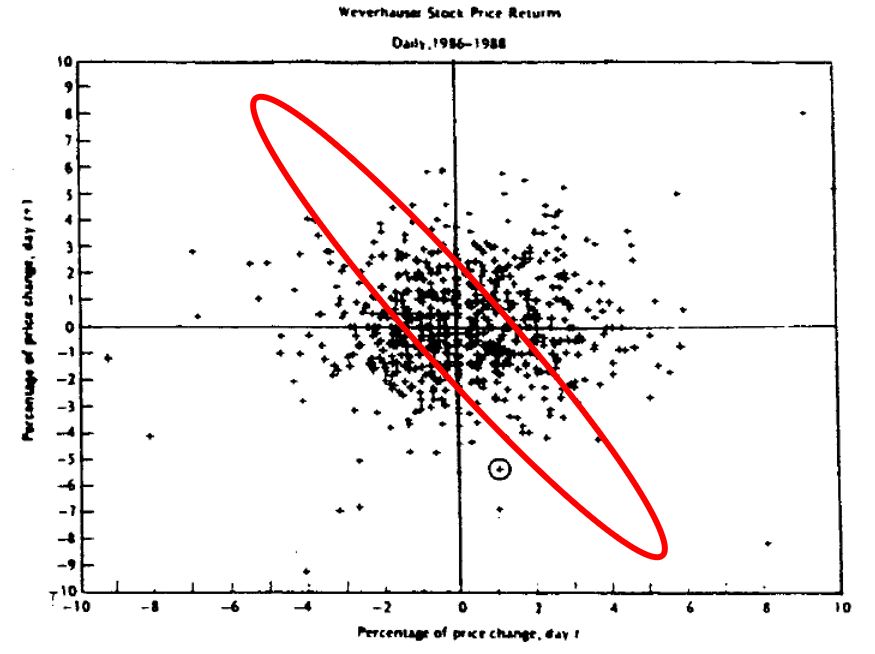

Evidence on the Weak Form

Slide:

In some tests, stock prices do follow a random walk:

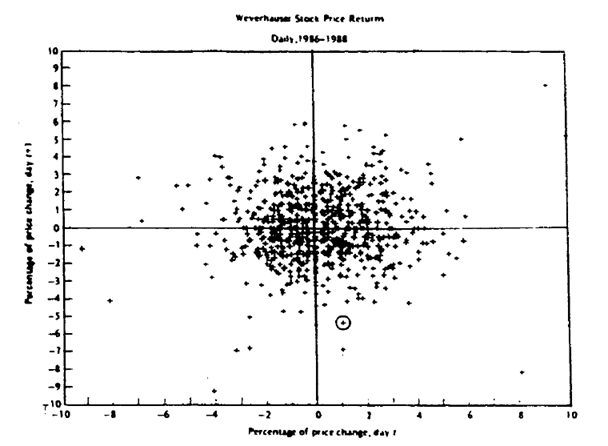

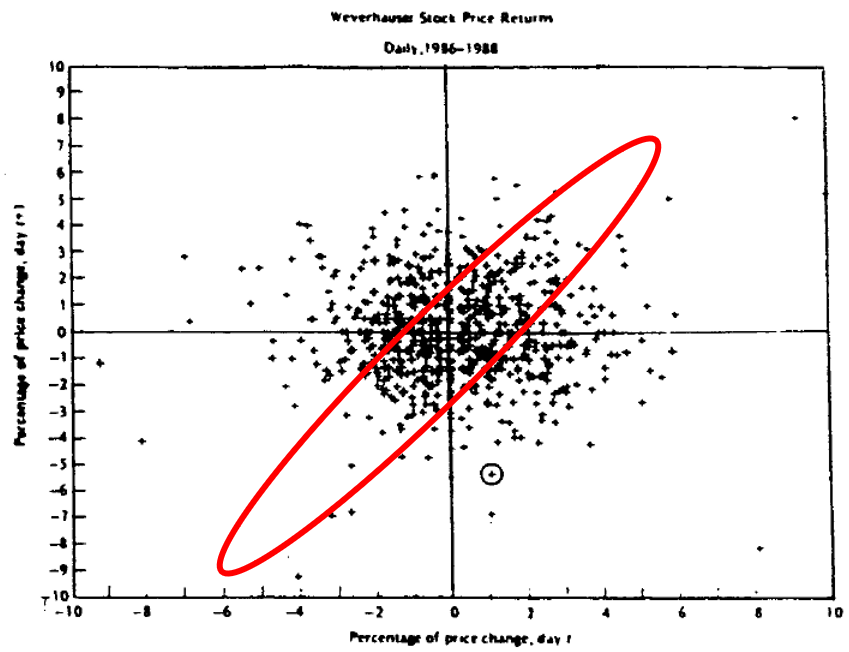

If stocks exhibit “momentum,” then we might expect that there would be a positive correlation between the return on a stock today and the return on a stock tomorrow. We don’t generally see this type of correlation.

Slides:

What we should see if price movements are positively correlated:

What we should see if price movements are negatively correlated:

This illustrates how, if it is easy to make excess returns using a specific strategy, various traders will incorporate that strategy until it no longer leads to excess returns.

means that we can break today’s return down into a basic outperformance (a, which is essentially the alpha of the stock), an exposure to the wider market return (b, like from the CAPM, indicates our exposure to the broader market return ), and an unpredictable error term.

In fact, the error term is defined as

Anomalies:

The above slide is in dialogue with the following one:

Human beings compute the Expected values and can be irrational when they are afraid (ie they may not process information correctly - this may lead to incorrect probability distributions when calculating Expected Values).

When the fear index (VIX) goes up, they may make suboptimal decisions, based on their behavioral biases. Suddenly, for example, they may use a higher discount factor, i, when calculating their PDVs.

A comprehensive perspective on financial markets.

More or less securities prices are somewhat rational ← EMH

But be greedy when others are fearful and fearful when others are greedy. ← be sure to add in some behavioral