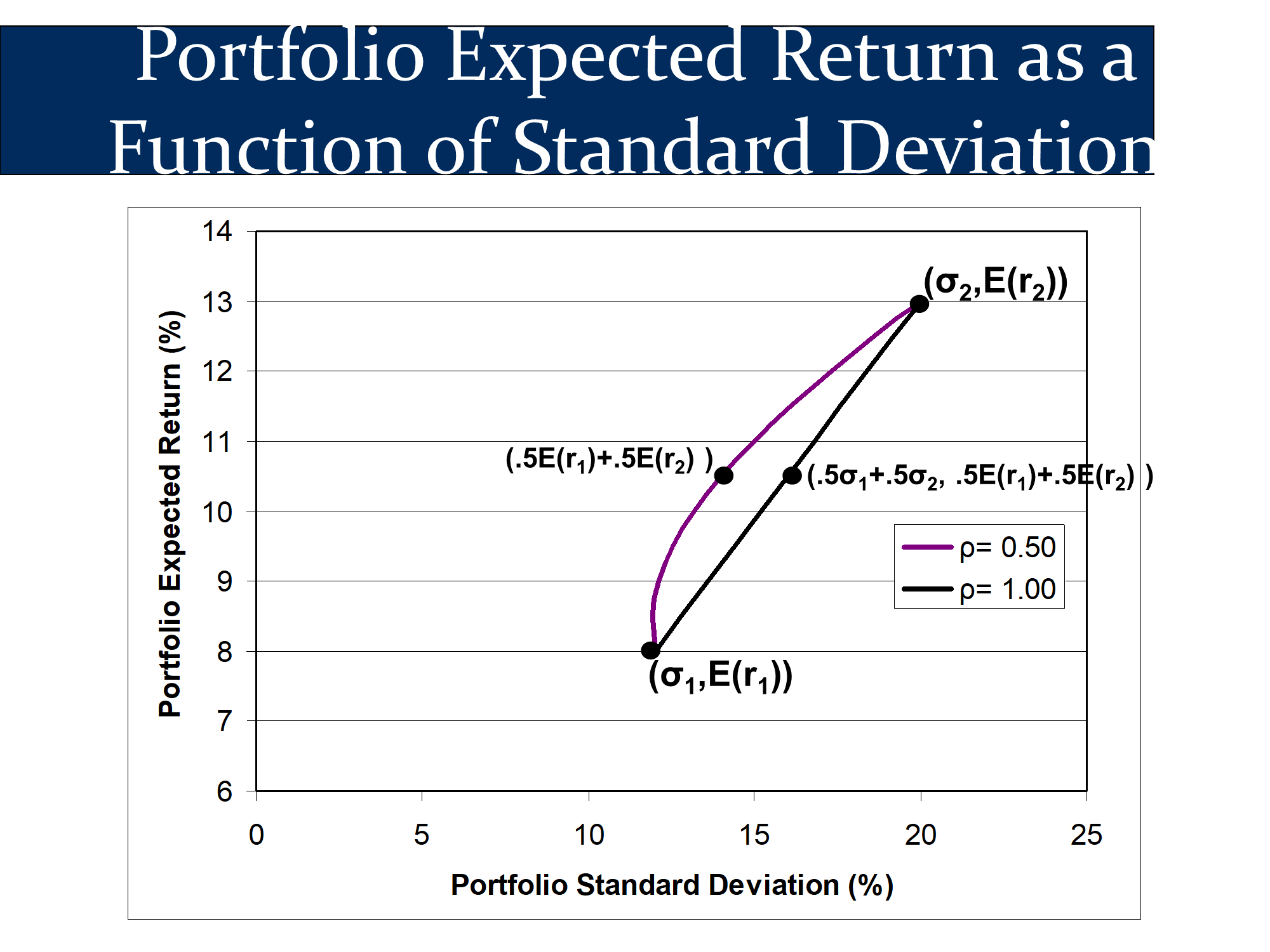

🔎 No benefits to diversification?

🙋 Why are there no benefits to diversification when the correlation is ρ=1?

Full Question:

🙋 Why did you say that there were no benefits to diversification in the dot on the right?

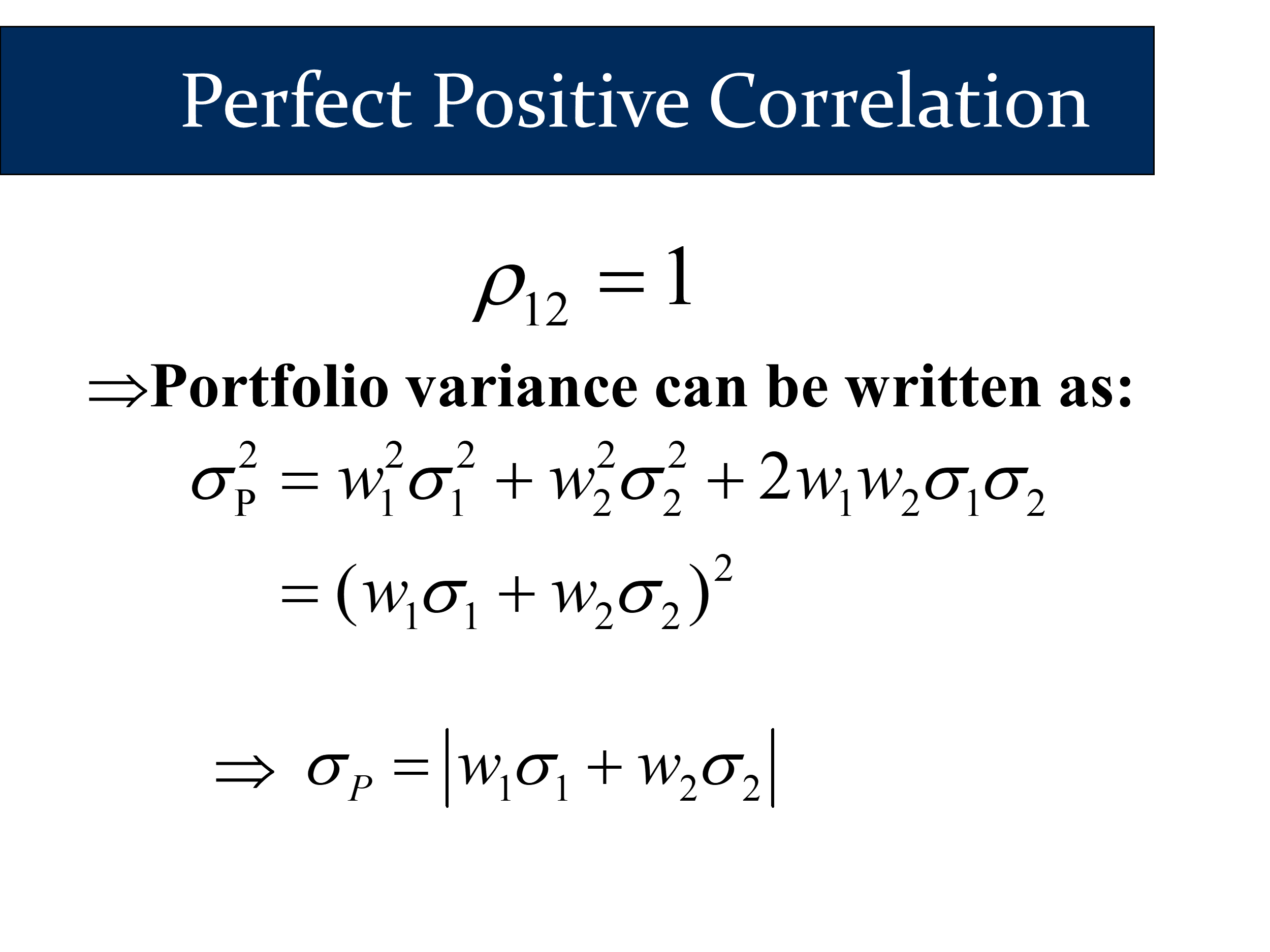

✔ This example is related to the following slide:

If I do a 50-50 portfolio of stocks and bonds and my return is as follows, I feel like I don’t get any benefits of diversification.

What I mean is that my portfolio is smack dab in the middle of the other two portfolios with . I didn’t get anything for free.

The reason why everyone should have some bonds in their portfolio is that in the real world, , so your real return is more like:

👍

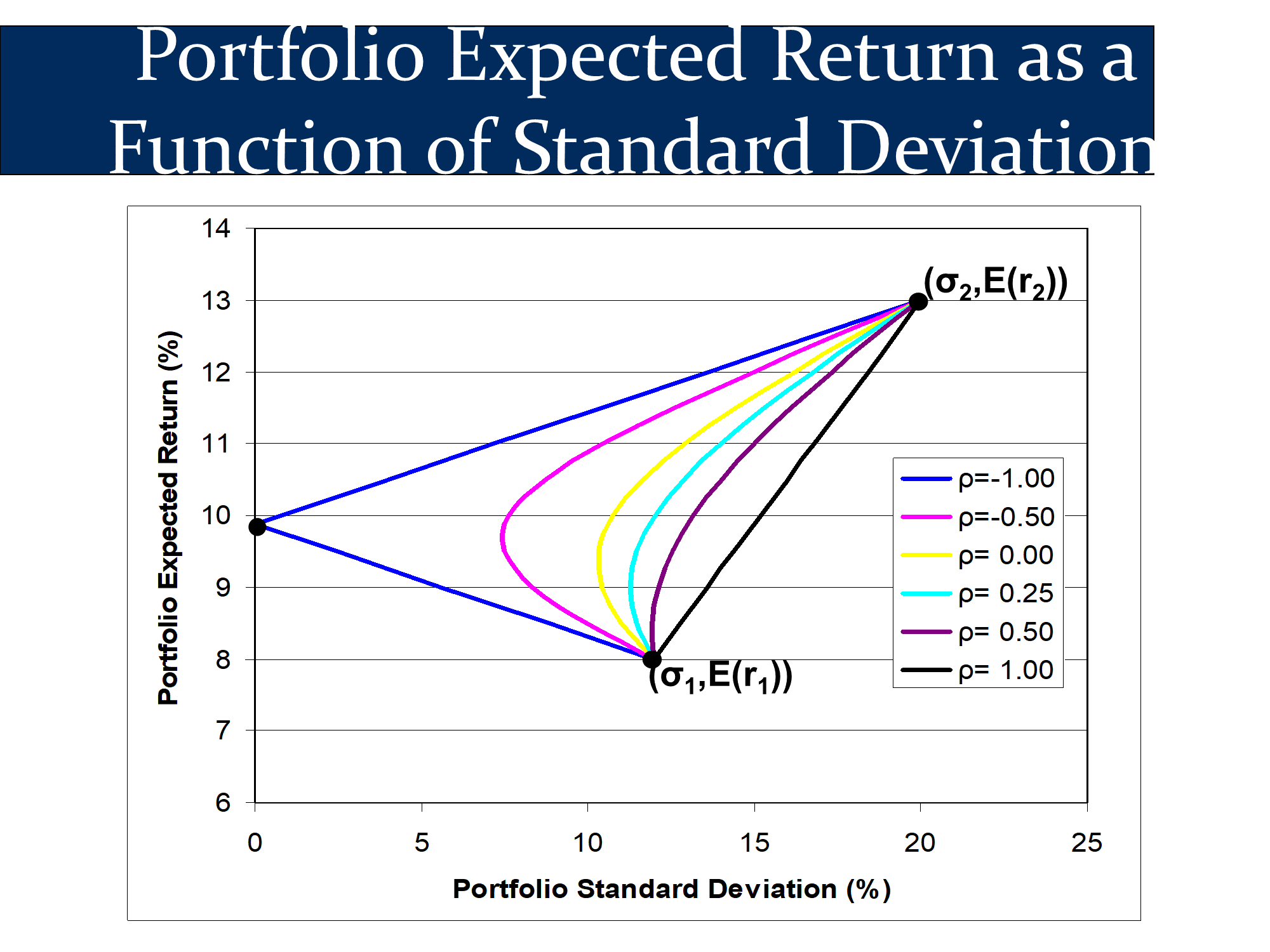

TAKEAWAY: low correlation decreases your risk without decreasing your expected return. Because most correlations between assets are between 0 and 1, diversification is an amazing way to decrease risk.

(Not financial advice, but) You can get “free insurance” by adding some BND to your VTI.

The rightward shift you see below is “the magic of diversification”.

In the blue line, we got our risk to zero, but a correlation of -1 is costly.

The blue line would be

- an S&P 500 ETF, such as SPY

- would be a short position in the S&P500 index via a futures trade.

The risk of these two positions would cancel each other out entirely. Any losses in SPY would be made up for in your futures contract. However, any gains in spy would also be made up for in your futures contract, so you would have an