👨🏫 Outline of Lecture 1

Capital Allocation

- Capital Allocation: The “Top Down” Approach

- Three-step process of portfolio construction

- Capital allocation between risky and risk-free assets

- The CAL line

Portfolio Construction: The “Top Down” Approach

- Capital Allocation Decision

- Allocation of portfolio between a risk-free asset and risky assets

- Asset Allocation Decision

- Distribution of risky investments across broad asset classes (e.g. bonds, stocks, currencies, etc.)

- Security Selection Decision

- Choice of individual securities within each (risky) asset class

Capital Allocation Across Risky and Risk-Free Portfolios

The simplest way to control risk is to manipulate the fraction of the portfolio invested in risk-free assets versus the portion invested in the risky assets

Basic Asset Allocation Example

Percentage of risky portfolio in Equities and Bonds:

Let

- = Weight of the risky portfolio, P, in the complete portfolio

- = Weight of risk-free assets

Percentage of complete portfolio in Equities and Bonds:

The Risk-Free Asset

- Only the government can issue default-free securities

- A security is risk-free in real terms only if its price is indexed and its maturity is equal to the investor’s holding period

- T-bills viewed as “the” risk-free asset

- Money market funds also considered risk-free in practice

Capital Allocation Decision: One Risky and One Risk-Free Asset

| Notation | Meaning |

|---|---|

| = Proportion of capital invested in risky asset | |

| = Proportion of capital invested in risk-free asset | |

| = rate of return on risky asset | |

| = expected rate of return on risky asset | |

| = standard deviation of return on risky asset | |

| = rate of return on risk-free asset | |

| = risk premium on the risky asset | |

| = rate of return on the complete portfolio |

The second line (formula ①) is important because it shows us how to think of the return of a portfolio. Specifically, we think of the Complete portfolio as being a mixture of a risk-free asset and a risky asset. In probability, we calculate mixtures using weighted averages, so the return of our complete portfolio will be a weighted average of the return on the risky asset and the risk-free asset. Writing this as a formula, we get the equation that Bruce put in the slides - that the rate of return of the complete portfolio is .

If you aren’t familiar with weighted averages, this step may not make sense to you. That’s fine - just try to remember the formula.

I suspect you can afford to gloss over some of the slides of math later on in this lecture, but I think this slide is worth going into a little more deeply. Here are the key steps:

This step works because of formula ①, discussed about two paragraphs above. Specifically, it works because the complete portfolio is just a mixture of a risky asset and a risk-free asset.

This follows from a math fact from probability. It’s a deep math fact that underlies this entire topic. I discuss it at the bottom of the page entitled 🔎 Where did our two formulas come from?.

This step is intuitive. What is the expected value of the risk free rate? Well, we know exactly what the return on the risk-free asset will be. That’s what it means for the asset to be risk free: we know in advance exactly what the return will be. Therefore, is not random. We know the true value, and our expected value is exactly equal to the true value. Mathematically, .

This is just rearranging the terms from formula ④ using algebra. Algebra isn’t a focus of this course, so don’t worry if you have trouble seeing how ④ and ⑤ are equivalent.

While the 5 steps above are helpful, the main point is the final equation, which Bruce explains as follows:

The formula above shows that , the risk free rate, is a base rate of return on any portfolio:

Expected return on the complete portfolio = base rate (risk-free rate) + the risk premium on the risky asset weighted by the proportion of the total portfolio invested in the risky asset

assuming investors are risk-averse

Calculating the Standard Deviation of the Portfolio Return

Recall that, if X and Y are independent random variables and a and b and constants:

Here, and

So,

Taking the square root of both sides and remembering that

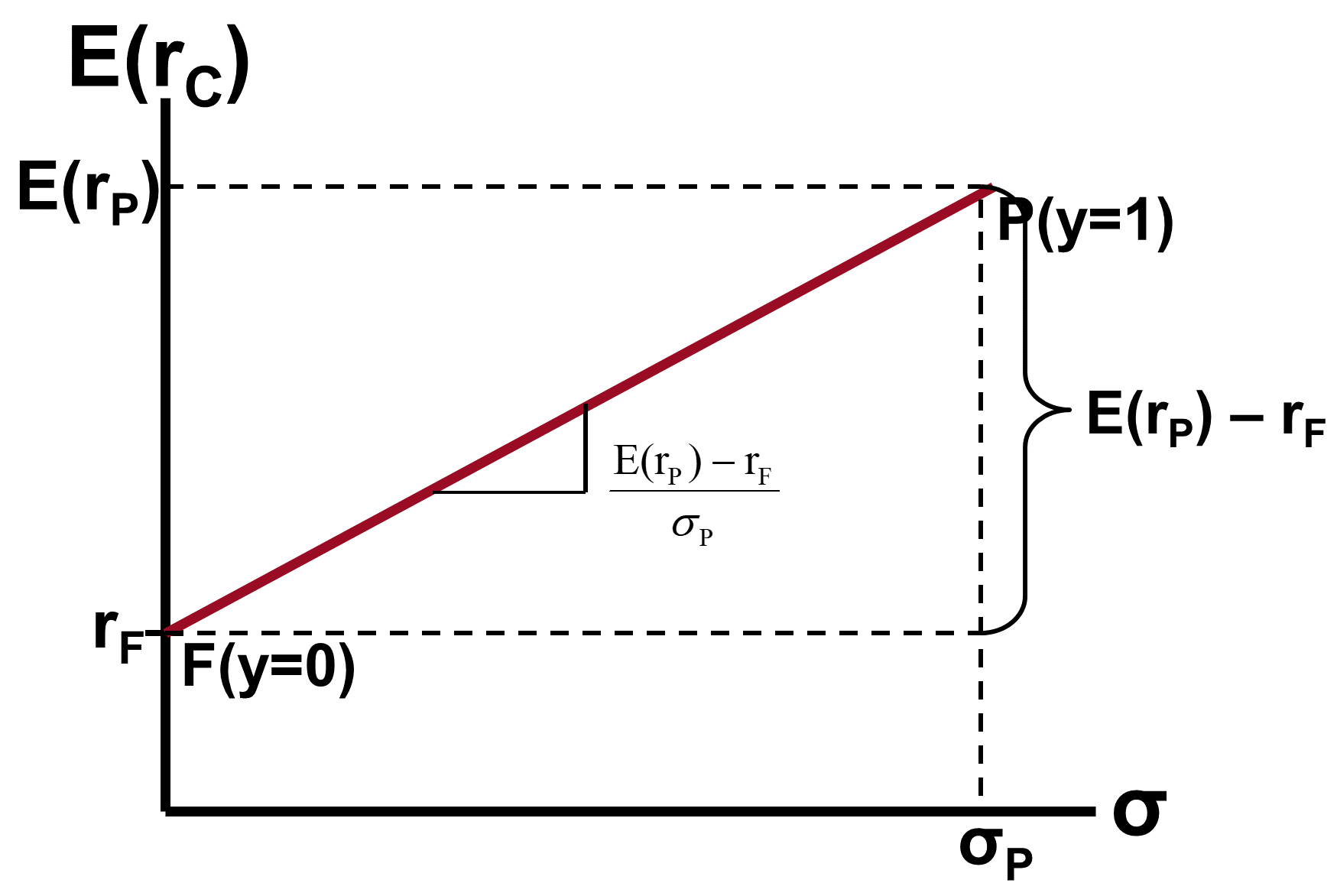

Equation for the CAL

is known as the Sharpe ratio or Reward-to-variability ratio.

Let and . Therefore

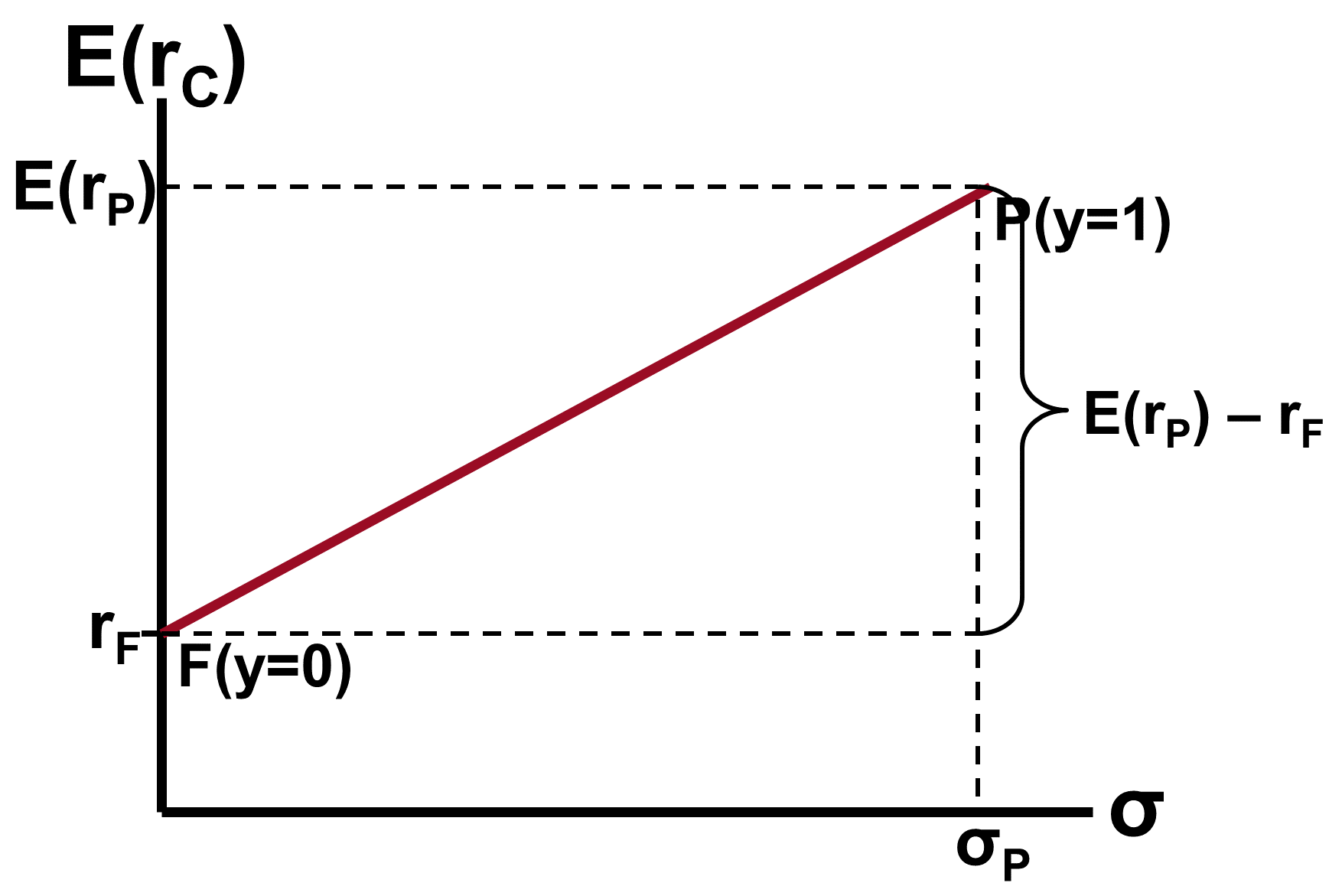

The Capital Allocation Line (CAL)

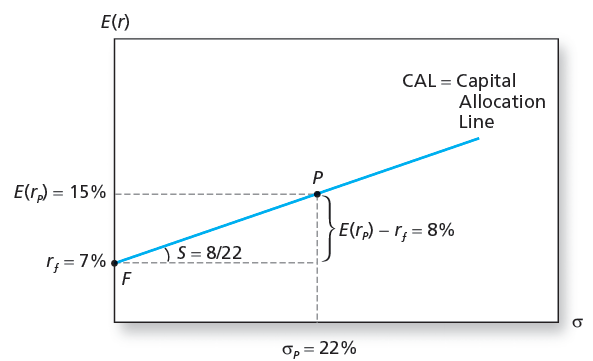

One Risky Asset and a Risk-Free Asset: Example

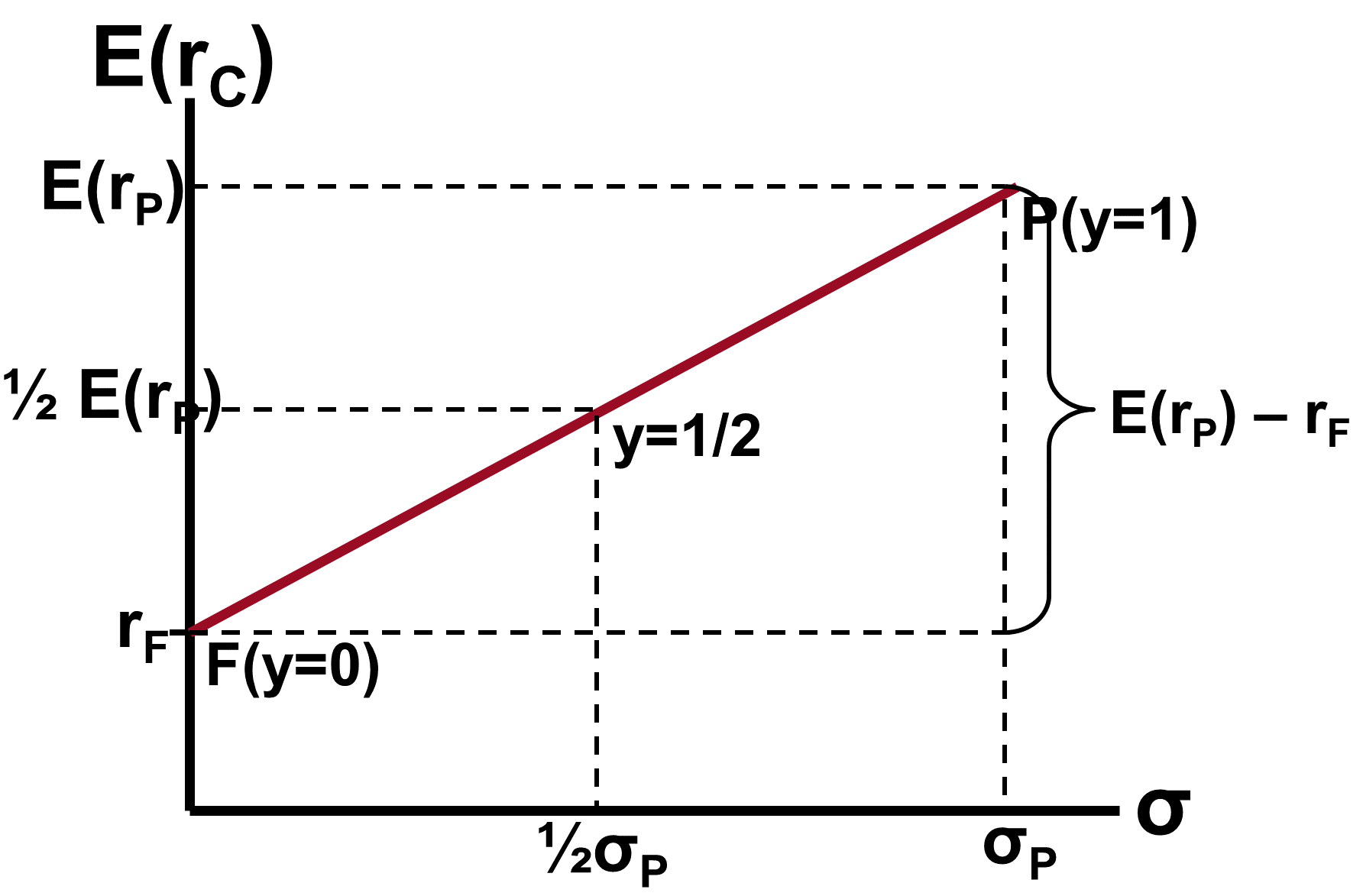

The expected return on the complete portfolio:

The risk of the complete portfolio:

Rearranging:

Substitute into CAL equation:

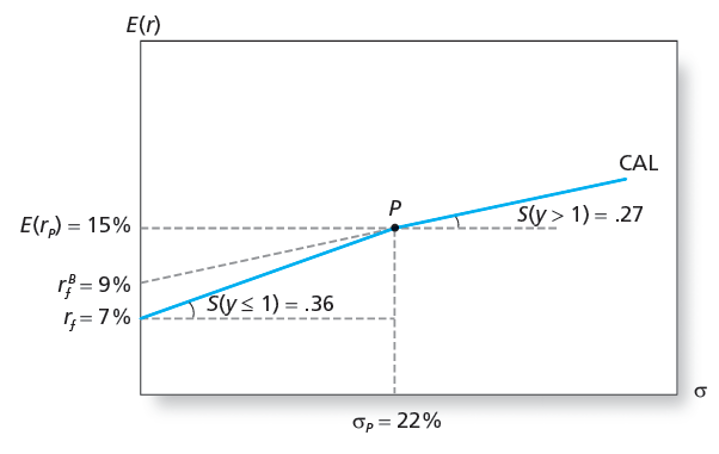

The Investment Opportunity Set

Portfolios of One Risky Asset and a Risk-Free Asset

- Capital allocation line with leverage

- Lend at and borrow at

- Lending range slope =

- “Lending range” is the portion of the CAL where y is less than 1, so the investor is investing in the risk-free asset. By investing in the risk free asset, they are “lending” money.

- Borrowing range slope =

- “Borrowing range” is the portion of the CAL where y is greater than 1. The portion of the investor’s wealth invested in the risky asset is . If , then , so the investor has a negative investment in the risk free asset. They are essentially attempting to “borrow” money. Because they they might not repay the loan, they can’t borrow at the risk-free rate, and this reduces their Expected return. This causes the CAL to have a lower slope in the borrowing range.

- Lending range slope =

- CAL kinks at , where .

- Lend at and borrow at

The Opportunity Set with Differential Borrowing and Lending Rates

Example:

Two Assets: