✏️ Tax exempt bond examples

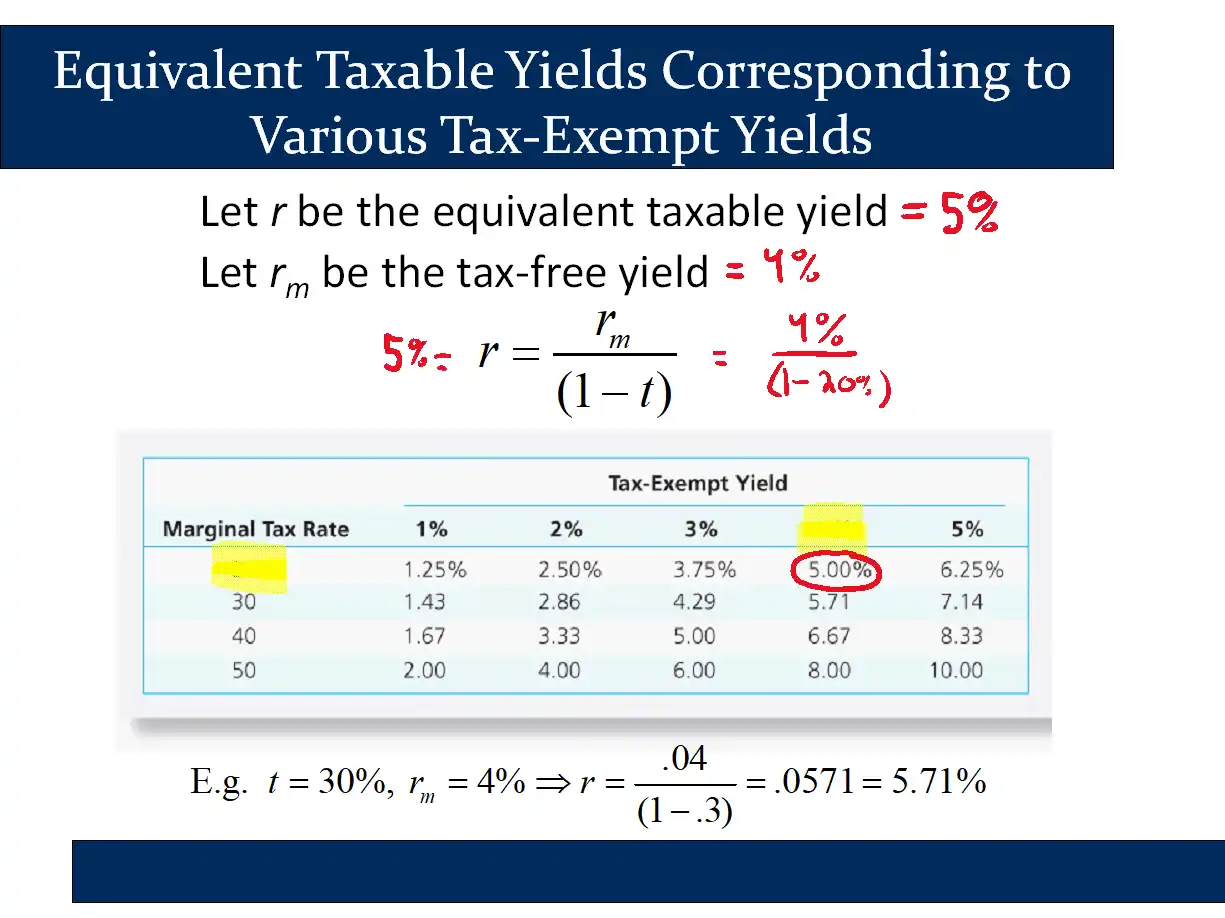

Based on the above example, an investor who has a marginal tax rate of 20% should be indifferent between a muni paying 4% and a corporate paying 5%.

Basic formula from the slides:

(I’ve used for the return of the taxable, Corporate bond.)

✏️ Suppose you are considering a corporate bond with a yield of 6%. Assume that your marginal tax rate is 20%. What tax free rate would that be equivalent to?

✔ Click here to view answer

Note that we can’t simply plug the corporate rate into the formula:

To get a reasonable answer, we must solve for . Multiply both sides by and get:

.

Therefore, a 6% taxable bond is equivalent to a 4.8% tax-free bond for someone in the 20% MTR.

This is just an example of Plug and Chug:

Plug and chug: (http://robmunger.com/plugchug

)

- Equation →

- Plug 🔌 →

- Solve 🚂 →

- 🧠 → It makes sense that the tax free bond could offer a lower interest rate. The Muni isn’t a “bad deal” - rather it is taking advantage of its tax-free status. It is a better investment for someone in their prime earnings years who needs to shield their income.

Jargon:

Taxable rate = corporate rate

Tax-free rate = muni rate.

Three Types of “Tax-Equivalent” Problems

There are basically three types of “Tax-Equivalent Calculation Problems” that can be asked.

We basically have one equation for tax equivalent bonds:

There are three variables in this equation, so there are basically three different types of questions that he can ask with this using algebra. Generally, he will tell you the values of the two of the variables and then ask you the third.

If you can do these three problems and understand the material in the slides, then I think you have the key ideas you need for this topic.

Type I: Find

This is the “vanilla” type of problem, where you just put the numbers in the equation and the answer pops out.

✏️ You are selling muni bonds and you want to find an equivalent corporate interest rate that your muni is equivalent to. The muni offers a return of 7.1% and you are targeting people with an effective tax rate of 24%. What corporate rate would your bond be equivalent to.

✔ Click here to view answer

If someone is receiving less than 9.34% on a taxable bond, you can claim that your bond is better.

Type II: Find

This type and the next type involve a little algebra. I call this type of algebra “Plug and Chug.”

✏️ You are considering switching some of your portfolio from taxable bonds to munis. You are currently invested in a taxable bond fund with an return of 11.5%. You have a tax rate of 26%. What is the minimum return you should be looking for in muni funds?

✔ Click here to view answer

In this case, we’ll need to do a tiny bit of algebra. I call it “plug and chug:“

Plug and chug: (http://robmunger.com/plugchug

)

- Equation →

- Plug 🔌 →

- Solve 🚂 →

- 🧠 → The corporate bonds are equivalent to a muni earning 8.51%. Note: here is essentially the “after tax” rate.

Type III: Find

✏️ You are selling munis with a return of 9.3% and similar taxable bonds are returning 11.5%. What do people’s tax rates need to be to make the munis more attractive.

✔ Click here to view answer

In this case, we need to find the tax rate that make the corporate and muni bonds equivalent. For anyone in a higher tax bracket, they will prefer the muni. For anyone in a lower tax bracket, they will prefer the corporate.

Once again, we plug and chug:

Plug and chug: (http://robmunger.com/plugchug

)

- Equation →

- Plug 🔌 →

- Solve 🚂 → [multiply both sides by ]

[divide both sides by 11.5%]

- 🧠 → The cutoff is 19.1%. Anyone below that tax rate will prefer the corporate. Anyone above that tax rate will prefer the muni